Economies of Scale

View FREE Lessons!

Definition of Economies of Scale:

Economies of scale exist when a company gains a cost advantage by increasing its output.

Detailed Explanation:

Assume you have two options when shopping for paper towels. You could purchase a package of six rolls for $3.00, or a package of 24 rolls for $8.40. Do you want to lower your average cost per roll from $0.50 to $0.35 by purchasing the larger package? There is an economy of scale gained from purchasing the package of 24 rolls because your average cost per roll is lower.

Economists refer to economies of scale when discussing the advantages of capital investment. A capital investment in equipment can enable a company to increase output while improving productivity and lowering the average cost because the fixed costs are spread over a larger number of units. When the economies of scale are enormous, it can result in the formation of an oligopoly or even a monopoly, such as the investment to build a nuclear power plant.

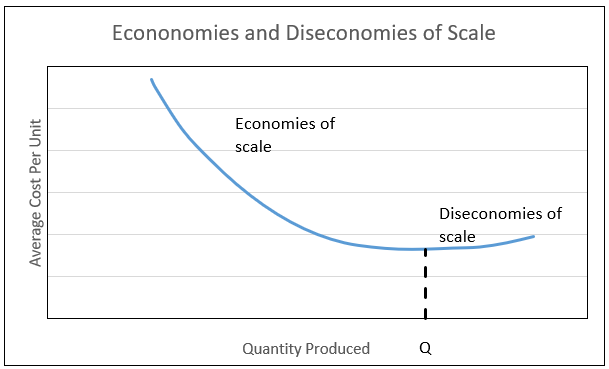

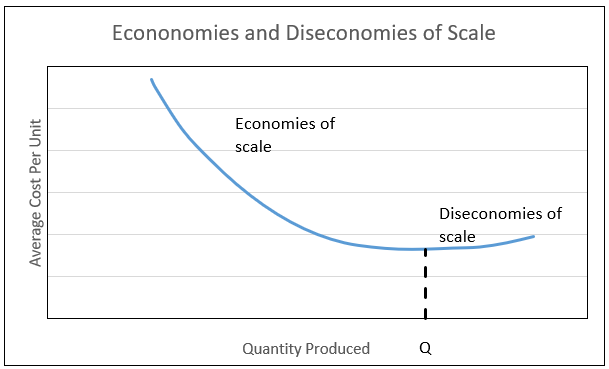

The graph below illustrates economies and diseconomies of scale. Up to output Q, there are economies of scale because the average total cost is falling. Diseconomies of scale exist when output exceeds Q.

Listed below are several examples of companies benefiting from economies of scale. In each case, a higher output results in a lower average cost to produce a good or service.

- Larger purchases may give the buyer more leverage to negotiate a lower cost for an input, such as a raw material or fleet of motor vehicles in much the same way as you benefited from purchasing more rolls of paper towels.

- Marketing and delivery costs can be reduced as output increases if a company is able to negotiate bulk advertising rates or transportation rates. Television advertising may be more expensive, but it may be the least expensive way to reach a large market. In other words, the average cost of reaching a person is lower.

- Large companies may have access to the capital markets that smaller companies do not have. Financial economies of scale exist because when larger companies can secure more favorable loans than smaller companies. Bankers have similar fixed costs associated with reviewing and managing a loan, whether it is $500,000 or $20,000,000. Banks may pass some of the savings through to a large customer as lower fees (relative to the loan amount) and a more attractive interest rate.

- Larger companies may have a more efficient division of labor. Managerial economies of scale exist because large companies can afford to hire specialists in many areas. Managers of small companies frequently have many responsibilities – some of which they are proficient at, and others that they are not good at. For example, a plumber may be a terrific plumber, but his business suffers because he is very uncomfortable marketing his services.

- Technological economies of scale usually create high barriers to entry in monopolies and oligopolies. Large capital investments improve productivity, which reduces the average total cost to produce a good. Automating a factory using robotics requires a large fixed investment, but once the investment is made, the variable cost to produce a good may be very low. As more is produced, the total average cost is reduced because the fixed cost of automating the plant is averaged over a larger output.

The examples mentioned above are internal economies of scale because they result from decisions made inside the company. Vendors, universities, and governments may respond to growing industries in ways that lower the cost of all the companies in an industry. Economists refer to these as external economies of scale. External economies of scale exist when a development within an industry but outside the company results in lowering costs as output increases.

For example, when an industry grows, equipment vendors may invest more in research and development to build more efficient machinery that benefits the entire industry. University research or the specialty training of employees may benefit many companies in an area. These are examples of external economies of scale. The graph above illustrates internal economies of scale. The company’s average moves down the curve when output is increased. External economies of scale would shift the entire curve downward because there is a cost saving at every level of output.

Diseconomies of scale are the opposite of economies of scale. A point is reached where a company’s total average cost increases when output grows. On the graph above this is where output exceeds Q. For example, the cost of a raw material may increase if the supply of the material from a local source is stretched and the manufacturer is forced to pay a higher price for the material from another supplier that is further away. Decision making may be impeded by the levels of bureaucracy that exist within a large company. Companies with many employees may experience a rise in absenteeism because workers believe they can be easily replaced. Employees may feel unimportant or lost and not sense the need to work efficiently or make suggestions to improve operations. Coordination in the manufacturing process becomes more challenging as production increases – especially if it involves several manufacturing plants.

Dig Deeper With These Free Lessons:

Market Structures Part I – Perfect Competition and Monopoly

Market Structures Part II – Monopolistic Competition and Oligopoly

Output and Profit Maximization

Capital and Consumer Goods – How They Influence Productivity