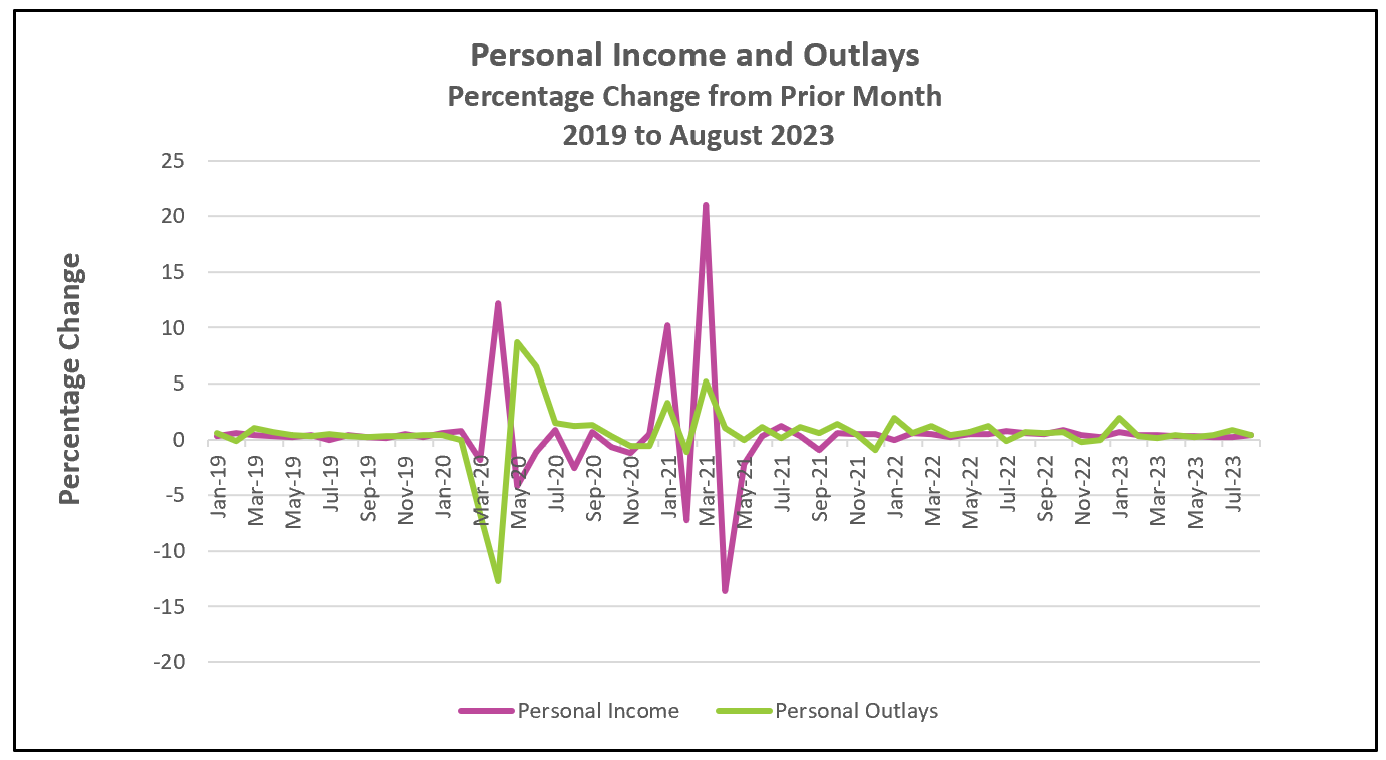

August income gains failed to keep pace with inflation, but consumers continued spending – albeit growth in spending slowed to the slowest pace since May. Higher energy prices were the most significant contributor to an increase in spending on nondurable goods and fueled a jump in the PCE price indexes. However, policymakers will be pleased that the PCE price indexes fell when excluding the increases in gas and food prices. Economists view core price indexes as a better indicator of price trends since food and energy prices are very volatile.

The highlights of the Bureau of Economic Analyses’ full report, Personal Income and Outlays – August 2023, are listed below.

Consumer spending is the foundation of the US economy, and its resilience, with the support of rising incomes, has prevented the economy from entering a recession. Until recently, gains in household disposable income have exceeded inflation. But disposable income has failed to keep pace with inflation for the second consecutive month, making it more challenging for households to meet their budgets. Indeed, much of the recent growth in consumer spending has been financed with debt and savings, a trend that is not sustainable. A 6.1% jump in energy prices resulted in a 1.6% increase in nondurable goods purchases but added to the hardship many consumers faced and partially explains a 0.6% drop in durable goods purchases. Service purchases rose 0.4%, the slowest pace since May. When adjusting for inflation, spending rose 0.1%.

Borrowers of Federal student loans must resume payments in October for the first time in three years. The government deferred the payments of nearly 44 million borrowers during the pandemic to provide relief to households and bolster the economy. The monthly savings helped fuel consumer spending and prevented a recession. Many economists believe the resumption of loan payments will hinder growth by reducing their borrowing capacity and the money available to spend on other items.

The United Autoworkers’ strike will impact the economy. How much depends on the length of the strike and whether other workers join the walkout. While the union targeted GM, Ford, and Stellantis (Chrysler’s parent company), it has not targeted all their plants. The UAW’s strategy is to add plants if progress is slow in reaching an agreement. Suppliers, local businesses, and more would feel the impact. The Wall Street Journal reported on the effect on the steel industry.

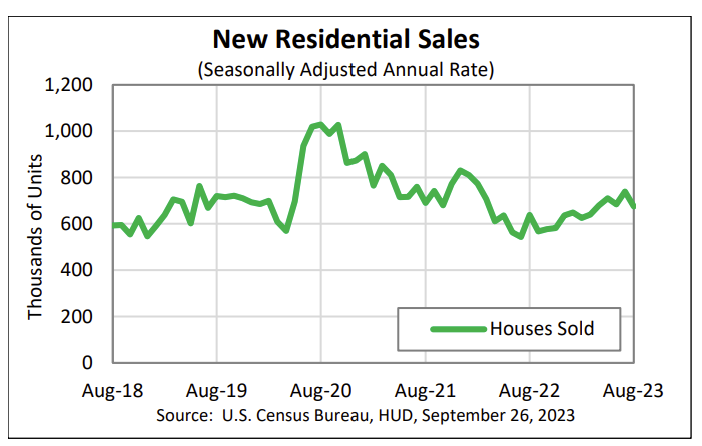

Higher mortgage rates have squeezed sales of both new and existing homes. The National Association of Realtors reported sales of existing homes fell 0.7% in August and over 15% lower than a year ago. New home sales fell at an annual rate of 8.7%, according to a Census Bureau’s recent release.

Policymakers at the Federal Reserve were likely encouraged by this report. Their objective was to cool inflation by decelerating the growth in consumer spending when they began raising their target for the federal funds rate in March 2022. Inflation has decelerated. The 12-month core PCE price index, the index favored by policymakers, has fallen from 5.2% to 3.9% since September 2022. The monthly core index rose 0.1%, the smallest increase since July 2022. Higher rates and other factors reducing the available household income will continue suppressing spending and lessen inflationary pressures. Still, they also raise the risk of steering the economy into a recession. Recent trends likely contributed to the Federal Reserve’s decision to pause their rate hikes at their last meeting on September 20th. Policymakers want to evaluate the impact of past rate hikes, the resumption of student loan payments, and the UAW strike before tightening further. However, inflation still exceeds the Fed’s 2% target – which raises expectations policymakers will raise its benchmark rate again before the end of the year.

A strong labor market has supported higher wages, which has financed the strength in consumer spending. New hires rose in August, but the unemployment rate rose because more people entered the labor force. Wage gains were less. Will the trend continue? The Bureau of Labor Statistics will release its September report on October 6th. For a summary and analysis of this release, visit HigherRockEducation.org shortly after its publication.