Liquidity

View FREE Lessons!

Definition of Liquidity:

Liquidity is a measure of how easily an asset can be converted to cash without affecting the asset's price.

Detailed Explanation:

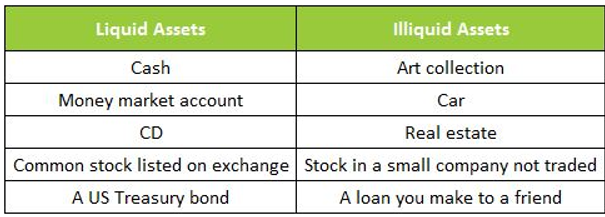

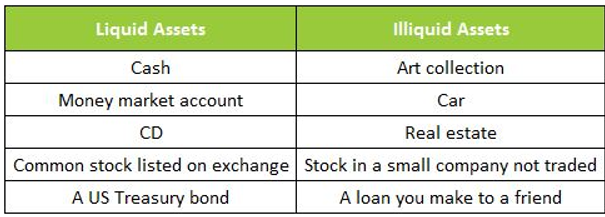

Liquidity is a measure of how easily an asset can be turned into cash. To understand the concept, ask yourself the question: “If I needed cash today, how quickly and easily could I convert my assets to cash? Would I have to sell the asset at a steep discount?” The asset would not be very liquid if you were forced to discount it to sell it quickly. Of course, cash is the most liquid asset. You could convert your money market account and certificate of deposit (CD) into cash, so they are also examples of liquid assets. You could sell your stock if it is traded on a stock exchange, so stock is considered a liquid asset. However, stock in privately held small companies may be hard to sell, so it is not very liquid.

An illiquid asset is any asset that cannot be easily converted to cash without significantly discounting the price. For instance, some might argue that a car is a liquid asset because it can be sold quickly. However, in order to sell it promptly, the owner will likely have to reduce the price drastically. This makes a car an illiquid asset. The same is true for real estate. A real estate market would be more liquid (but still considered an illiquid asset) when there is a “seller's” market. Houses generally remain on the market for short periods and buyers pay close to the listed price. When there is a “buyer's” market, homes sit on the market for longer periods, so sellers are more willing to accept lower prices.

A jumbo mortgage is a residential loan equal to or greater than $417,000 in most areas of the United States. Prior to the financial crisis, jumbo loans were liquid assets. Lenders were able to sell them to pension funds and other investors. Almost overnight, the liquidity of jumbo loans disappeared. Pension funds and other investors were concerned about the mortgage market and were reluctant to purchase these loans. Many lenders that offered jumbos with the intent of selling them left the industry. Many buyers of large homes had difficulty obtaining a mortgage because of the illiquidity of the jumbo mortgage market. Fortunately, the problem was temporary and there is now a market for jumbo loans.

In accounting, liquidity refers to the ability of a company to pay its bills. A company with a liquidity problem may not have enough cash to meet its payroll even if the company owns a substantial amount of real estate or has a large inventory.

Dig Deeper With These Free Lessons:

Capital – Financing Business GrowthFractional Reserve Banking and the Creation of Money

Understand A Stock’s Performance Using Supply and Demand