Representative money can be anything that has no value itself, but can be redeemed for something with intrinsic value.

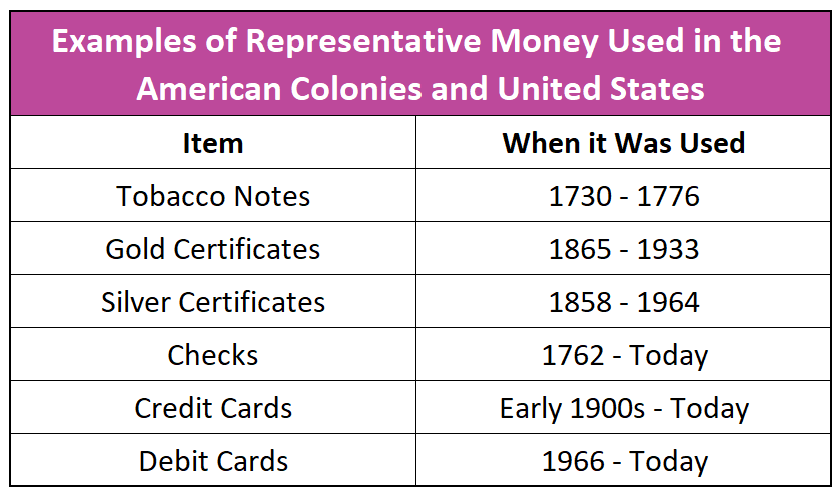

Paper certificates are representative money when traders use them as the medium of exchange to purchase an item. Residents used tobacco notes issued by Virginia and North Carolina in 1715 as representative money. After all, carrying or storing a large amount of tobacco was very cumbersome.

Gold certificates are another example of representative money. Suppose a paper certificate is backed by gold, and a farmer uses a paper certificate to buy a cow. The seller is willing to accept the certificate because he knows he can redeem the certificate for gold.

Widespread acceptance of representative money requires that the population trusts the certificate as much as the commodity that backs it. A lack of widespread acceptance became a problem in the United States when State-chartered banks issued certificates backed by gold in the 18th and 19th centuries. While supported by gold, they were not backed by enough gold to satisfy all the people who wanted to redeem their certificates, causing a run on the banks.

Silver certificates were another form of representative money that circulated in the United States between 1858 and 1964. The certificates could be redeemed for silver coins until 1964. After 1964, holders could use the certificates as currency but could not convert them to silver. By 1900, the boom and busts of the gold and silver markets motivated the US government to pass the Gold Standard Act, making gold the official currency unit. Its objective was to stabilize the dollar by making US notes redeemable for gold at $20.67 per ounce. A country has a gold standard when it links its monetary system directly to gold, and a noteholder can convert the notes into gold.

Eventually, the use of the representative money became so common and accepted that there was no need to back it with an asset. The dollar became fiat money when the US left the gold standard in 1971, and the dollar was no longer backed by gold.

Checks, debit, and credit cards are representative money used today. Checks and debit cards represent money deposited in a financial institution. Merchants accept them because transactions can be converted to cash quickly. Credit cards are widely accepted because they can also be converted to money. However, credit cards represent money that is accessed with a line of credit.