An individual, company, or government has a balanced budget when its expenditures equals its income.

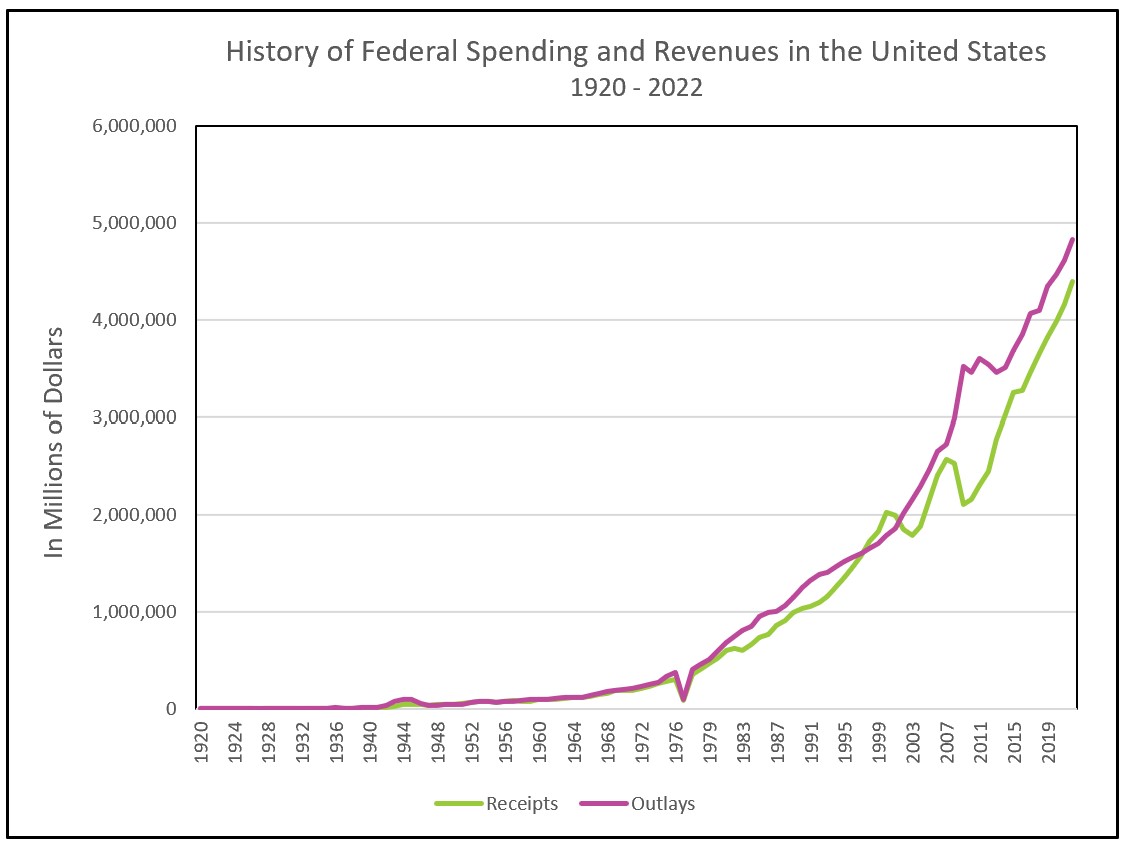

Governments have a balanced budget when tax revenues equal government spending. (Note that sometimes a budget where revenues exceed expenses is considered balanced, but never when expenditures exceed revenue.) Graph 1 illustrates the exponential increase in both revenues and spending since the 1920s. Social programs, entitlements, and military expenditures have increased the federal government’s annual budget. Deficit spending gained acceptance with the popularity of Keynesian economics. John Maynard Keynes advocated using government spending to micromanage the economy. He thought the government should kick-start the economy and that the Depression could be shortened by increasing government spending, even if it meant going into debt. The objective was to directly stimulate the demand for goods and services by hiring companies and individuals to provide various goods and services. His views remain popular and have diminished the government’s drive to balance the budget.

Graph 1

Source: U.S. Government Publishing Office

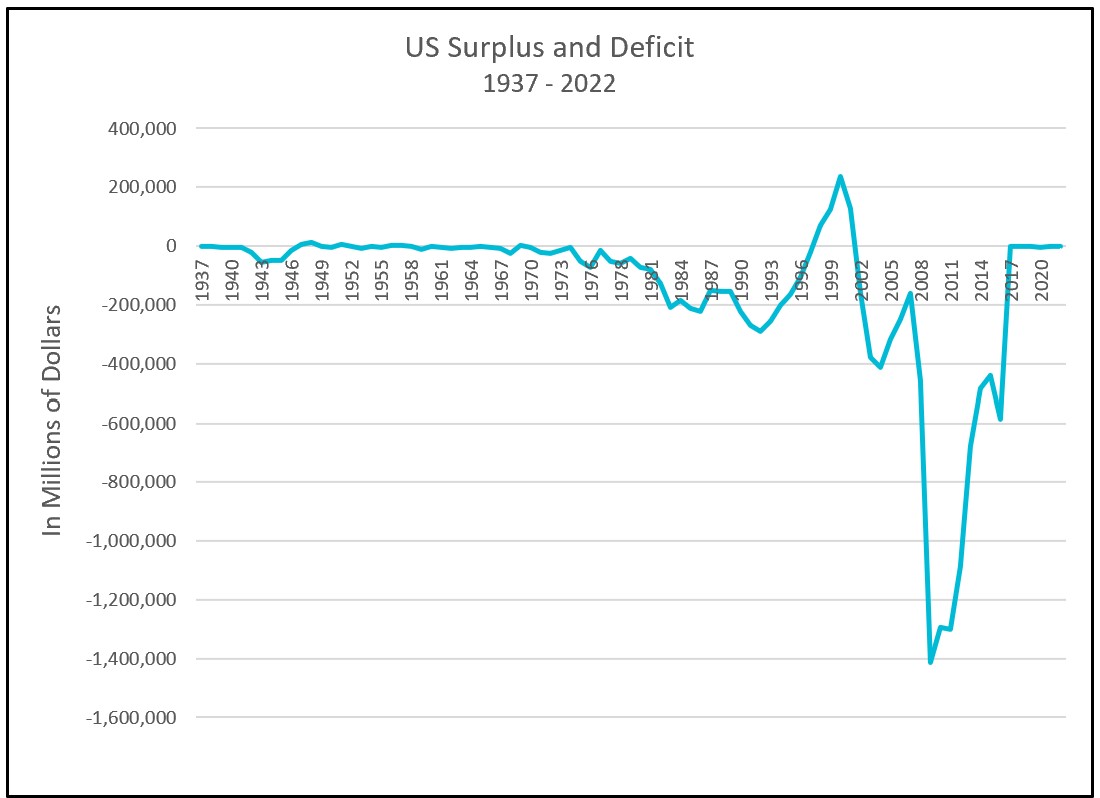

Graph 2 illustrates the annual surplus or deficit in the federal government’s spending since 1937. A surplus exists in years when the curve exceeds zero. Since 1935 there have only been twelve years when there was a surplus, and only four years between 1998 and 2023. Furthermore, the magnitude of the deficits has grown. Deficits are financed with debt, and accumulating deficits have increased the national debt to over $32 trillion. (View the US National Debt Clock to see today's balance.)

Graph 2

Source: U.S. Government Publishing Office

Financial planners recommend that families save and invest during prosperous times so money is available to pay their bills if a family member loses a job or has a medical emergency. Similarly, most economists believe a nation should save money, minimize debt, or even aim to have a surplus during prosperous periods to prepare for periods of little or no economic growth. When recessions occur, the government could use deficit spending to manage the economy without adding to the nation’s debt. In other words, fiscal policy should be expansionary (increasing the budget deficit) during recessions and contractionary (limiting the budget deficit) when the economy is overheated.

Balancing the Budget

Most economists believe that requiring a balanced budget would worsen recessions or further overheat expanding economies. Unemployment is a concern during recessions. Income decreases, so tax revenues drop. Meanwhile, mandatory spending increases because more people become eligible for programs such as Temporary Assistance to Needy Families (commonly known as welfare), food stamps, and Medicaid. How would the government secure the money it needs? The expenses are fixed, so the only way is to increase revenues by raising taxes. A balanced budget would require increasing taxes to generate the revenues needed to pay for the rise in mandatory spending. The tax rate increase would reduce discretionary income, meaning consumers would have less money to spend, further decreasing the country’s aggregate demand (the total number of goods and services consumers purchase at a given price level). In turn, the economy’s output would drop. Balancing the budget, which in theory is a good thing, in this case, would end up deepening a recession.

In theory, Congress could cut spending rather than increase taxes to achieve a balanced budget during a recession. But what should they cut? An act of Congress is required to cut mandatory spending. Assume the government passes a law that reduces entitlements such as Social Security – lowering payments to formerly entitled citizens when they need them most. Imagine the public outcry! It is hard to imagine Congress passing such a law. Reducing government spending would reduce the nation’s aggregate demand, slowing economic growth. Requiring a balanced budget would force Congress to cut spending and/or increase taxes; both are contractionary and would exacerbate a recession.

During prosperous periods, the reverse would occur. An overheated economy would result in higher tax revenues and possibly a budget surplus. A balanced budget requirement would require Congress to either spend the surplus or reduce taxes to eliminate the surplus. These actions are expansionary and increase the demand for most goods and services. Prices would likely increase if the economy is operating near its full-employment level (which is common in an overheated economy).

Economists who favor a balanced budget amendment argue that a balanced budget is necessary because the federal government lacks fiscal discipline. They point to the time lag between recognizing a problem and implementing a solution results in untimely fiscal policy that can be counterproductive. Another problem is that government programs can be hard to discontinue once implemented. Regions and individuals become dependent on the income from a project, making it difficult for policymakers to terminate. (Would you vote for a politician who favors closing a military base in your community?) This dependence makes it politically popular to include some “pork” in the budget. Pork is a term used for budget items that benefit special interests or small groups of voters. These items are hidden within larger budgets. A bill is passed when there is enough pork to satisfy enough representatives to vote for it.

The Federal Budget and Managing The National Debt

Fiscal Policy – Managing an Economy by Taxing and Spending

Monetary Policy – The Power of an Interest Rate

Fractional Reserve Banking and The Creation of Money