The interest effect is the effect that a change in interest rates has on investments and RGDP due to a changed price level.

A change in the price level can influence interest rates, which in turn impacts investment and the RGDP. If the price level drops, it is like an increase in income because consumers can purchase the same basket of goods they purchased before the drop with less money. The savings or additional income is either invested in a savings account or used to purchase additional goods or services. The added savings increase the banking industry’s supply of loanable funds. Banks compete for loans by lowering their lending rates.

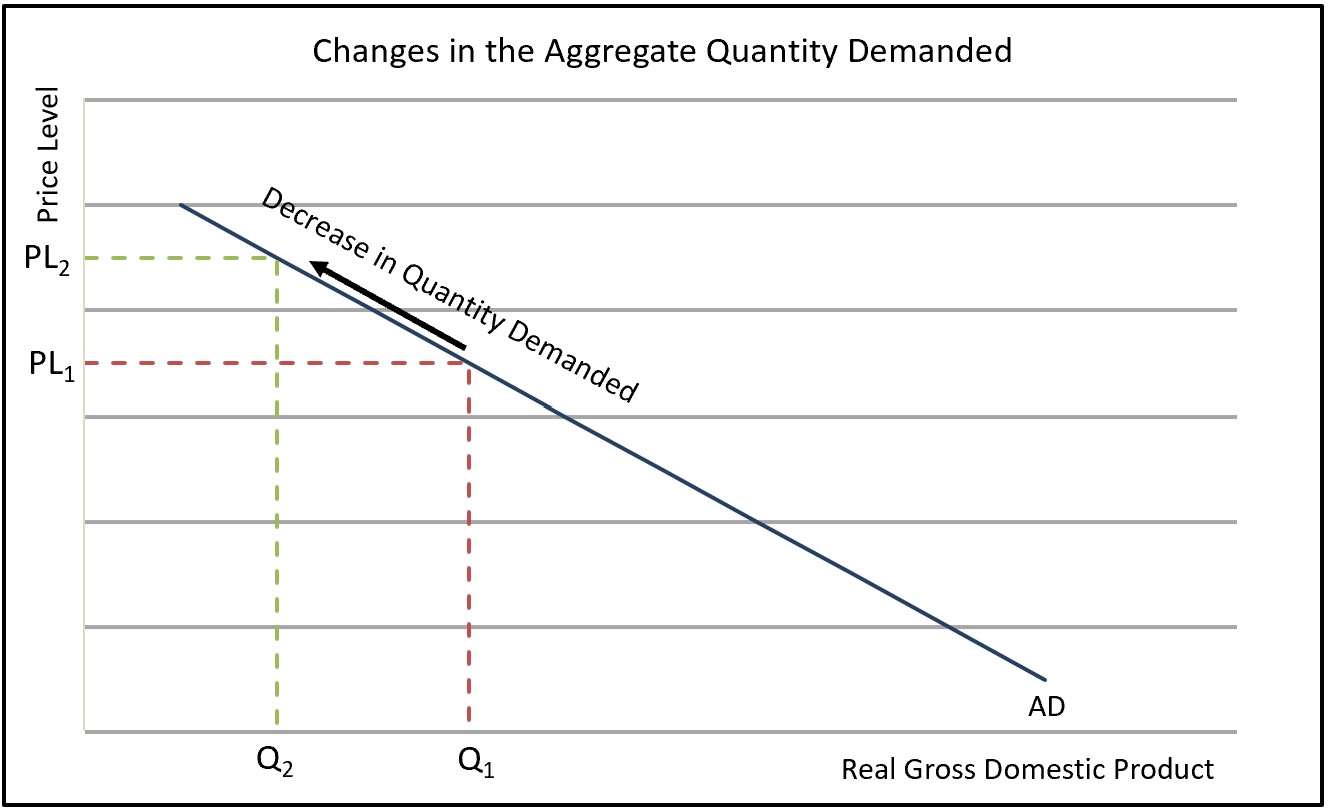

In summary, the increase in money supply to lend reduces the interest rate (price or opportunity cost of money). The lower rate prompts some businesses to increase their investments to grow their businesses. This case would cause movement along the aggregate demand curve. In the graph below, the price level increases from PL1 to PL2 and reduces RGDP from Q1 to Q2.

Fiscal Policy – Managing an Economy by Taxing and Spending

Gross Domestic Product – Measuring an Economy's Performance

Monetary Policy – The Power of an Interest Rate

Causes of Inflation

Inflation