Multiplier Effect

View FREE Lessons!

Definition of the Multiplier Effect:

A

multiplier effect is the ripple effect from a change in fiscal or monetary policy that results in an increase or decrease in an economy’s aggregate demand that exceeds the amount of the initial change.

Detailed Explanation:

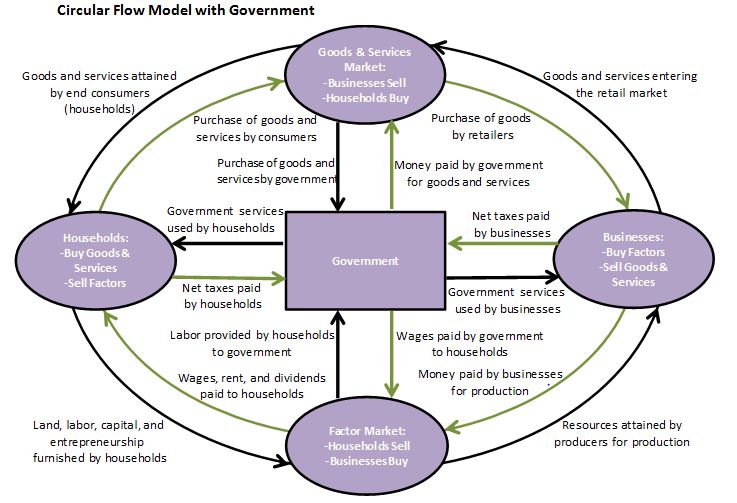

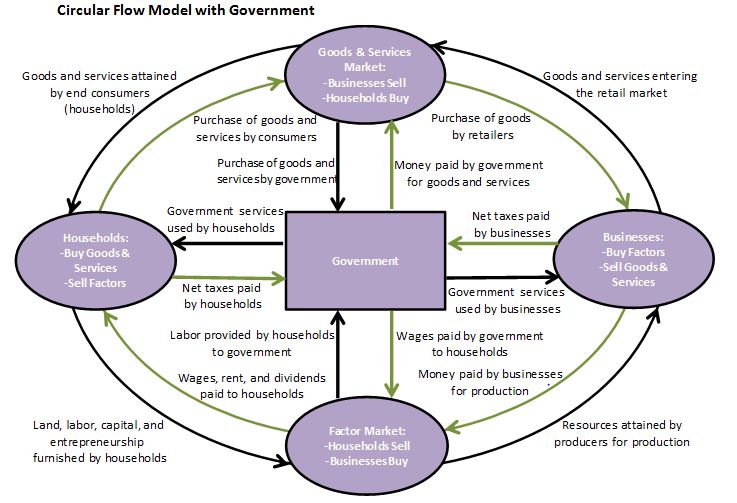

The circular flow model illustrates how a single transaction affects many parties. Households depend on businesses to provide the goods and services they need as well as the money to purchase those goods and services. Businesses depend on households to provide the factors of production they need and the money to build the goods and services they offer.

For example, assume that Zoey’s Manufacturing secures a large contract. Management needs to employ more workers. The income paid to these workers benefits local restaurants, retailers, and other businesses patronized by the workers. Additionally, Zoey's Manufacturing must increase its purchasing from its suppliers. To meet the added demand, the suppliers will either need to pay their workers for additional hours or hire more workers. Each step

– the added contract, the added demand from the suppliers, the added demand by households for goods and services

– increases the economy’s aggregate demand. Eventually, the increase in economic growth exceeds the initial investment.

When the government adds or withdraws money from the economy, it is easy to see the compounding effect using the circular flow diagram. Adding money creates jobs that generate a higher household income and aggregate demand. Withdrawing money prompts businesses and families to curtail spending which decreases the economy’s aggregate demand. The two most common multiplier effects studied by economists are the fiscal multiplier and the monetary multiplier.

Fiscal Multiplier

A government has two tools to implement its fiscal policy: taxing and spending. Assume Zoey's Manufacturing contracts with the government to build some weapons for $5 million. Economists would like to know how much a $5 million increase in spending would increase the gross domestic product (GDP). When a household or business receives money, it will spend some and save some. How much consumers spend can be estimated using the marginal propensity to consume (MPC). The MPC is the percentage of a consumer’s disposable income that is used to purchase consumer goods or services. It is needed to calculate the multiplier effect and the resulting increase in GDP.

The formula for the fiscal multiplier is:

Fiscal Multiplier = 1 / (1-MPC)

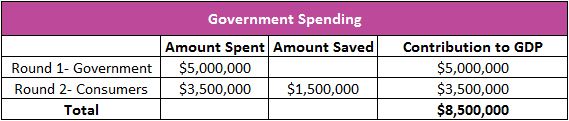

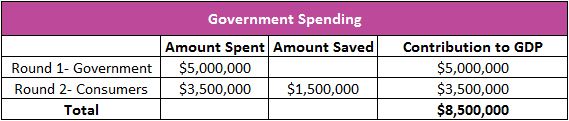

If the MPC equals 70 percent, then the multiplier equals 3.33. To illustrate, let’s return to the $5 million investment. In the first round, the $5 million would generate a $5 million increase in the economy’s GDP. In the second round, workers would spend $3.5 million ($5 million x 0.7) and save $1.5 million. After two rounds the $5 million investment will have contributed $8.5 million to the nation's GDP.

The growth in GDP doesn’t stop after two rounds. Those receiving the $3.5 million would spend $2.45 million and save $1.05 million. We could proceed for many more rounds, but eventually, the $5 million investment would contribute $16.67 million to GDP!

The same formula can be used to determine how much an economy's GDP would decrease following a reduction in government purchases. A challenge facing governments when trying to balance the budget is that cutting spending decreases the aggregate demand, which in turn lessens the short-run economic growth.

Returning to the circular flow model, a change in tax policy can be traced through the economy. Tax cuts are common during periods when the economy is in a recession. The fiscal policy’s objective is to increase the aggregate demand. When the government reduces the income tax it increases business income and household disposable income. Businesses and households purchase more, which in turn increases the economy’s aggregate demand by more than the tax reduction.

Monetary Multiplier

Economists also refer to the monetary multiplier. The monetary multiplier is used to determine how much a nation’s money supply will increase for every dollar a bank holds in reserves. Most nations have a fractional banking system, which means that banks are permitted to lend more than they accept in deposits. A nation’s money supply includes more than the cash in circulation. M1 is the most limiting definition and it includes cash in circulation, demand deposits, and traveler’s checks. A bank adds to the money supply when it makes a loan. How? When a bank makes a loan, it does not lend the actual cash received from a depositor. Instead, it credits the borrower’s account by adding a demand deposit. The monetary multiplier answers the question, “How much will a deposit increase the money supply?” The answer depends on how much banks lend. In a fractional reserve banking system, the monetary multiplier is determined by the relationship between the bank reserves and the amount they lend.

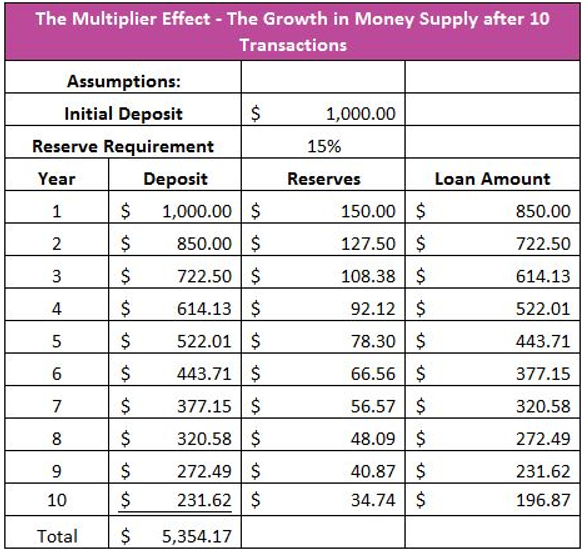

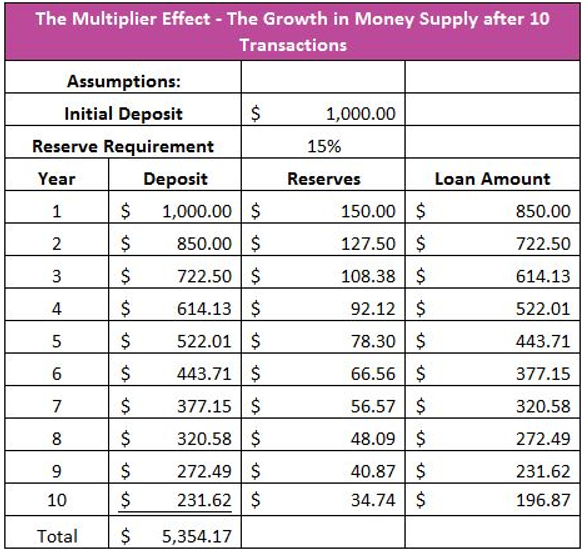

The central bank controls the amount a bank can lend by establishing a reserve requirement. The reserve requirement is the minimum a bank must hold in its reserve to meet its daily obligations. To illustrate, assume we begin with a $1,000 deposit and a 15 percent reserve requirement. The bank is required to retain $150 to meet its daily needs but is free to lend $850. When making a loan, the bank does not provide the borrower with $850 in cash. Instead, the bank credits the borrower’s account $850, resulting in an $850 increase in demand deposits and the money supply. The borrower uses the loan to pay another party, who in turn deposits $850 in their bank. Their bank must maintain $127.50 in reserves but can lend out the rest. The cycle continues.

The table below summarizes how an initial deposit of $1,000 could increase the money supply for ten transactions when each bank retains15 percent of their deposits in reserve. Note that the increase in the money supply is smaller after each transaction.

The monetary multiplier formula is similar to the fiscal multiplier, except it uses the reserve requirement rather than the marginal propensity to consume.

Monetary Multiplier = 1 / (Reserve Requirement)

If the central bank establishes a 15 percent reserve requirement, the monetary multiplier would equal 6.667, and a $1,000 deposit would increase the money supply by $6,667. The Federal Reserve presently has a reserve requirement of approximately 10 percent for US banks, resulting in a monetary multiplier of approximately 10.

Dig Deeper With These Free Lessons:

Fiscal Policy – Managing an Economy by Taxing and Spending

Monetary Policy – The Power of an Interest Rate

Fractional Reserve Banking and The Creation of Money

Circular Flow Model – We Depend On Each Other