Inflationary Gap

View FREE Lessons!

Definition of Inflationary Gap:

The

inflationary gap is the gap between actual production and the full employment output when the actual output exceeds the full-employment output.

Detailed Explanation:

During boom periods the economy can be overheated and growing too fast. Production exceeds the long-run equilibrium. Factories are operating beyond their optimal capacity, meaning they are deferring maintenance. Workers are working overtime. New workers are hard to find and demand higher wages. Companies raise their prices as their costs increase and do not fear losing too many sales by doing so. Policymakers are concerned about rising inflationary pressure. An increase in aggregate demand yields a small increase in production and a large increase in the price level. An inflationary gap exists when the short-run output exceeds the long-run aggregate supply.

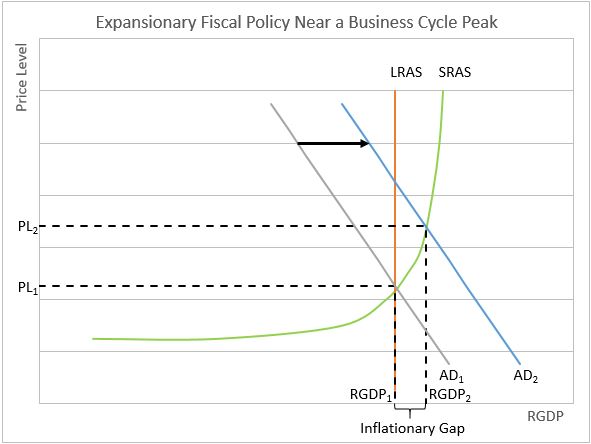

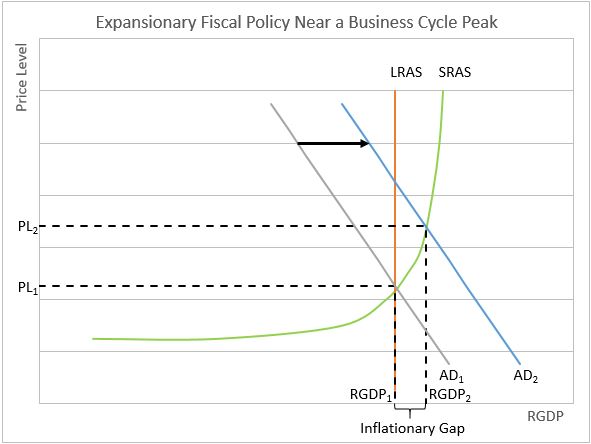

The inflationary gap is labeled on the graph below. Assume the economy begins in a long-run equilibrium where the aggregate demand AD

1, short-run aggregate supply (SRAS), and long-run aggregate supply (LRAS) intersect. RGDP

1 is produced and PL

1 is the price level. The government increases spending, which causes a shift in the aggregate demand curve to AD

2. The economy's output increases to RGDP

2.

Meanwhile, prices jump to PL

2. The inflationary gap is the difference between RGDP

1 and RGDP

2 when RGDP

2 exceeds RGDP

1. The SRAS curve is steep because the economy is beyond its long-run equilibrium. Most companies are operating near their capacity and have little room to respond to the increase in the demands for their goods and services. Any increase in the AD generates a relatively small increase in output from RGDP

1 to RGDP

2 and a larger increase in the price level from PL

1 to PL

2.

When there is an inflationary gap, the aggregate demand exceeds the short-run aggregate supply at the initial price level. Much like the standard supply and demand model, there is a shortage of goods. When there is a shortage of a good or service in the economy, manufacturers increase its supply. Unfortunately, during boom periods the aggregate supply is not easily increased. The long-run aggregate supply is constrained by the country’s resources and workforce. Prices must rise or the aggregate demand must fall to reach a new equilibrium.

During periods when there is an inflationary gap the appropriate fiscal and monetary policies would reduce the aggregate demand back to AD

1. Fiscal policies include limiting spending and raising taxes. Monetary policies include increasing interest rates to decelerate economic lending and ease inflationary pressures.

Dig Deeper With These Free Lessons:

Fiscal Policy – Managing an Economy by Taxing and Spending

Business Cycles

Aggregate Supply and Demand – Macroeconomic Equilibrium

Monetary Policy – The Power of an Interest Rate