An inverted yield curve illustrates the rare occurrence when short-term interest rates are higher than the rates on longer-term debt for investments of similar risk.

A yield curve can be drawn for any debt instrument with varying maturities, but of similar default risk. Mortgages, CDs, corporate bonds, and municipal bonds are several securities that have yield curves. However, when investors speak of the yield curve, they are referring to the market for US government Treasuries. The US Department of the Treasury publishes daily yield curve rates.

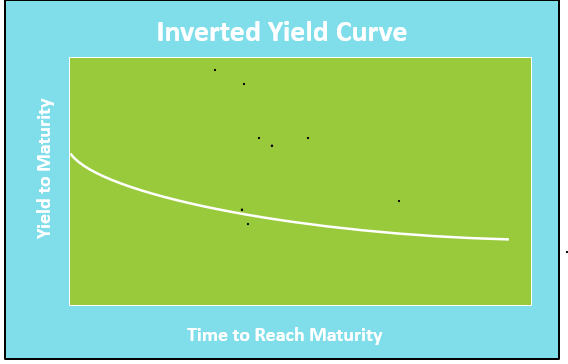

When graphing a yield curve, the vertical axis is the yield to maturity and the horizontal axis is the time until maturity. Normally investors demand a higher return for longer-term investments of similar default risk. But occasionally short-term rates may exceed long-term rates. When they do, economists and investors take note, because it may be a sign of an impending recession. A recent study by the Federal Reserve of San Francisco concluded that an inverted yield curve preceded every recession in the United States for the past 60 years.

It is important to consider an investor’s perspective when understanding the yield curve. Suppose you have $10,000 to invest, and you choose to buy US government guaranteed securities. You have several options. You can buy short-term treasury bills (a maturity of one year or less), medium-term Treasury notes (a maturity between two and ten years), or long-term treasury bonds (a maturity of 30 years). Keep in mind that if interest rates increase, the value of the investment will decrease. This is truer with longer-term bonds than Treasury bills or notes. (Watch our video Bonds and Interest Rates for an explanation of why bond prices increase when interest rates decrease.)

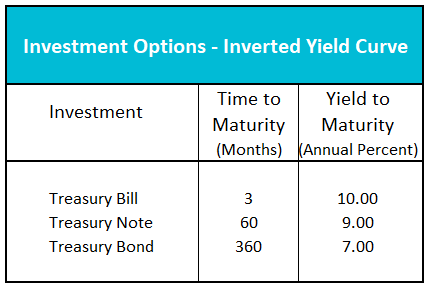

Suppose, the economy is stagnant and crippled by a high rate of inflation. You expect rates will return to lower levels within two years. Your investment options are listed below.

You could earn a 10 percent return for a short period by purchasing a 3-month bill, but if you purchased the 30-year bond you could lock into a seven percent return for 30 years. You would also realize a larger capital gain when rates fall.

What causes a yield curve to invert?

Business Cycles

Monetary Policy – The Power of an Interest Rate

Capital – Financing Business Growth