An expansion is a period of economic growth when an economy’s real gross domestic product increases.

The economy moves in cycles, business cycles, alternating between periods of prosperity and periods of hardship.

Economic expansions begin at the trough, where production hits its lowest point. Unemployment is high, business earnings are down, and there is little inflation. Policymakers at the Federal Reserve have likely lowered its benchmark rate to increase aggregate demand and fuel business investment. Congress probably reduced taxes and/or increased spending to stimulate the economy.

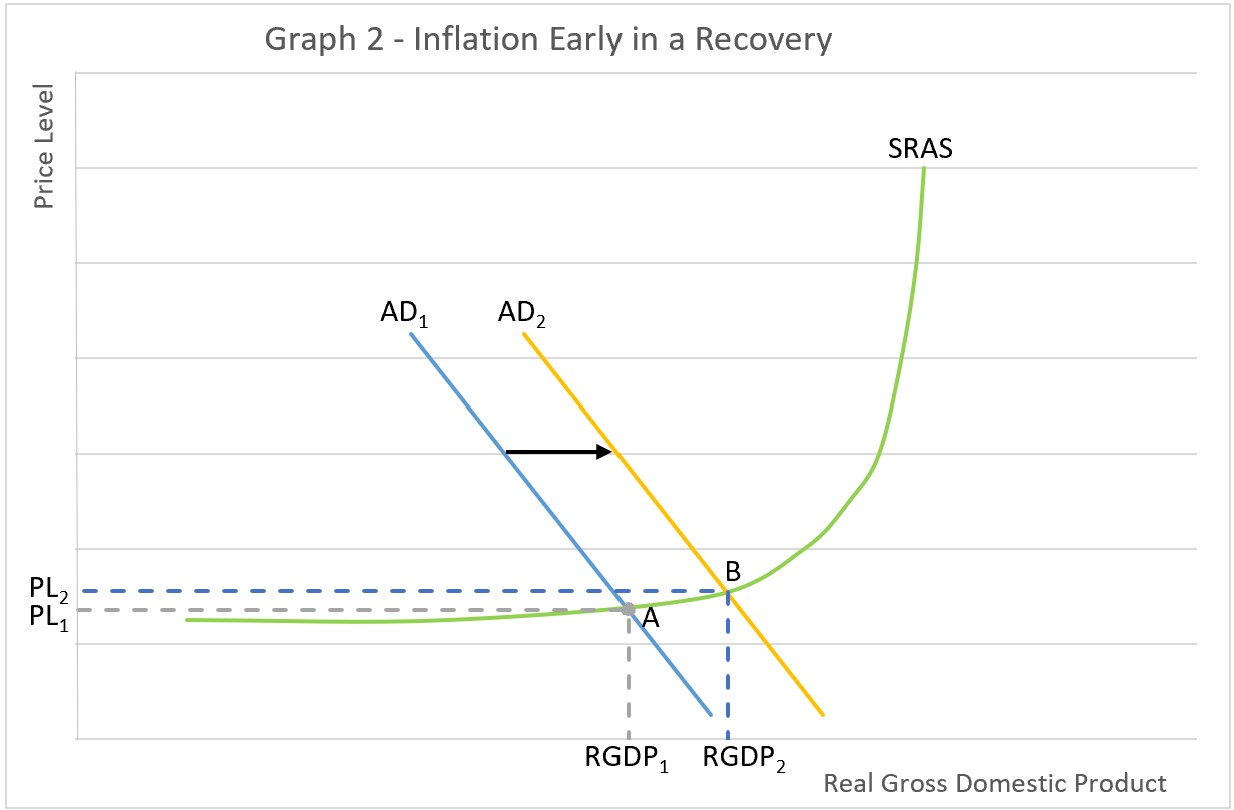

Early in an expansion, business managers are reluctant to raise their prices. Profits are down. The demand for their goods and services dropped during the recession. Companies want to increase sales. Businesses have a great deal of excess capacity, so it is relatively inexpensive to ramp up production. A high unemployment rate reduces worker negotiating power. The short-run aggregate supply (SRAS) curve is relatively flat during this stage. In other words, companies are willing to increase production without a significant increase in the market price. Any increase in the economy’s aggregate demand has little impact on the economy’s price level. Graph 2 illustrates this where movement from AD1 to AD2 only lifts the price level from PL1 to PL2.

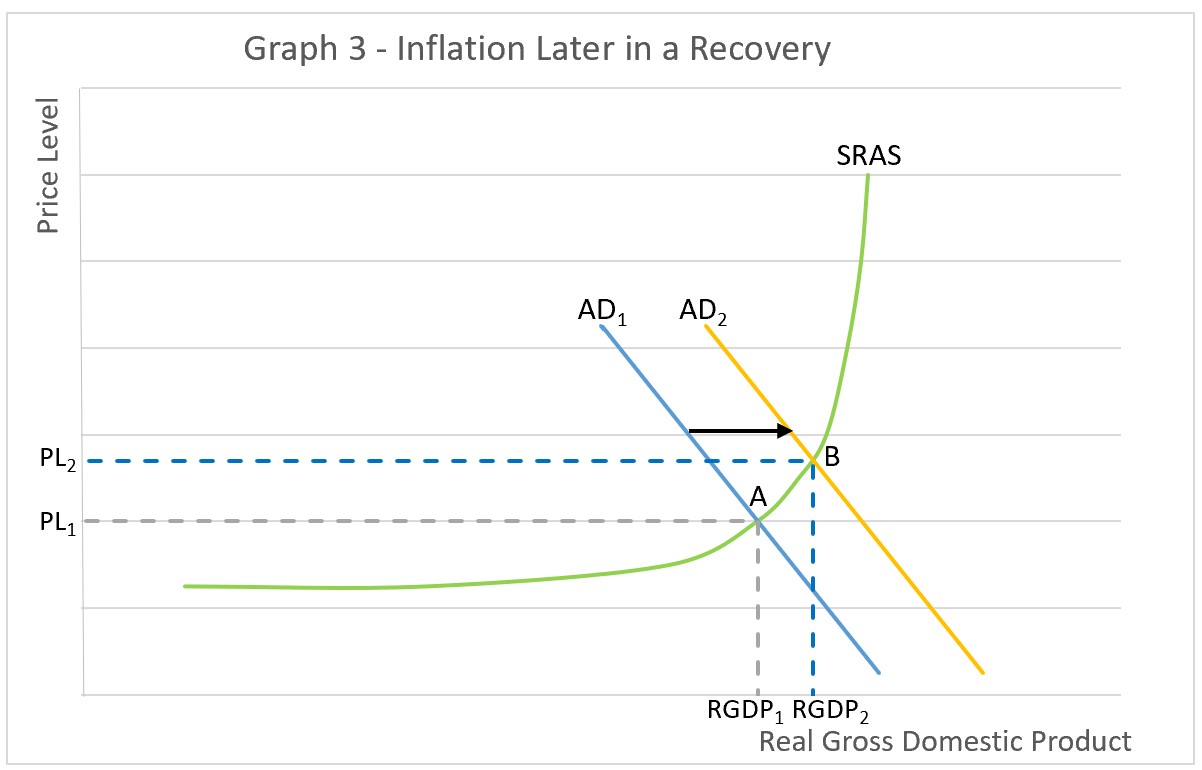

The economy picks up momentum as the economy continues to recover. Workers are hired, reducing the unemployment rate. The supply of available workers falls, thereby increasing their negotiating power. Wages and per capita income increase providing consumers with added money to buy more goods and services. Inflationary pressures mount, as illustrated in Graph 3. As the economy grows, the SRAS curve steepens because as production costs increase. Eventually, companies reach their capacity and struggle to meet the added demand. Workers work overtime. New manufacturing plants are planned but take years to build. Companies increase their prices to slow demand and recoup some of their added cost. The economy is overheated.

Graph 3 uses the same short-run aggregate supply curve as Graph 2. In this case, the aggregate demand increases from AD1 to AD2. The price level increases to PL2, a much larger increase than in Graph 2.

The Federal Reserve policymakers grow more concerned about inflation and raise interest rates to curb demand, hoping to slow the economy’s growth rate enough to sustain some growth without entering a recession. The economy is near its peak.

Many events can trigger an expansion. Containment measures imposed by governments at the beginning of the COVID-19 pandemic threw the global economy into a recession. In the United States, Congress passed The Coronavirus Aid, Relief, and Economic Security Act (CARES Act), which appropriated over $2 trillion to help families by sending checks directly to households. The CARES Act and many other government programs reduced the recession’s severity and propelled the economy into an expansion. Technological developments can also propel an economy into an expansion. The development of the internet helped fuel an expansion in the 1990s by reducing production efficiencies in almost every industry.

Expansions vary in length. The 12 US business cycles between 1945 and 2020 averaged six years and three months, but the time between peaks varied. During the fourth quarter of 2019, the COVID-19 pandemic ended the longest expansion at 12 years, breaking the record of 128 months between July 1990 and March 2001. During this expansion, the US economy grew approximately 23 percent, much less than the 41 percent growth between 1991 and 2001.

Business Cycles

Fiscal Policy – Managing an Economy by Taxing and Spending

Gross Domestic Product – Measuring an Economy's Performance

Monetary Policy – The Power of an Interest Rate