Disposable Income

View FREE Lessons!

Definition of Disposable Income:

Disposable income is the remaining income after paying taxes that households use to purchase consumable goods and services or save.

Detailed Explanation:

Good news! You just received a $500 pay increase. Bad news! Your income tax just increased by $75. Your disposable income has therefore increased by $425. Disposable income is the income remaining after paying personal taxes. A household must use its disposable income to purchase consumer goods and services or invest in savings.

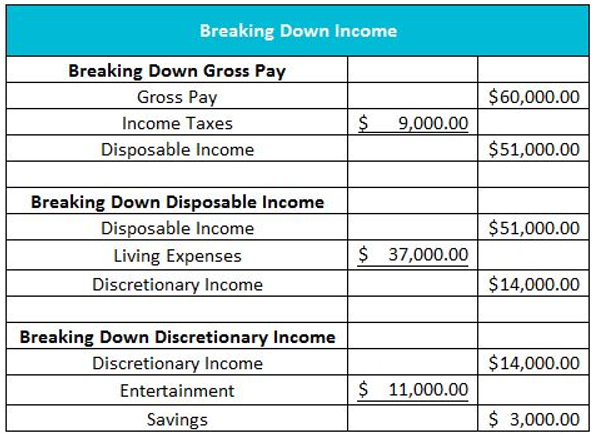

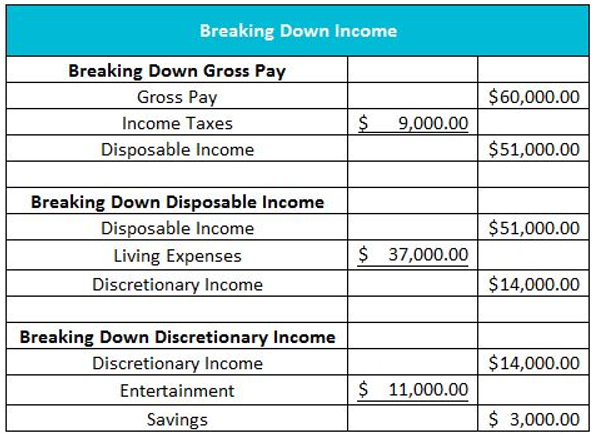

Disposable income should not be confused with discretionary income. Discretionary income is the amount households have leftover after paying all of their living expenses. For example, assume your salary is $60,000 per year, of which you pay $9,000 in income taxes. Your disposable income is $51,000. From your disposable income, you must pay your annual living expenses for items such as rent, food, clothing, utilities, and other necessary items. Assume these necessary expenses total $37,000. You have $14,000 left to spend or save at your discretion. Economists refer to the remaining income after paying your taxes and other necessary living expenses as discretionary income. Any amount of your discretionary income that is not spent equals your savings. The table below summarizes the breakdown of these categories using the example above.

Dig Deeper With These Free Lessons:

Fiscal Policy – Managing an Economy by Taxing and Spending

Opportunity Cost – The Cost of Every Decision

Gross Domestic Product – Measuring an Economy's Performance

The Federal Budget and Managing The National Debt