Price Maker

View FREE Lessons!

Definition of Price Maker:

A

price maker is a seller who can influence the price of a good or service by adjusting its output.

Detailed Explanation:

Any company with a downward sloping demand curve qualifies as a “price maker”, although in most cases the pricing power is minimal. A company's pricing power for a good or service depends on the number of substitutes and the product's price elasticity of demand. Sellers of a good or service with a very elastic (flat) demand curve have very little pricing power.

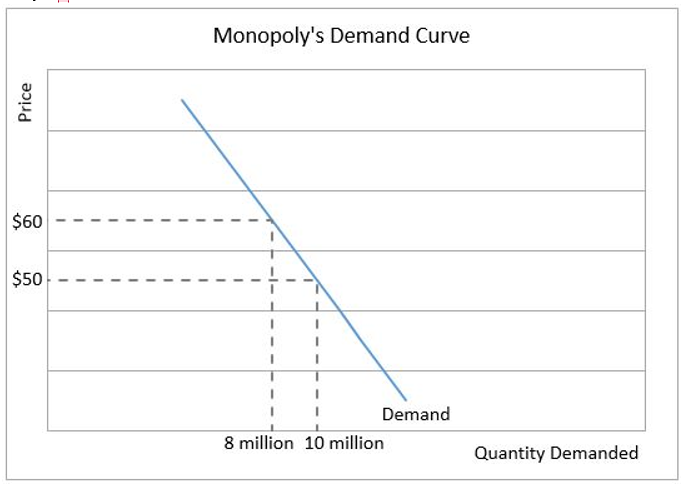

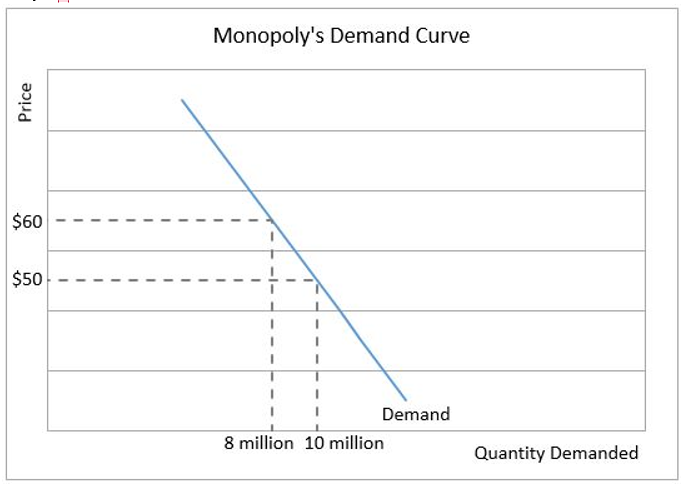

Monopolies are truly price makers, especially if they have no substitutes. A monopoly’s demand curve is also the industry demand curve because there is only one producer. This means management can control the price by controlling its output. Monopolists can raise their price if they are willing to accept the resulting drop in the number of units sold. As a price maker, the monopolist will set prices by modifying the quantity it produces. The graph below illustrates this point. If the monopoly produces 10 million units, the price would be $50 per unit. If management chooses to increase the price to $60, it can do so by reducing its output to 8 million units. There is no fear of losing sales to a competitor because a monopoly does not have any competitors!

In contrast, a company operating in a perfectly competitive industry is a price taker, so if it raises its price, sales will drop to zero (assuming the new price exceeds the market equilibrium) because many other companies are willing to offer the product at the market price. A company in a perfectly competitive industry does not need to decrease its price to sell more goods because it can sell as much as it can produce at the market price. The demand curve for a perfectly competitive firm is horizontal, which means that the equilibrium price is unchanged no matter where the supply curve is placed on its supply and demand graph.

Companies in industries that are oligopolies or monopolistic competition have downward-sloping demand curves. Like monopolies, they will not lose all their sales if they increase their price, so they have some price-making ability because some of their customers are loyal and willing to pay a higher price. Companies with more elastic demand curves are more susceptible to price changes and will lose more market share if they increase their price. Companies with a low market share behave more like price takers than price makers because they have minimal price-making powers.

Dig Deeper With These Free Lessons:

Market Structures Part I – Perfect Competition and Monopoly

Market Structures Part II – Monopolistic Competition and Oligopoly

Output and Profit Maximization

Supply and Demand – Producers and Consumers Reach Agreement

Supply and Demand - Understand The Dynamics of The Stock Market