Hyperinflation is a period of extreme inflation when the price level increases 50 percent or more in a month.

In 2008, Zimbabwe’s inflation rate hit 231,000,000 percent. Imagine a candy bar that cost $1.00 in 2007, costing $2,310,000 one year later! People stopped using their money. Bartering became the norm. When they did pay with cash, the currency of choice was the American dollar. Fortunately, Zimbabwe’s inflation is more under control, and the country has begun to emerge from the devastation caused by hyperinflation. To learn more, read “In Dollars They Trust,” published in The Economist on April 27, 2013.

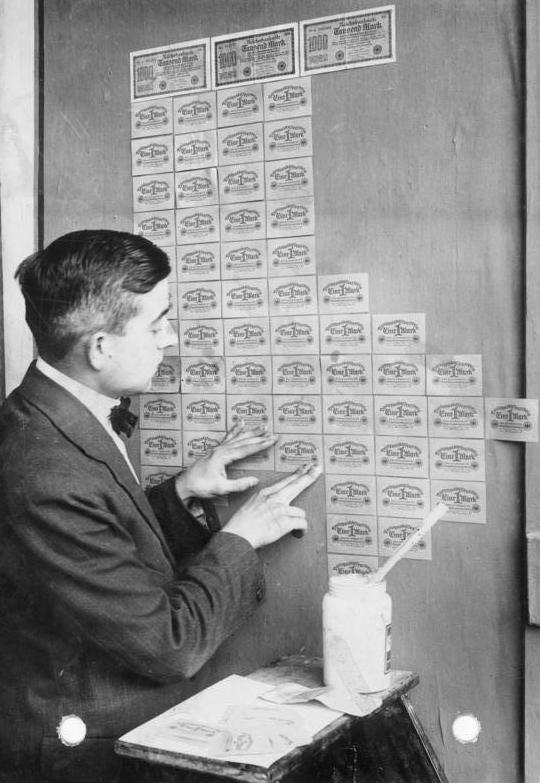

Germany also suffered from hyperinflation following World War I. In 1923, Germany’s Weimar Republic printed so much currency that some people used banknotes as wallpaper. Imagine going out to dinner. You request a menu, but your server can’t give you one because the price will likely increase before you finish your meal! In Germany, patrons negotiated the price and paid with wheelbarrows full of cash.

By Bundesarchiv, Bild 102-00104 / Pahl, Georg / CC-BY-SA 3.0, CC BY-SA 3.0 de,

https://commons.wikimedia.org/w/index.php?curid=5414025

The extreme inflation in Zimbabwe and Germany is called hyperinflation. Hyperinflation results in the devaluation of money so rapidly that people find that the goods they own hold their value better than currency. Business owners do not know what to charge, and customers do not know what a fair price is. People hoard items so they can barter or trade for goods and services in the future. They also spend their paychecks as soon as they receive them to avoid “losing” their money through sharp price increases. Banks do not lend because they do not want to lend currency today that may be worthless tomorrow.

It is improbable that hyperinflation will occur in the United States; however, it is not inconceivable. Suppose our national debt was so high that investors refused to purchase government bonds. How would the government pay its obligations? Instead of taxing its citizens, the government, out of desperation, might choose to print money—lots of money. Theoretically, this could result in hyperinflation.

A central bank’s job is to prevent hyperinflation. Policymakers usually act long before inflation is out of control by tightening the money supply, which increases interest rates and represses demand-pull inflation.

Inflation

Causes of Inflation

What is Money

Monetary Policy – The Power of an Interest Rate