Sunk Cost

View FREE Lessons!

Definition of a Sunk Cost:

A

sunk cost is a past cost that is irretrievable.

Detailed Explanation:

Have you ever spent an enormous amount of time and energy in a relationship that you knew was going nowhere? That time and energy is a sunk cost. You cannot recover it if the relationship sours. Business owners are frequently guilty of holding onto their business too long because they have invested so much in the business. Investors refrain from selling a stock that has plummeted because “I have so much invested in it. I’ll sell it when it returns to the price I paid.” Ignore sunk costs in these circumstances. By not selling, the investor may be losing an opportunity to purchase an appreciating stock. The business owner may be blind to a future opportunity. Business owners should not consider their sunk costs when marginal benefits equal marginal costs because marginal costs and revenues do not include already expended money, time, and energy.

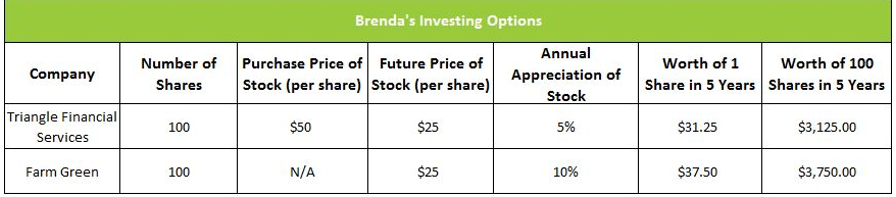

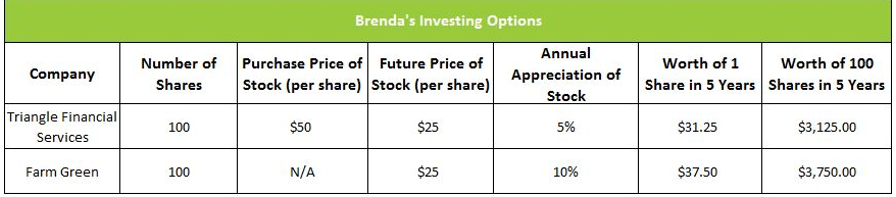

For example, assume that Brenda has purchased 100 shares of stock in Triangle Financial Services. She paid $50 per share. Brenda has invested $5,000 (100 x $50). A financial crisis has pushed the price down to $25. Brenda still believes in the management of the company, but she thinks it will take five years for the financial stocks to recover. Analysts believe the stock will only appreciate five percent annually, which is less than other available stocks. Farm Green Ventures is an environmental consulting service. The industry is growing at ten percent a year, and analysts anticipate growth of ten percent annually in the Farm Green stock price. The table below shows how Brenda’s expected profit is $625 more if she accepts the loss, sells her Triangle Financial Services stock, and invests the proceeds in Farm Green. Unfortunately, Brenda is stubborn and does not want to take a loss. She chooses to keep the stock instead of investing in Farm Green Ventures. Brenda’s failure to treat her loss in Triangle Financial Services as a sunk cost means she will continue to miss opportunities. Brenda should learn to ignore sunk costs when making decisions. Make decisions looking forward, not back in time.

Dig Deeper With These Free Lessons:

Marginal Analysis – How Decisions Are Made

Opportunity Cost – The Cost of Every Decision

Understand a Stock’s Performance Using Supply and Demand