Restrictive Monetary Policy

View FREE Lessons!

Definition of Restrictive Monetary Policy:

Restrictive monetary policy refers to the monetary policy of slowing the money supply’s growth to decelerate the economy. Usually, its objective is to reduce inflation. It is also referred to as contractionary or tight monetary policy.

Detailed Explanation:

Sometimes an economy can grow too fast. Assume the economy is nearing the peak of a business cycle. Consumer confidence is high. Most families enjoy higher incomes. Some purchase a new home. Others may purchase a new car, or treat themselves to a nice vacation. Many families and businesses finance their acquisitions with debt, such as a mortgage, business loan,

car loan, or credit cards. After all, life is good. The economy’s aggregate demand is increasing, and they are confident that their incomes will remain high.

Businesses are thriving. Their biggest challenge is accommodating the increase in the demand for their goods and services. Workers may be pushed to work overtime. Companies must pay higher wages to retain workers. They may need to hire and train new employees. The rising demand for raw materials pushes up input prices. Manufacturing plants are being stretched to their maximum operating capacity. Extra shifts are added. Scheduled maintenance is delayed to complete customers’ orders. The economy is overheated, and many businesses just can’t keep pace with the increase in demand, so they raise their prices rather than turn customers away. Growth at this level is unsustainable for extended periods, so prices must go up to slow the growth in the quantity of goods and services demanded. The central bank must choose between slowing economic growth to reduce inflation or accept the inflation and allow the economy to

continue to grow.

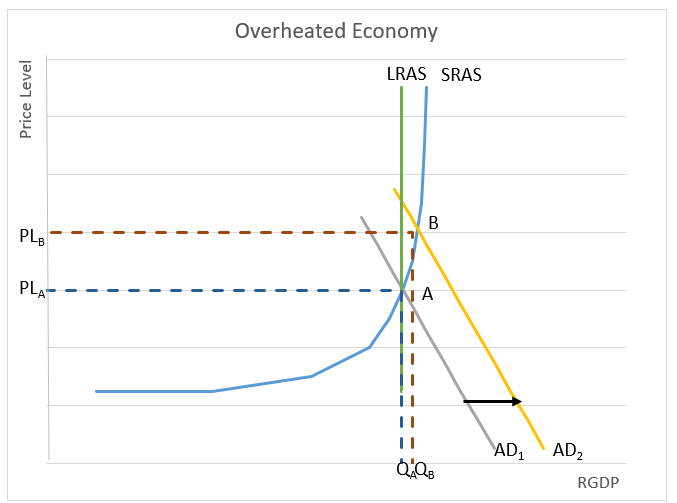

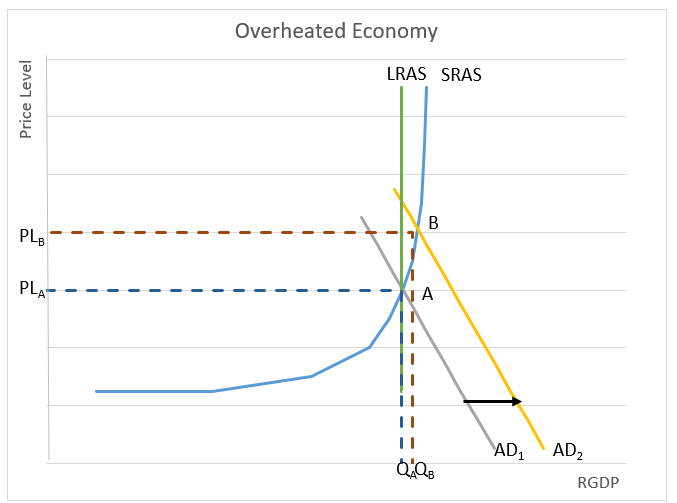

The graph below illustrates what is happening and the central bank’s dilemma. Assume the economy begins in its long-run equilibrium where the aggregate demand (AD), short-run aggregate supply (SRAS), and long-run aggregate supply (LRAS) are in equilibrium. The economy’s output and price level are Q

A and PL

A, respectively. Assume a tax cut increases the aggregate demand to AD

2, pushing output to Q

B and prices to PL

B. Notice that output increases, but prices increase much more. Somehow the aggregate demand must be reduced to closer to AD

1 if inflationary pressures are to be alleviated.

What can reverse the continuing increase in prices? Higher interest rates will help slow the sales of interest-sensitive items such as cars, homes, and financed equipment. Central banks use a restrictive monetary policy to increase interest rates by slowing the growth in the money supply. In the United States, the Fed may restrict credit by increasing the discount rate (the rate the Federal Reserve Banks charge banks that go to the Fed’s window to beef up their required reserves), increasing the banking system’s reserve requirement (which decreases the money available for lending), and increasing the federal funds rate through Federal Open Market Operations. Each strategy decreases the reserves available for banks to lend. The cost of a restrictive monetary policy is slower economic growth, but the benefit is less upward pressure on prices, so inflation should subside.

Dig Deeper With These Free Lessons:

Monetary Policy – The Power of an Interest Rate

Causes of Inflation

Fiscal Policy – Managing an Economy by Taxing and Spending

Aggregate Supply and Demand – Macroeconomic Equilibrium