Demand deposits are payable by the bank on demand. Checking accounts are the most common example of demand deposits.

The key characteristic that distinguishes demand deposits from savings deposits is accessibility. Demand deposits offer unlimited, immediate access, allowing withdrawals at any time without penalty or prior notification. Financial institutions provide various convenient methods for accessing these funds, including in-person withdrawals at the bank, writing checks, using ATMs, debit cards, or online banking. While some financial institutions pay interest on demand deposits, the interest rates are typically very low.

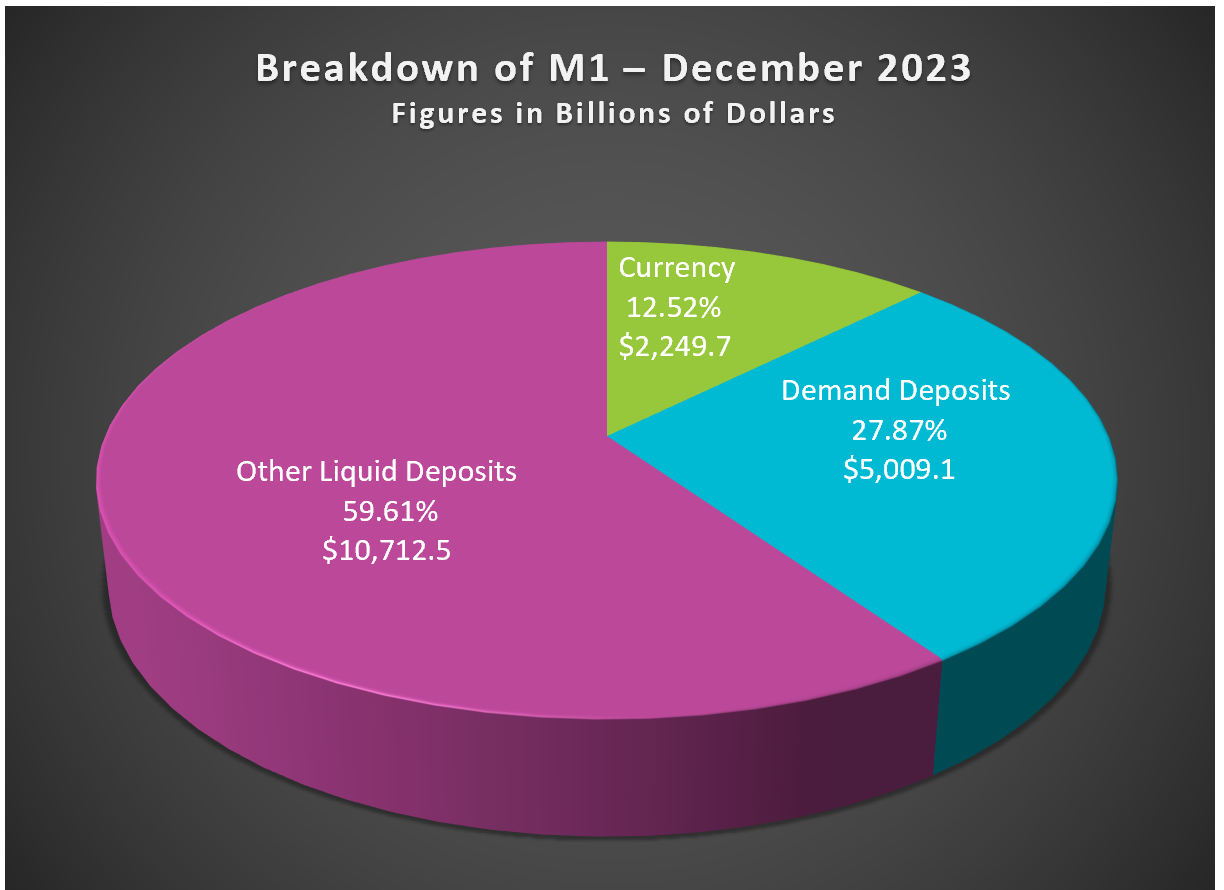

Demand deposits are included in M1, the narrowest definition of money. M1 consists of currency, demand deposits, and other highly liquid deposits.

Data Source: Federal Reserve

In contrast, savings and time deposit accounts are not considered demand deposits because they have restrictions. For instance, certificates of deposit (CDs) incur penalties if cashed out before maturity, while money market accounts may limit the number of transactions or require a minimum check amount. Some accounts also require advance notice for withdrawals.

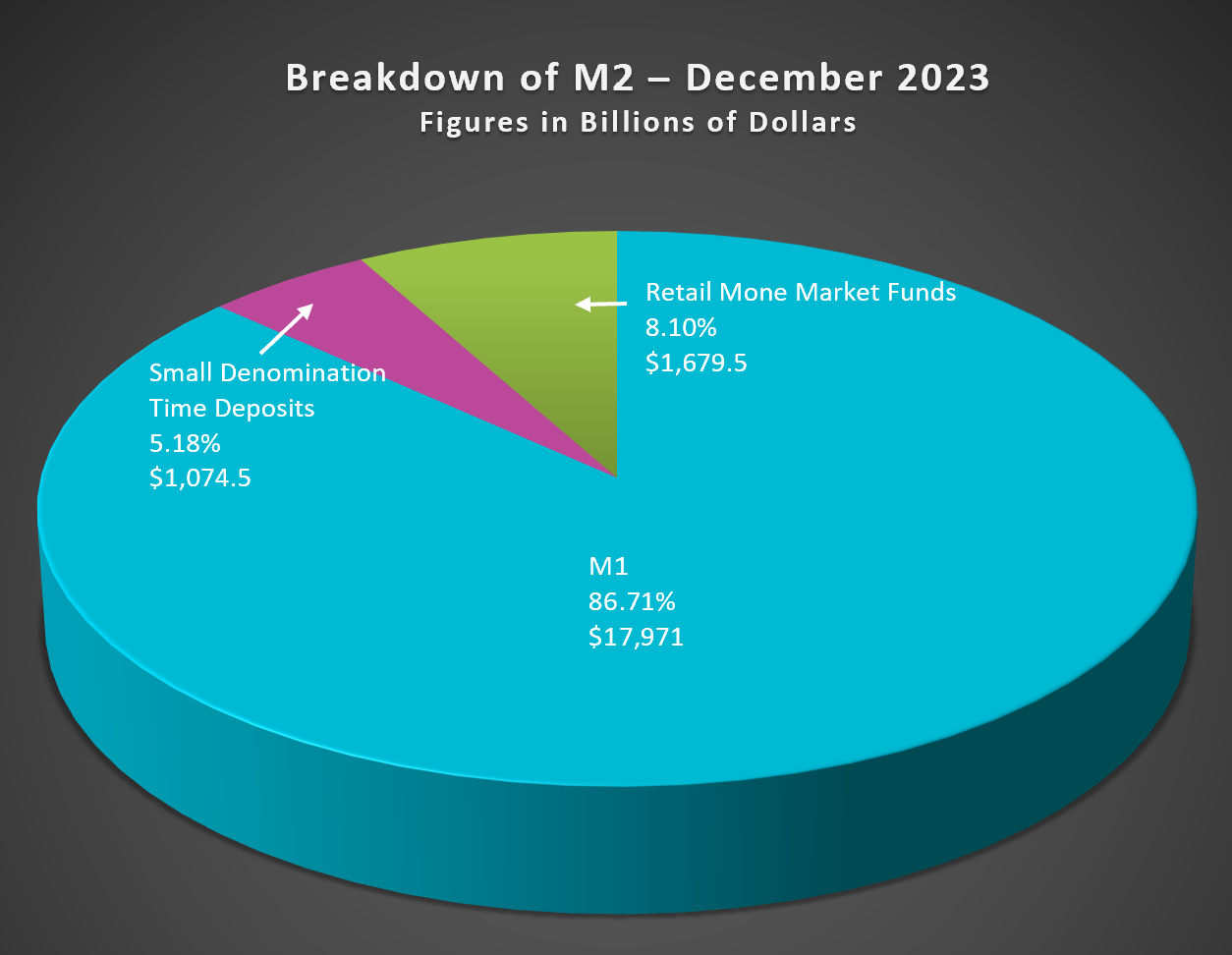

Demand deposits and these savings accounts are included in M2, a broader definition of money. Before May 2020, in the U.S., M2 was more than three times larger than M1. Savings accounts were less liquid then because Regulation D (Reg. D) limited the number of withdrawals depositors could make each month, and only some savings accounts allowed check-writing privileges.

However, on April 24, 2020, the Federal Reserve waived the Reg. D transaction limit, significantly increasing the liquidity of many savings and money market accounts. As a result, the definition of M1 was updated to include these other checkable deposits.

Data Source: Federal Reserve

Banks may provide checks to customers to access a line of credit. This type of account is classified as a loan and is not a demand deposit despite providing immediate cash access through check writing.

Opportunity Costs – The Cost of Every Decision

Monetary Policy – The Power of an Interest Rate

Fractional Reserve Banking and The Creation of Money