Debt

View FREE Lessons!

Definition of Debt:

A

debt is an obligation or liability that one party, typically referred to as the borrower or debtor, owes to another party, called the lender or creditor.

Detailed Explanation:

A debt usually involves the borrower receiving a certain amount of money, goods, or services from the lender with a commitment to repay the amount (or its equivalent value) at a later date, often with interest. Debt is a common financial tool used for personal and institutional purposes, allowing for the purchase of assets or funding projects that may not be possible through current income alone.

Bank loans, bonds, credit card loans, student loans, and mortgages are examples of debt. The terms of the debt require the loan plus interest to be repaid during a specified period. Payments of debt include principal and interest. The principal is the amount borrowed or the balance that was initially borrowed and has not been paid off. Interest is the price of debt or the cost of borrowing, which the borrower agrees to pay to the lender over time. Other repayment terms include the loan’s duration, the schedule of payments, and the penalties for failing to make payments on time.

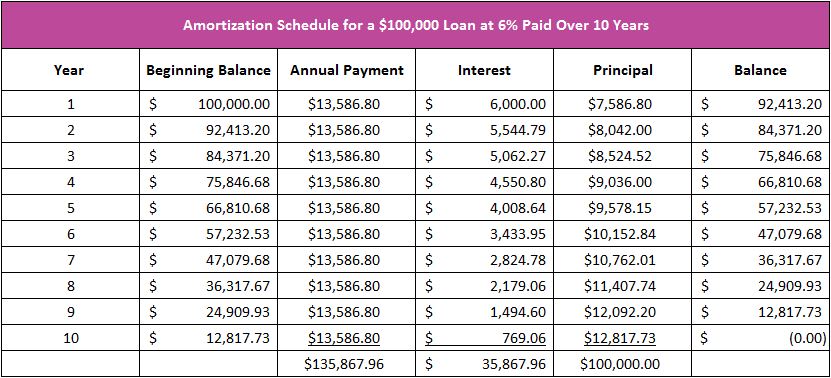

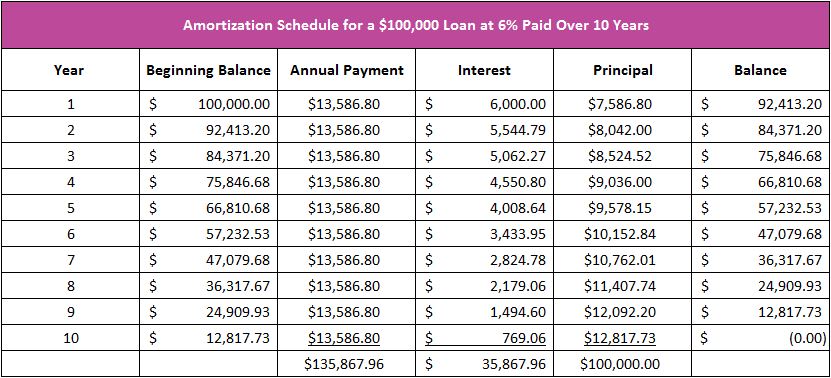

The Amortization Schedule

A loan’s amortization schedule allocates payments to interest and principal. This information is helpful in understanding how debt works and its dangers. When a payment is made, interest is paid first. Interest is directly related to the loan balance and the interest rate. The larger the loan balance or the higher the interest rate, the greater the interest expense. The table below shows the amortization schedule for a $100,000 loan with an interest rate of six percent paid over 10 years. A $13,586.80 payment is due annually. During the first year, $6,000 in interest is paid (.06 x $100,000). The principal portion of the payment is derived by subtracting the interest from the payment. The principal reduction after the first payment equals $7,586.80, or the difference between the $13,586.80 payment and $6,000 in interest. The loan balance at the end of the first year is $92,413.20, which equals $100,000 (the beginning balance), less $7,586.80 (the principal paid). The amortization schedule below shows that more interest is paid in the early stages of a loan. This is because interest is paid on the outstanding balance, and the loan balance has decreased in the second year. In the second year, the payment’s interest portion equals $5,544.80 ($92,413.20 x .06), which means that $8,042 is paid to the principal ($13,586.80 - $5,544.80).

A borrower can pay off a loan sooner and save money by making payments larger than the minimum required. The higher payment negates the cost of future interest on any reduction in the loan balance. For example, the borrower would save $6,517.10 if a $25,000 payment is made in the second year. This is entirely due to a reduction in interest paid over the remaining term of the loan.

Business Debt and Leverage

Business owners frequently prefer using a loan (debt) to selling stock (equity) because they do not give up an ownership interest when they borrow money. Lower borrowing rates make more projects economically attractive. Using debt to finance growth is an example of leverage. A business grows faster when it leverages its debt properly.

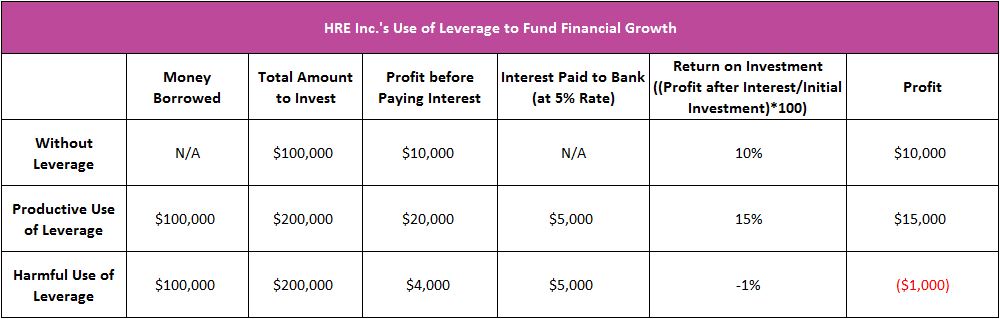

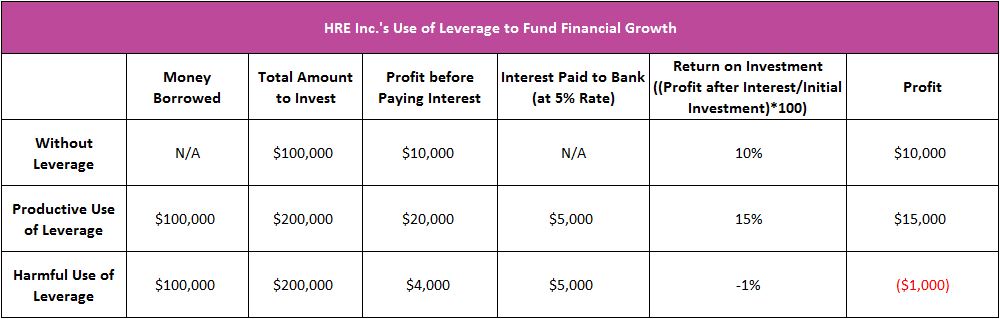

To illustrate, assume HRE, Inc. has $100,000 to invest and projects a 10% return on its investment, which means HRE would earn a $10,000 profit (10% of $100,000). Management could increase its investment to $200,000 by borrowing $100,000 at a 5% rate. HRE’s projected profit before paying interest increases to $20,000 (10% of $200,000). However, HRE would need to pay the bank $5,000 for its loan (5% of $100,000), so the projected profit after paying the loan equals $15,000. This means HRE would earn $15,000 after investing $100,000 of its funds, thus netting a 15% return on investment (($15,000 / $100,000) x 100).

This is a productive use of leverage, but leverage can be risky. Remember, the bank needs to be paid, so if the project fails, HRE may need to sell other assets to make its payment. For example, assume that HRE invests the $200,000 but earns only $4,000 before paying the bank. After paying the bank, HRE would lose $1,000. The return on investment would drop from a positive 10% to a negative 1%.

Leverage reduces a company’s profit anytime the amount earned on the borrowed funds is less than the interest paid. The table below summarizes HRE’s use of leverage.