Market Structure

View FREE Lessons!

Definition of Market Structure:

Market structures define an industry’s characteristics in relation to the number of businesses in the industry and how they compete. Perfect competition, monopolistic competition, oligopoly, and monopoly are the four market structures.

Detailed Explanation:

Understanding market structures help students and economists explain how businesses reach decisions related to pricing and output. An industry's market structure can be identified by the number of companies in an industry, the standardization of the good or service produced by companies in the industry, and the barriers to entry in an industry.

Differentiating Characteristics of Market Structures:

Number of companies relative to the size of the market: The number of companies in an industry influences the way companies compete. When there are many companies in an industry price competition is limited because companies are price takers, they must accept the market price determined by the laws of supply and demand. Price leadership is exercised when there are only a few dominant companies in an industry.

Standardized Product Vs. Product Differentiation: When possible, companies compete by differentiating their products. Product differentiation is easier when there are fewer companies, especially if the good or service has few close substitutes. Product differentiation is a common marketing strategy used to build brand loyalty by emphasizing a difference between the company’s product and competing products. The difference, assuming it is an improvement, enables the seller to sell at a higher price than its competitors. A standardized product cannot be differentiated, meaning each company offers a perfect substitute for the good or service offered.

Barriers to Entry and Exit: People copy success – if they can. Profits attract competitors – if a company can enter the market. A profitable lemonade stand would probably attract many competitors quickly since it is very easy to enter the lemonade business. However, large profits in the automotive industry have attracted very few new companies in the past fifty years. Why? Because the enormous capital requirement to enter the automotive industry does not warrant the risk for most entrepreneurs. The barriers to entry are very high.

Industries with large economies of scale have high barriers to entry. Economies of scale occur when increasing output reduces the average unit production cost. Industries with large economies of scale normally have a few large competitors.

Characteristics of The Four Market Structures:

Perfect Competition – Perfect competition is a market structure where there are many sellers and buyers that trade in identical products. Neither sellers nor buyers are powerful enough to influence the market price. A perfectly competitive firm is unable to sell any of its product at a price exceeding the market price because it sells a standardized product and its competitors offer perfect substitutes. There is no incentive for the seller to lower its price to gain sales since it can sell all its product at the market price. Economists refer to companies that have no influence over their price as price takers.

Companies can easily enter and exit an industry with perfect competition. Examples of perfectly competitive industries include farming and commercial fishing. A wheat buyer would not distinguish between Farmer Joe and Farmer Sue, just as a local dairy would not differentiate between milk purchased from Farmer Karen and Farmer Jose.

Monopoly – A monopoly is a market structure with a single seller offering a unique product. Entry into the industry can be blocked legally as when a company is granted a patent. It also can be blocked by economic considerations as in the case of a natural monopoly. A natural monopoly occurs when large economies of scale enable one company to provide a good or service more efficiently than many companies. Electrical utilities, railroads, and natural gas companies are examples of natural monopolies.

Products are not differentiated because the monopoly has no competition. A monopoly’s demand curve is the industry’s demand curve, but a monopoly is still subject to the law of demand and will experience a drop in its quantity demanded when it raises its price. A monopoly can set the amount it wants to produce in its pricing, or it can set its price by adjusting its output. Monopolies are considered price makers because they have pricing power. The existence of close substitutes diminishes a monopoly’s power.

Monopolistic Competition - Monopolistic competition is a market structure where there are many companies that compete by offering a slightly different product. Like perfect competition, no single producer dominates the market. There are many producers because there are few barriers to entry. But unlike perfect competition, producers differentiate themselves from their competition by offering a slightly different product. The objective is to build brand loyalty. For example, an accounting firm that prides itself on preparing tax returns in a timely manner may build brand loyalty and charge a slightly higher rate than its competitors. A local convenience store may use its active support of the local high school teams to differentiate itself. These companies have a downward-sloping demand curve because they can charge their loyal customers a higher price. Pricing power is very limited because typically these goods and services have many close substitutes.

Local professional services, fast food restaurants, and the lodging industries are examples of industries with a monopolistic competition market structure.

Oligopoly – An oligopoly is a market structure where a few companies dominate the market. Economists refer to the concentration ratio when measuring the market power of the dominant companies in an industry. “C4” is the concentration ratio of the four largest companies in an industry and equals the sum of their market shares. Most oligopolies have concentration ratios exceeding 40 percent. Large economies of scale create high barriers to entry and discourage potential competitors from entering an industry.

Oligopolies try to avoid competing on price. Management fears raising their price and losing sales to its competition because competitors offer close substitutes. They are also reluctant to lower their price because they expect their competitors will match their price decrease. For example, Coca-Cola may fear losing sales to Pepsi Cola if it raises its price because Coke and Pepsi are close substitutes. Management is also reluctant to lower the price of a Coke because it believes Pepsi’s management would match any drop, which would start a price war. Price wars occur when one company lowers its price to gain share and its competitors follow. Oligopolies have a kinked demand curve. It is elastic at higher prices because consumers will readily switch to a competitor if management raises its price. However, the demand curve is steeper at lower prices because a price reduction will not generate a large increase in sales because competing companies will lower their prices to match any decrease.

Instead of price, oligopolies compete by differentiating their product. Product innovation is most likely with an oligopoly as companies strive to create advantages over their competitors.

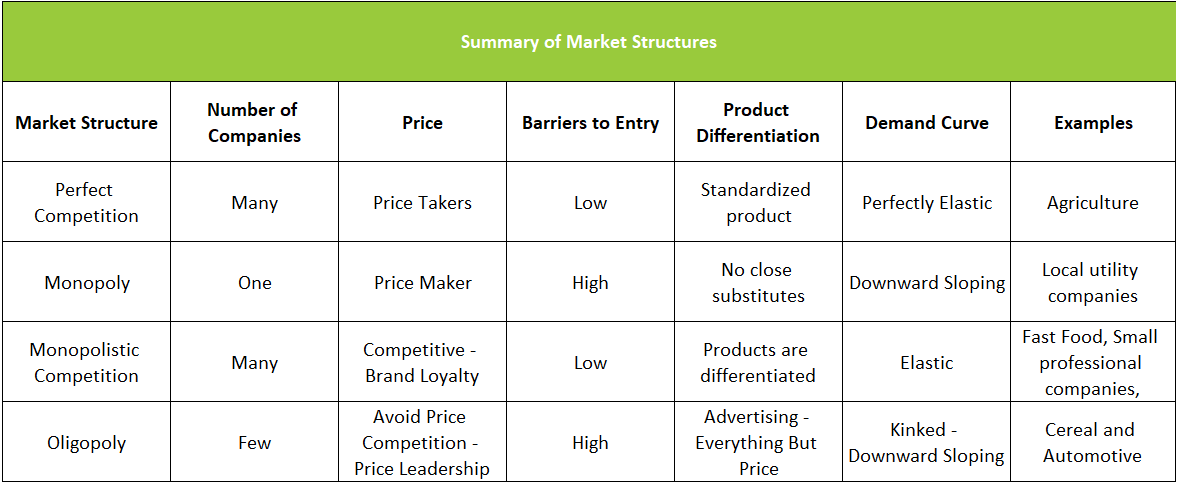

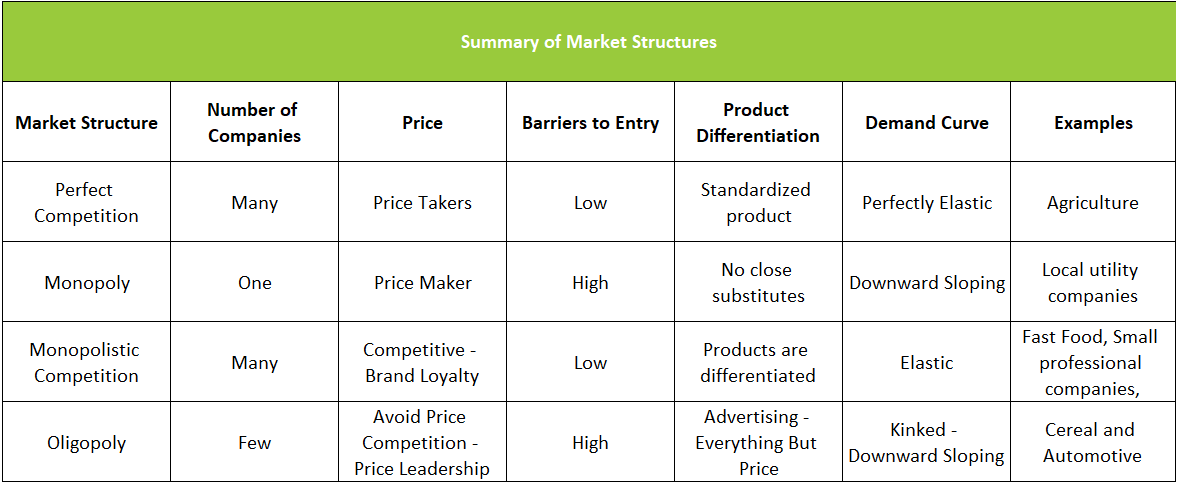

The table below summarizes the characteristics of the market.

Dig Deeper With These Free Lessons:

Market Structures Part I – Perfect Competition and Monopoly

Market Structures Part II – Monopolistic Competition and Oligopoly

Output and Profit Maximization

Supply and Demand – Producers and Consumers Reach Agreement

Factors of Production – The Required Inputs of Every Business