Expansionary Fiscal Policy

View FREE Lessons!

Definition of Expansionary Fiscal Policy:

Expansionary fiscal policy includes any fiscal policy with the objective of generating economic growth by accelerating the growth of aggregate demand or aggregate supply. Expansionary policies include lowering the marginal tax rates and increasing government spending.

Detailed Explanation:

The objective of fiscal policy is to use government spending and taxation to manage the economy. Taxes are primarily used to fund government operations, but, in most economies, taxes are also used to redistribute income. The amount of a tax and how each taxpayer will respond to any change in the tax laws are important considerations for discerning the effectiveness of a specific fiscal policy.

A government may administer fiscal policy to shorten or avoid recessions by boosting employment and supporting economic growth. In boom times, fiscal policy may be used to reduce the threat of inflation by slowing economic growth. Expansionary fiscal policy includes cutting taxes, increasing spending, or a combination of both. These actions boost an economy’s aggregate demand. Businesses increase production to meet the increased demand for their goods and services. They may hire more workers or have their workers work longer hours to produce more. Incomes rise, and the added income is used to purchase more goods and services. The increase in the demand for goods and services again results in an increase in employment, and the cycle continues.

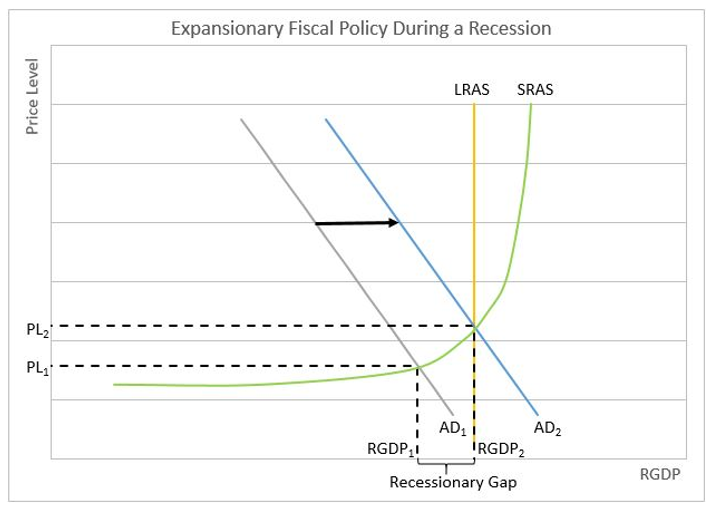

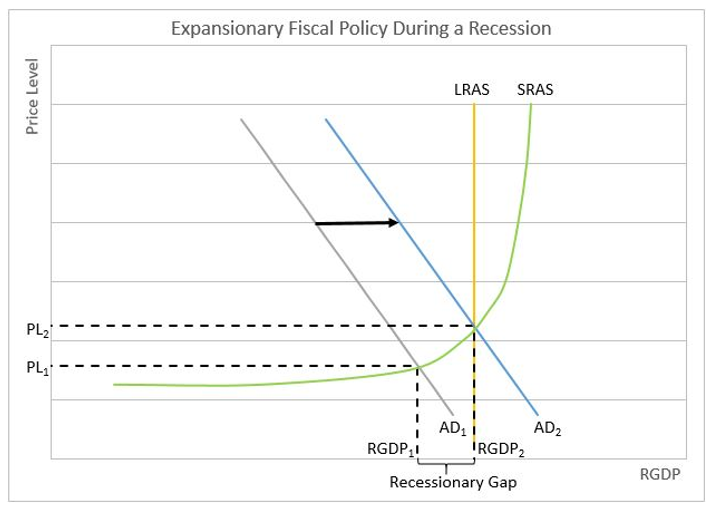

The graph above illustrates how expansionary fiscal policy increases a country’s real gross domestic product during a recession. Initially, output is at RGDP

1 and the price level is at PL

1. The long-run aggregate supply curve (LRAS) represents the economy’s potential. The initial output is where AD

1 and the short-run aggregate supply (SRAS) curves intersect. The output is less than the economy’s potential, or RGDP

2. By either cutting taxes, increasing spending, or a combination of both, the government increases the aggregate demand from AD

1 to AD

2. Small increases in the price level are a byproduct of expansionary fiscal policy during a recession. The expected price increase is much higher when expansionary fiscal policy is used during boom periods.

Fine-tuning an economy is difficult using fiscal policy. It takes time to move from the recognition of a problem to agreement on the best solution, and the implementation of a policy. Once implemented it takes time for the change to be felt throughout the economy. It is quite possible that an action may prove counterproductive if a business cycle has entered a new phase. For example, assume the economy is in a recession. Expansionary policy is recommended, but Congress takes an entire year before reaching an agreement on the appropriate action. A bill is passed with a combination of tax cuts and spending increases. Unfortunately, a trough has been passed and the economy is well into a state of recovery before the expansionary actions are felt. The consequence is more inflation than desired. The risk of implementing a policy too late is why most economists favor monetary policy for fine-tuning the economy.

Dig Deeper With These Free Lessons:

Fiscal Policy – Managing an Economy by Taxing and Spending

Monetary Policy – The Power of an Interest Rate

Aggregate Supply and Demand – Macroeconomic Equilibrium

Business Cycles

Gross Domestic Product - Measuring an Economy's Performance