The inflation rate is the annual rate of change in the general price level of an economy.

If the rate of inflation in 2014 was three percent, and a good cost $100, that same good would cost $103 in 2015 if its price increase equaled the rate of inflation. Normally the inflation rate is expressed in annual terms.

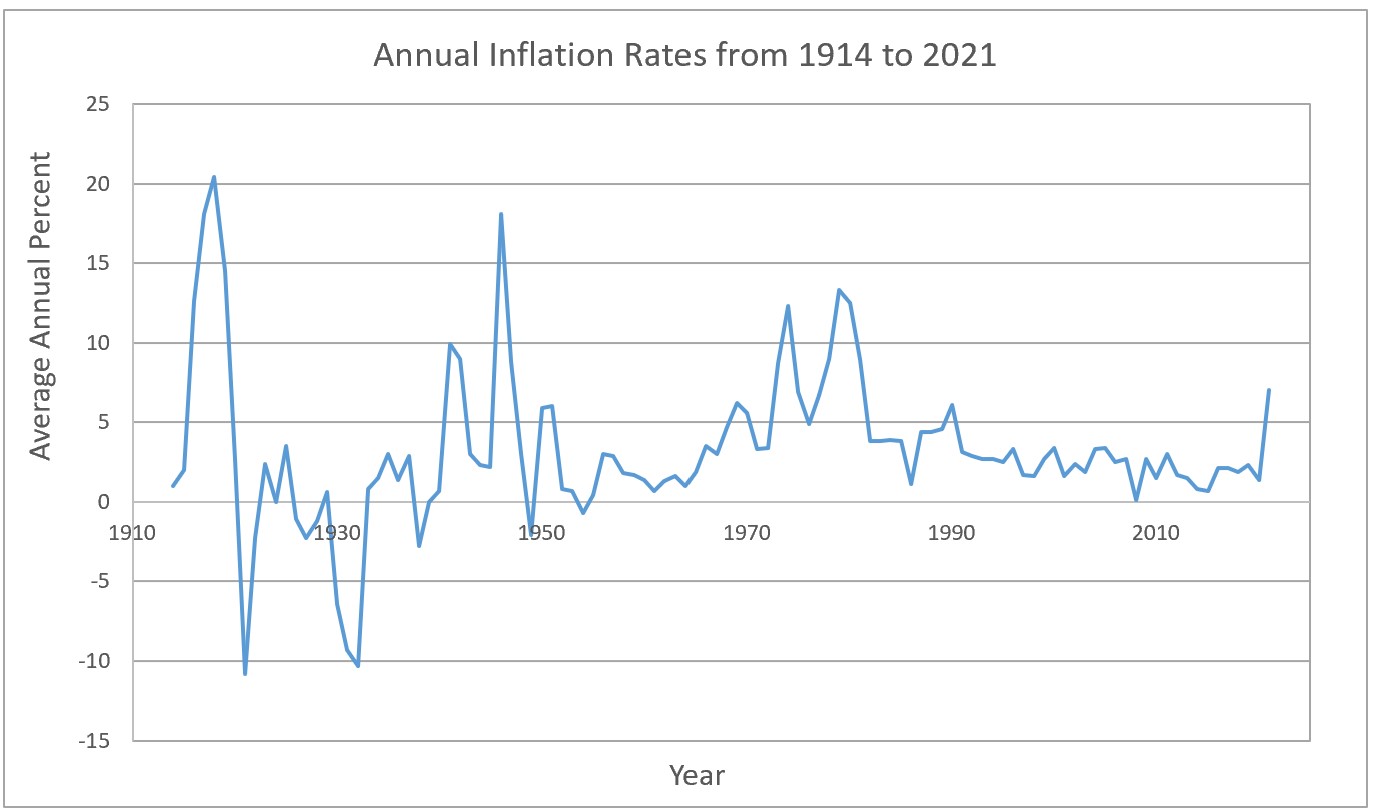

The United States has enjoyed inflation rates of less than five percent during most of the past century. Since 1980, inflation has been less than five percent and very stable. The graph below charts the historic annual inflation rate since 1913.

Calculating the inflation rate is theoretically simple, but in reality, the task is daunting. The prices of one period are compared to the prices of another period. The change in the average price is the inflation rate. But what items and what prices are used to get a good sample? The government uses “imaginary” market baskets. The market basket contains a standard set of goods and services commonly purchased by consumers. This is used to track changes in the cost of living for the average household over an extended period. The costs of the identical market baskets from different periods are compared. The inflation rate is the percentage change in the total cost of the two baskets. Massachusetts tracked inflation to adjust pay for soldiers during the Revolutionary War. The first basket included five bushels of corn, 68 4/7 pounds of beef, ten pounds of wool, and 16 pounds of leather. This would certainly not be a basket of goods commonly purchased by consumers today!

Many different baskets are used to measure inflation. The consumer price index (CPI) uses a basket of goods and services commonly purchased by an urban family. It is the most common measure of inflation because it is the broadest index that impacts the most people. Another basket includes goods and services sold in the wholesale market. Changes in the cost of this basket determine the producer price index (PPI), another measure of inflation. The producer price index measures inflation from the viewpoint of the sellers. The consumer price index and the producer price index are normally different because the market baskets used by the two groups differ, so the inflation rates for the two groups will probably vary.

A distinction between inflation and an index that measures inflation such as the CPI or PPI is that inflation is for the economy as a whole, whereas indexes measure inflation for a specific group. Indexes are useful when evaluating how a particular group has been affected by inflation.

After the cost of different market baskets is determined, the CPI can be calculated. A base year is chosen and given a value of 100. This way, the percentage change in prices since the base year can simply be calculated by subtracting the new index from 100. The base year is the year to which all prices will be compared. Any year can be chosen. The formula is:

CPI= Price of Market Basket in Given Yearx 100

Price of Market Basket in Base Year

The CPI is also used to quickly calculate the inflation rate between any two years without determining the cost of a market basket using the formula:

Inflation Rate = (CPI Year 2 – CPI Year 1) x 100

For example, the Bureau of Labor Statistics reported that the August 2016 index equals 240.853. The August 2015 index equals 238.316. Using these we can compute the inflation rate as:

Inflation Rate = (240.853 – 238.316) x 100

Inflation Rate = 1.07%

Inflation

Causes of Inflation

Fiscal Policy – Managing An Economy by Taxing and Spending

Monetary Policy – The Power of an Interest Rate

Gross Domestic Product – Measuring an Economy's Performance