Budget Deficit

View FREE Lessons!

Definition of a Budget Deficit:

A

budget deficit occurs when the amount that an individual’s, company’s, or government’s spending exceeds its income. Governments have a budget deficit when tax revenues are less than government spending.

Detailed Explanation:

Young and retired people frequently run a budget deficit, meaning their spending exceeds their income. This leaves them two options: sell an asset or borrow the money needed. Too often, young people do not have the assets to sell and resort to borrowing and live beyond their means. Retired people sell assets they accumulated to secure the money they need.

Governments finance their spending by collecting taxes, issuing debt, and printing money. When a government has a budget deficit, its revenues (taxes) are less than government spending. A budget surplus exists when tax revenues exceed spending. Politicians have a dilemma when choosing how to pay for increased spending or a growing deficit. Raising taxes is unpopular and will likely slow economic growth. Printing money is inflationary, and issuing debt raises the government’s interest expense and may crowd out business investment. Finally, governments may reduce their deficits by reducing spending, but doing so may be political suicide because the recipients feel entitled to the money they have grown accustomed to receiving.

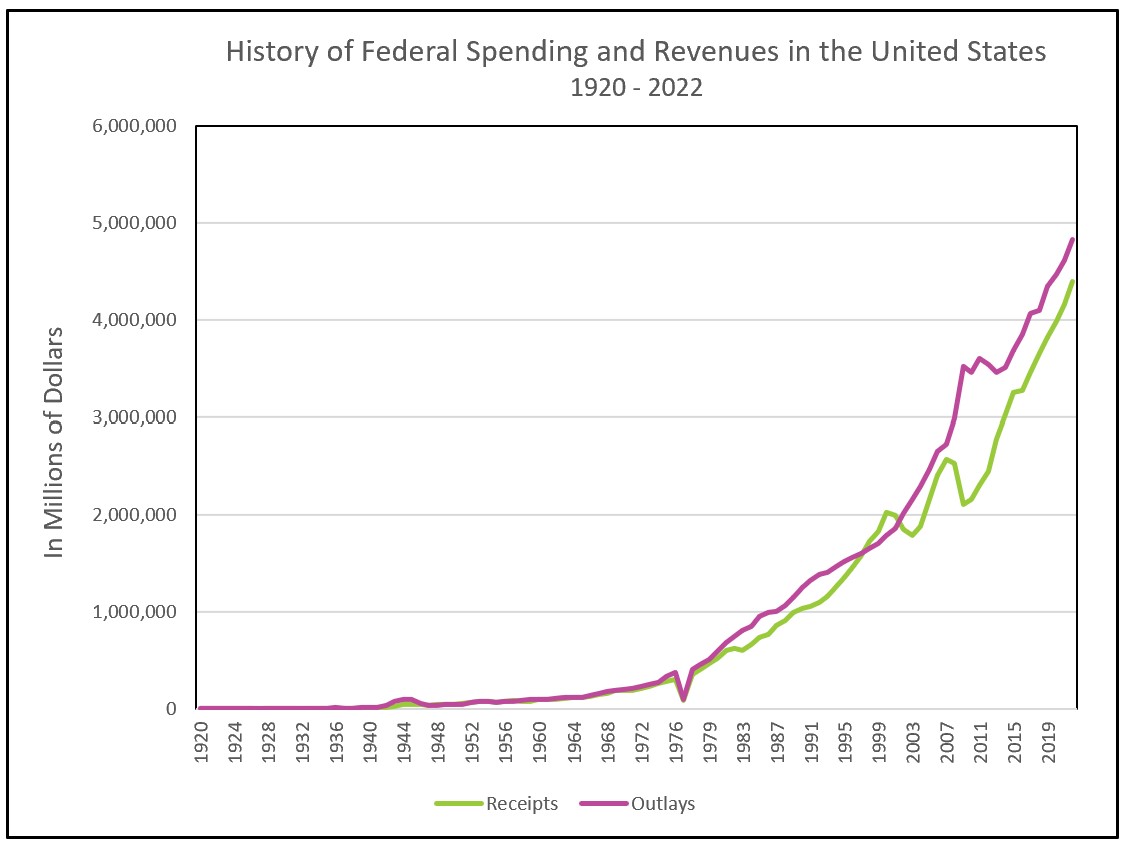

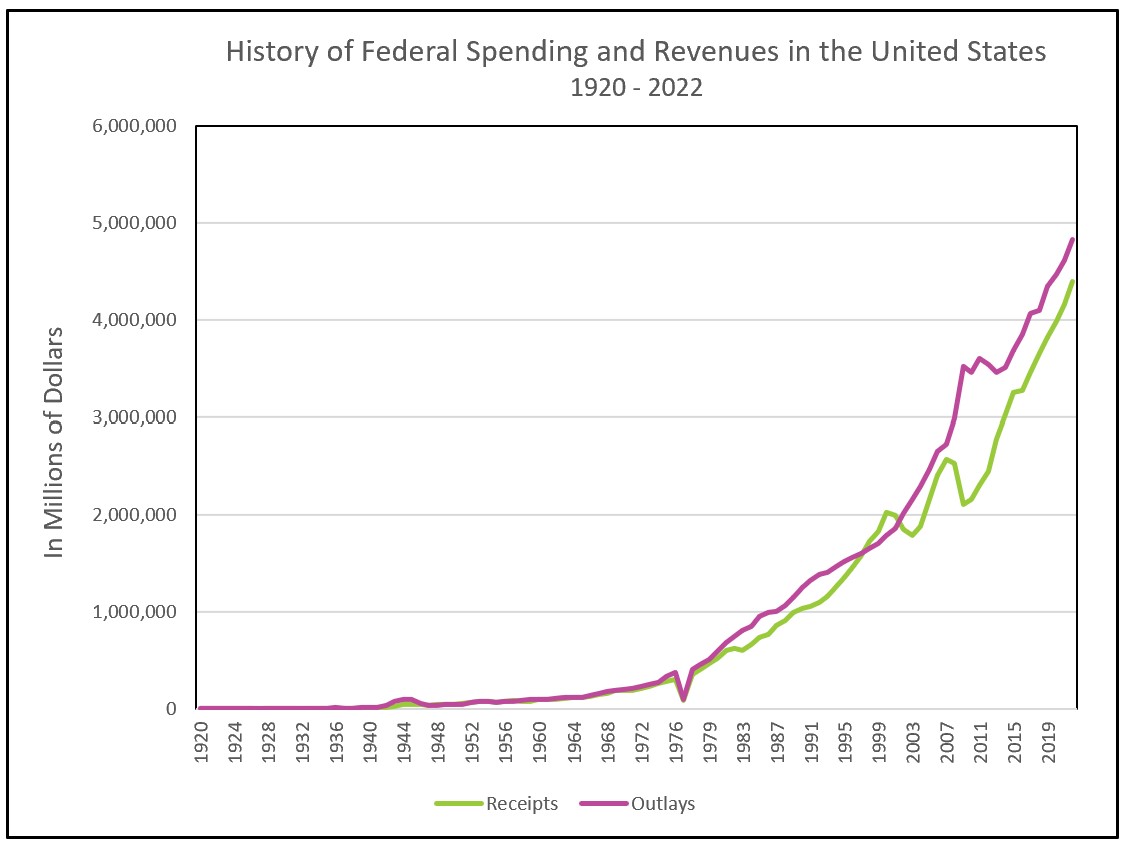

Since 1970, the US government’s only surplus was from 1998 through 2001. Financing the wars in Iraq and Afghanistan during a recession dramatically increased the US budget deficit. But the deficit rose to record levels in 2020 during the COVID-19 pandemic. When local and state governments imposed containment measures that put many people out of work, revenues fell. Spending increased because the federal government sent over a trillion dollars to families to supplement their income and shorten the recession. An aging population also pressures balancing the budget because Social Security and Medicare costs increase while tax revenues fall.

Source: U.S. Government Publishing Office

Dig Deeper With These Free Lessons:

The Federal Budget and Managing The National Debt

Fiscal Policy – Managing an Economy by Taxing and Spending

Monetary Policy – The Power of an Interest Rate

Fractional Reserve Banking and The Creation of Money