Leakage (Economics)

View FREE Lessons!

Definition of Leakage (Economic):

Leakage occurs when there is a withdrawal of money from the economy that results in a reduction of the national income. Sources of leakages include taxes, savings, and imports.

Detailed Explanation:

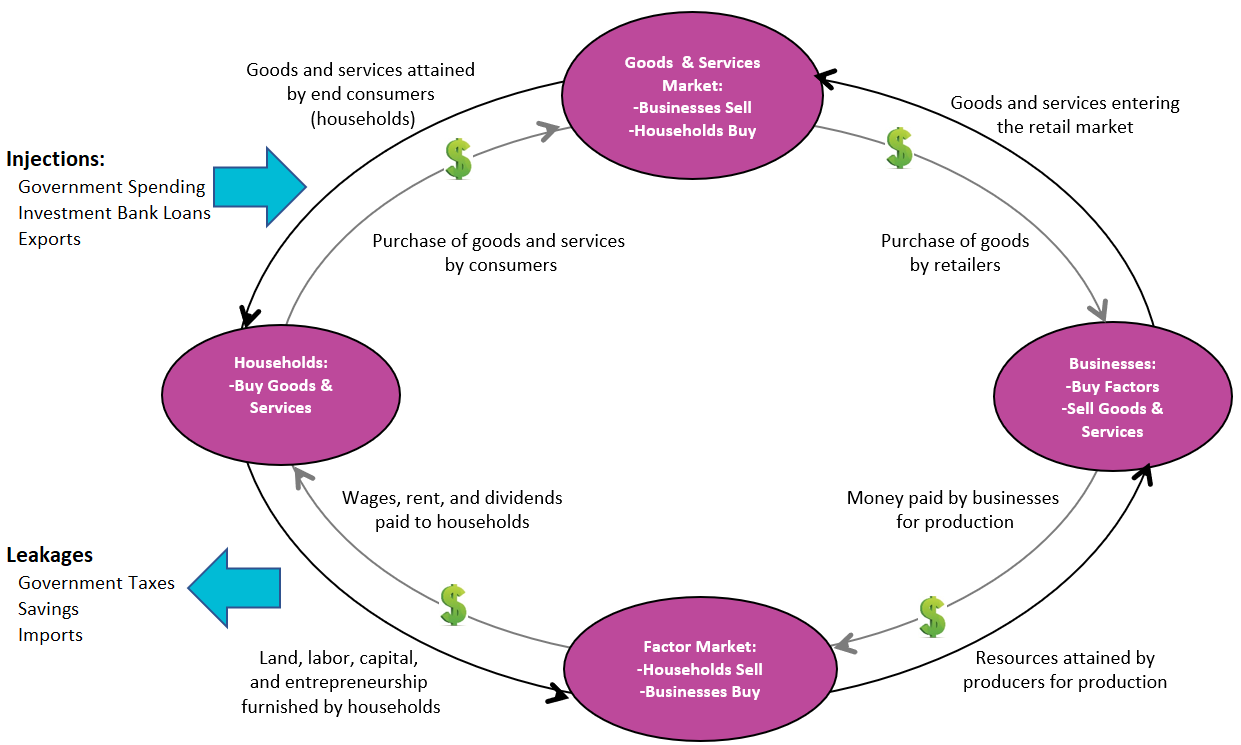

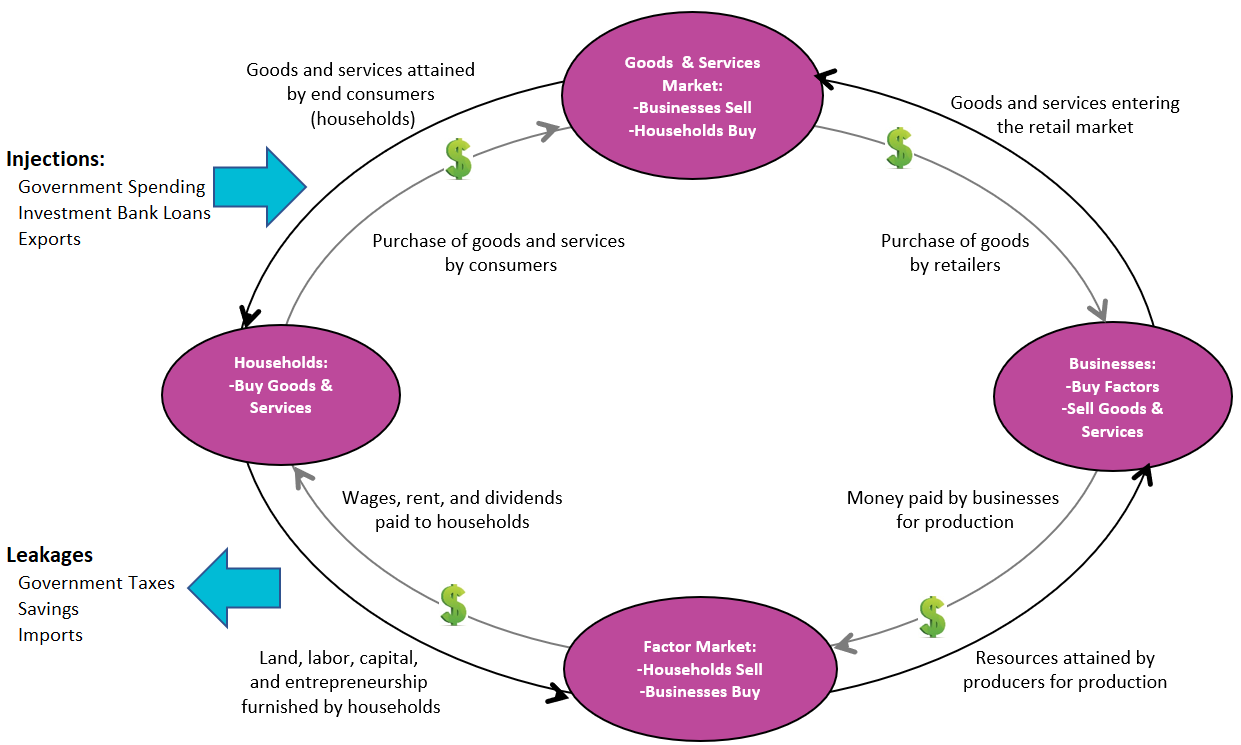

A leakage reduces the money available for consumers and businesses to purchase and manufacture goods and services. The circular flow model is a model that illustrates how consumer products and production inputs flow in exchange for money. Households and businesses are the two major actors in the circular flow model. They trade with each other in two markets—the factor market and the goods and services market. The factor market is where businesses shop for the resources they need to provide a good or service. Households purchase the goods and services they want from businesses in the goods and services market, which is anywhere businesses sell to a final consumer. The money businesses receive from households is returned to the economy when businesses purchase the resources they need in the factor market. The factors of production include labor, land, natural resources, capital, and entrepreneurship. All are provided by households. In return for providing the factors of production, businesses pay households wages, rent, interest, and profits.

The most basic circular flow model is closed, and money is circulated between businesses and households without any additional funds entering or exiting the system. (This is the diagram below without the leakages and injections.) However, in the real world, leakages occur when there is an outflow of money from the system, and consumption is reduced. Injections occur when money is added to the system and consumption is increased.

Taxes transfer money from households and businesses to governments and reduce the money available for households to spend on consumer goods and businesses to invest in the factors of production, so taxes cause leakage. However, government spending is an injection that offsets the reduction in household and business income.

Savings is another source of leakage. The money a household saves is not used to purchase consumer goods and services. However, when savings are deposited in a bank they can be used to increase lending, which increases investments. Investments funded by loans inject money back into the economy. Leakages also occur when borrowed money is not re-deposited because the money cannot be used for additional loans and reduces an economy’s capacity to extend credit.

Foreign trade can provide a leakage and an injection. Imports are a leakage because money is sent to the exporting country when an import is acquired. Conversely, exports are purchased with money from outside the economy, so the money received by a company within the economy is an injection.

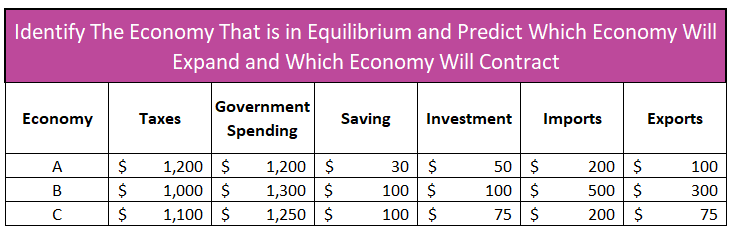

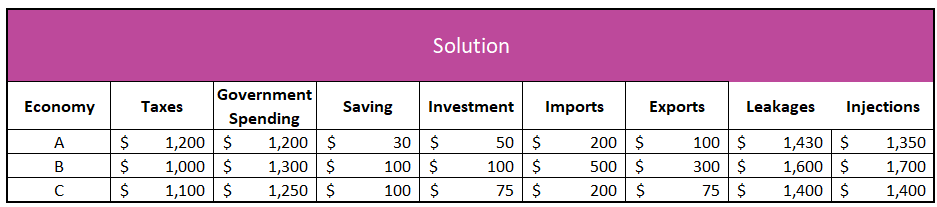

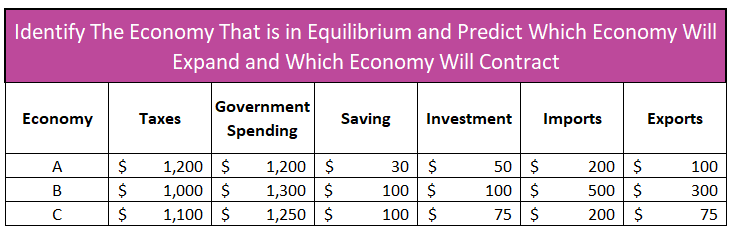

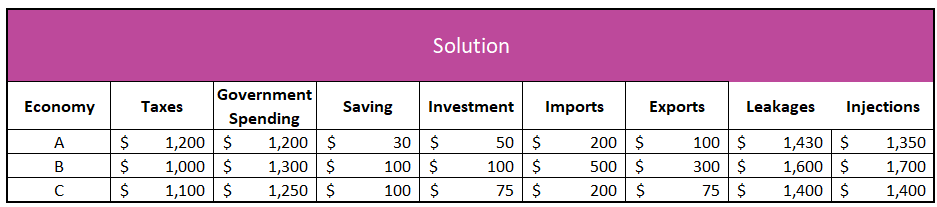

Leakages and injections can be used to predict the future direction of an economy. The economy is in equilibrium when leakages equal injections. An economy is expected to expand when injections exceed leakages. When leakages exceed injections, it signals a reduction in national income and a contracting economy. Solve the problem below. Identify which economy is in equilibrium. Which economy do you expect will expand and which will contract? Use the figures for the three economies provided in the table.

To solve the problem, for each economy, sum the leakages (taxes, savings, and imports) and compare the total with the sum of injections (government spending, investment, and exports) in each economy. When the sums are equal, the economy is in equilibrium, as is the case with Economy C. Economy B is expected to expand because its injections exceed its leakages. Finally, Economy A will likely contract since more money is leaking from consumers than is being injected into the economy. The solution is explained using the table below.

Dig Deeper With These Free Lessons:

Circular Flow Model – We Depend On Each Other

Fractional Reserve Banking and The Creation of Money

Gross Domestic Product – Measuring an Economy's Performance

Factors of Production – The Required Inputs of Every Business

Business Cycles

Fiscal Policy – Managing an Economy by Taxing and Spending

Aggregate Demand – Relating Inflation and Real Gross Domestic Product

Taxes transfer money from households and businesses to governments and reduce the money available for households to spend on consumer goods and businesses to invest in the factors of production, so taxes cause leakage. However, government spending is an injection that offsets the reduction in household and business income.

Taxes transfer money from households and businesses to governments and reduce the money available for households to spend on consumer goods and businesses to invest in the factors of production, so taxes cause leakage. However, government spending is an injection that offsets the reduction in household and business income.