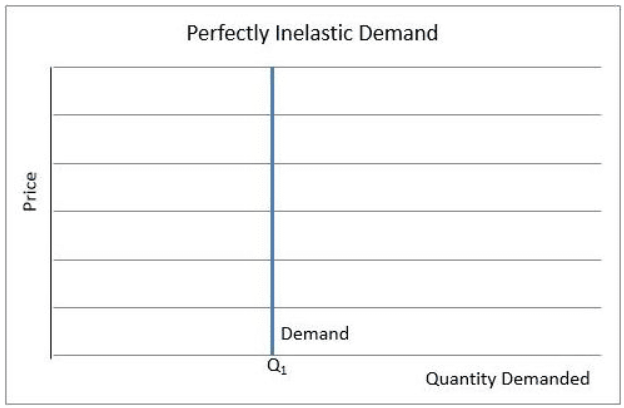

Life-saving drugs like insulin have nearly perfectly inelastic demands, especially if there is no substitute for the medication. Fortunately, pharmaceutical companies have developed alternatives, so the demand curve for insulin is more elastic than when insulin was first used. Graph 3 is for a product with a perfectly inelastic demand curve. The quantity demanded equals Q1 at all prices.

In contrast, a perfectly elastic demand curve is horizontal. Businesses selling a product with a perfectly elastic demand curve must accept the market price. If the company raised its price, it would not sell any of its goods or services because there are too many competitors offering the same product at the market price, which would be lower. The company would sell all it produced at the market price, so there is no incentive for the business to lower its price to increase sales. Typically, companies with a perfectly elastic demand curve are small producers producing identical goods and services, such as most agricultural products. Most farmers operate in what economists refer to as perfectly competitive markets. These companies are price takers because they have no impact on the price of a product. In other words, companies must “take it or leave it,” meaning that they either accept the market price or choose not to sell their product. For example, individual farmers cannot negotiate their prices when bringing their produce to market. They must accept the market price. A produce farmer who tries to negotiate a higher price would have to discard many unsellable rotten vegetables! A farmer who lowers the price would be leaving some money on the table.