A progressive tax is a tax where the average tax rate increases as taxable income increases, which means a higher-income family pays a larger portion of their income in the tax than a lower-income family.

In a progressive tax system a taxpayer’s average tax rate increases as the taxpayer’s income increases. For example, if Sandra earns $30,000 and pays $2,000 in taxes, while Bill earns $150,000 and pays $33,000 in taxes, there is a progressive tax system because Sandra's average tax rate of 6.67 percent is less than Bill's 33 percent average tax rate.

Most developed countries have a progressive income tax. Policymakers believe that higher-income individuals should shoulder more of the responsibility of paying for the goods and services government provides. They are better able to afford it, and perhaps they have more to gain. Higher-income people are more likely to travel, and so they benefit more from roads. Wealthier citizens have more to lose from the destruction of war, so they should pay more for the military. Other examples of a progressive tax are the estate tax and the luxury tax. In the United States, an estate tax is not paid until the value of an estate exceeds $5.49 million. A luxury tax is frequently charged for luxury items that only the wealthy can afford.

The US tax has become less progressive since 1963, when individuals with incomes exceeding $200,000 ($400,000 for families filing jointly) had a marginal tax rate of 91 percent. Most economists believe that high tax rates discourage people from working. Arthur Laffer developed the theory that a point is reached when higher tax rates actually decrease tax revenues because many people choose leisure over work. Assume you are single, earned $200,000, and had the opportunity to earn an extra $10,000. Would you choose work or leisure if you had to pay the government $9,100? Arthur Laffer believes many would choose not to work.

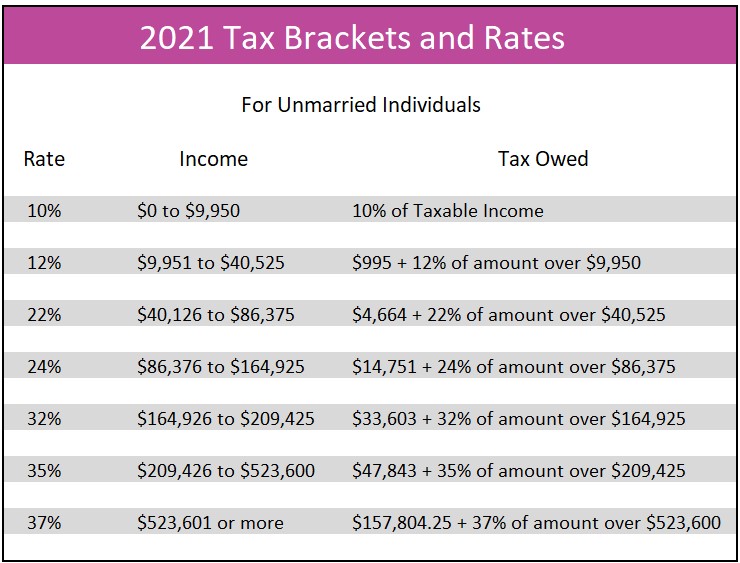

The table below provides the 2021 tax brackets for single taxpayers. Note that the marginal tax rate increases as income increases. An increasing marginal tax rate results in a higher average tax rate. For example, a person with a taxable income of $15,000 would owe $1,601, or 11 percent of her income. This person would also be in the 12 percent marginal tax rate bracket. Someone with a taxable income of $200,000 would owe $43,377. This person's average tax rate is 22 percent, and his marginal tax rate equals 32 percent.

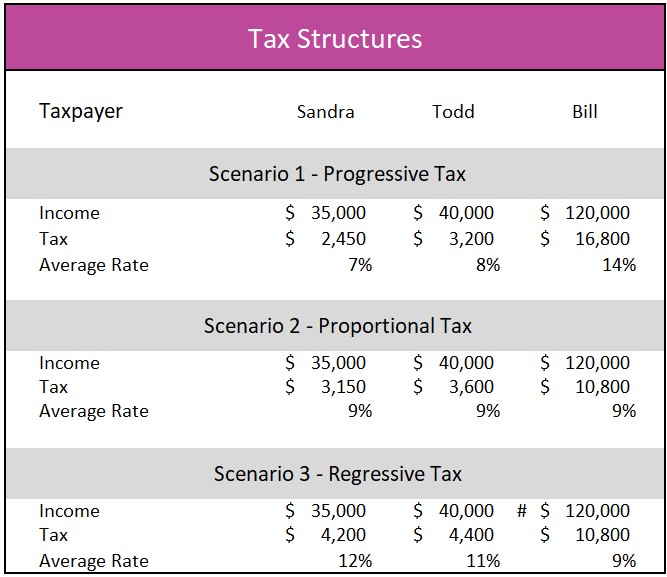

Students need to understand the difference between progressive, proportional, and regressive tax systems. A proportional tax on income fixes the tax rate as a percentage of income for all taxpayers. The proportional tax is frequently referred to as a flat tax because the tax rate is a fixed percentage. For example, assume the tax rate is 15 percent. A family earning $17,000 would pay $2,550, and a family earning $150,000 would pay $22,500. A payroll tax (Social Security and Medicare) is a flat tax because everyone pays 7.65 percent of their income - that is until they earn more than $142,800, after which the marginal rate falls to zero. Since no taxes are paid on income exceeding $142,800, payroll taxes are technically regressive.

Finally, a regressive tax requires lower-income taxpayers to pay a larger portion of their income than higher-income taxpayers. The sales tax is a regressive tax. Assume the sales tax is five percent, and a basket of goods costs $100. Everyone purchasing the basket would pay a sales tax of $5. Other regressive taxes include user fees to renew a license, enter a park, or a toll. In these cases, everyone pays the same amount, so lower-income taxpayers pay a higher percentage of their incomes.

The easiest way to distinguish between a progressive, regressive, and proportional (flat) tax is with an example. Sandra is a teacher. Her annual salary is $30,000. Todd works in the athletic department of a university and earns $35,000 per year, and Bill is a mortgage broker who earns $150,000 per year. Watch the presentation below illustrating progressive, proportional, and regressive tax systems.

In Scenario 1, Sandra pays $2,000 in taxes, Todd pays $3,500, and Bill pays $40,000. This is a progressive tax system because Sandra pays the lowest tax and has the lowest average tax rate (6.67%), while Bill pays the most tax and has the highest average tax rate (26.67%). In Scenario 2, the three tax payer’s incomes remain unchanged, but the government changes the tax system so now Sandra pays $3,000 in taxes, Todd pays $3,500, and Bill pays $15,000. Scenario 2 illustrates a proportional tax system because the average tax rates of all the taxpayers equals 10 percent. In Scenario 3, income is once again unchanged, but the government changes its tax system so Sandra, Todd, and Bill are taxed $4,000, $3,500, and $12,000, respectively. Scenario 3 has a regressive tax system because Sandra, who has the lowest income, has the highest average tax rate (13.33% vs Bill's rate of 8%).

In summary, assume a government needs tax revenues of $20 trillion. High-income payers would pay a larger portion of the $20 trillion with a progressive tax structure than a proportional tax structure or a regressive tax structure because the marginal tax rates increase as income increases. The lower-income taxpayers would shoulder a larger portion of the $20 trillion tax burden relative to their incomes in a regressive system. In the United States, the income tax is progressive, but most other taxes and user fees are regressive.

The Federal Budget and Managing the National Debt

Fiscal Policy – Managing an Economy by Taxing and Spending

Aggregate Supply and Demand – Macroeconomic Equilibrium