Budget Surplus

View FREE Lessons!

Definition of a Budget Surplus:

A

budget surplus is the amount that an individual’s, company’s, or government’s income exceeds its spending.

Detailed Explanation:

Governments have a budget surplus when tax revenues exceed government spending. For example, if the government is paid $3.5 trillion in taxes and other revenue and spends $3.0 trillion in the same year, it has a budget surplus of $0.5 trillion. Sometimes a budget surplus is referred to as a “balanced budget” even though the budget is not balanced. Families commonly refer to a budget surplus as “savings”; businesses use the term “net cash flow” rather than a budget surplus. A budget deficit is the opposite of a budget surplus.

Families may spend the money on an item it needs or a luxury. They may also invest the money in a savings account or stocks or buy real estate. Another option is to pay down debt such as a mortgage, car loan, or credit card. Businesses may pay their employees bonuses, shareholders dividends, or invest in an income-generating asset such as new equipment or a factory.

Governments may spend a surplus on a social program. They also can invest a surplus – perhaps in infrastructure improvements, education, or other areas that further the country’s economic growth. A surplus can also help reduce the national debt. Governments have another option – lowering taxes. Families or businesses, unlike governments, typically do not consider reducing their income when blessed with a surplus (although an individual may consider cutting back on working in favor of leisure).

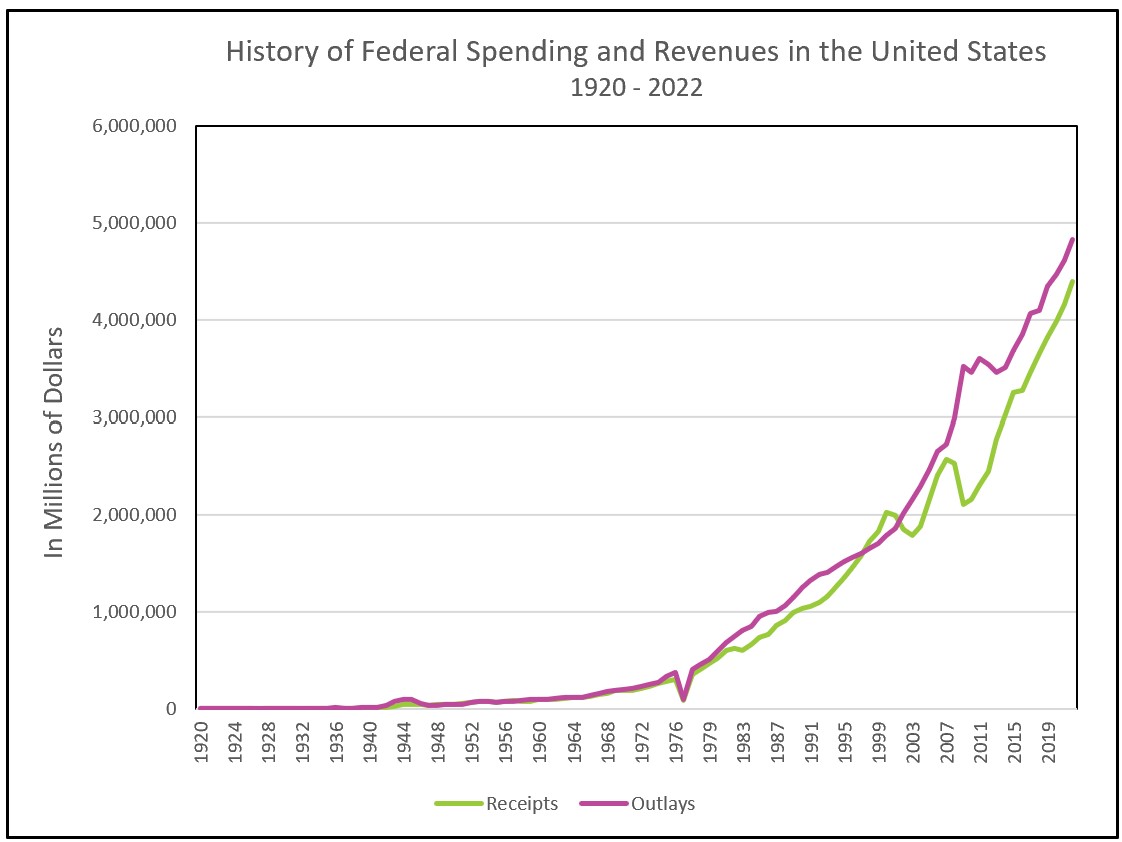

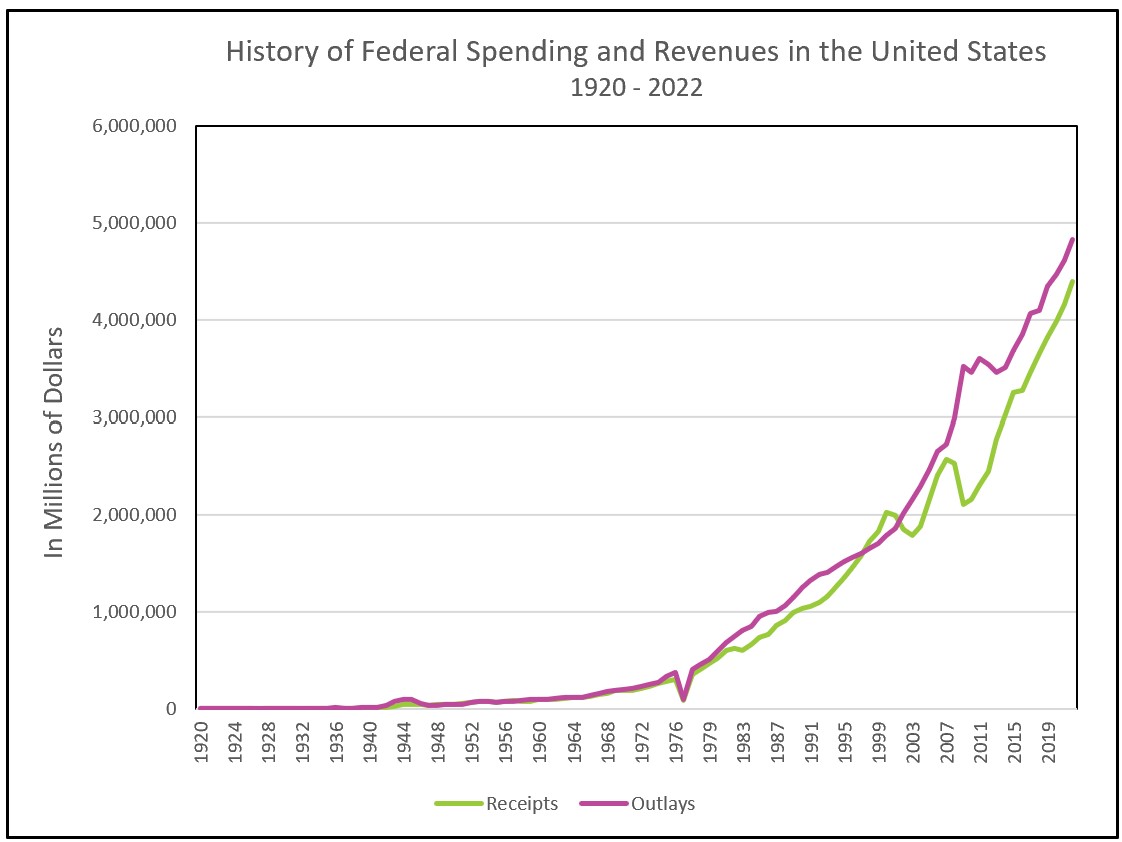

Since 1970, the United States has had a budget surplus in only four years, between 1998 and 2001. The graph below clearly illustrates how uncommon a surplus is and the exponential growth in public expenditures and deficits.

Source: U.S. Government Publishing Office

Dig Deeper With These Free Lessons:

The Federal Budget and Managing The National Debt

Fiscal Policy – Managing an Economy by Taxing and Spending

Monetary Policy – The Power of an Interest Rate

Fractional Reserve Banking and The Creation of Money