Savings

View FREE Lessons!

Definition of Savings:

Savings is the money that accumulates when consumers, businesses, and governments spend less than they receive as income.

Detailed Explanation:

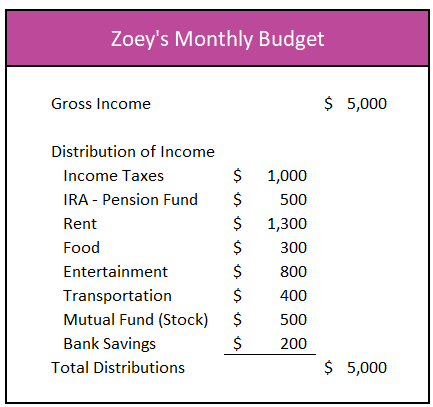

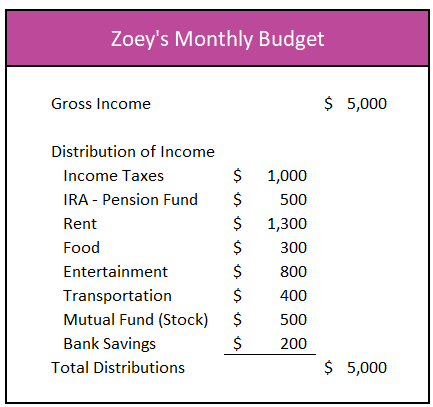

Zoey earns $5,000 per month. The table below lists her monthly budget. Which of these line items are considered savings?

If you chose the IRA, mutual fund investment, and bank savings, then you were correct. Savings are put aside for future use and are invested. Zoey saves using her IRA expecting the value to increase and help her when she retires. She expects a combination of interest, dividends, and/or capital appreciation. Banks pay savers interest. Companies pay dividends. Property owners are paid rent. (Yes, an investment in real estate is a form of savings.) In an economy, savings must equal investment because when people invest they are putting money aside for future gain. (Visit our lesson,

Monetary Policy – The Power of an Interest Rate to view the math proving savings equals investment.)

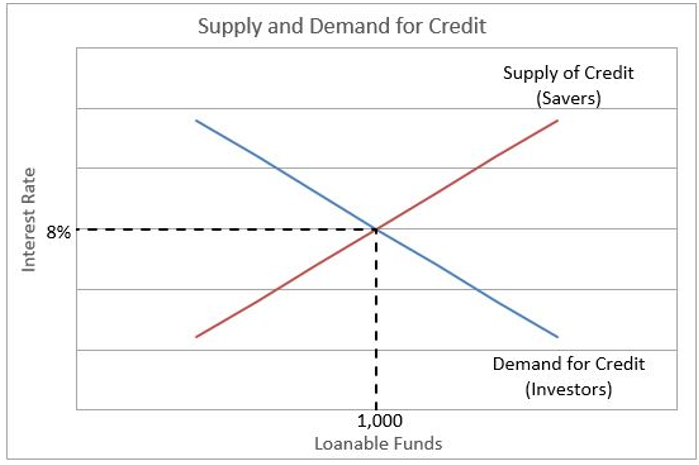

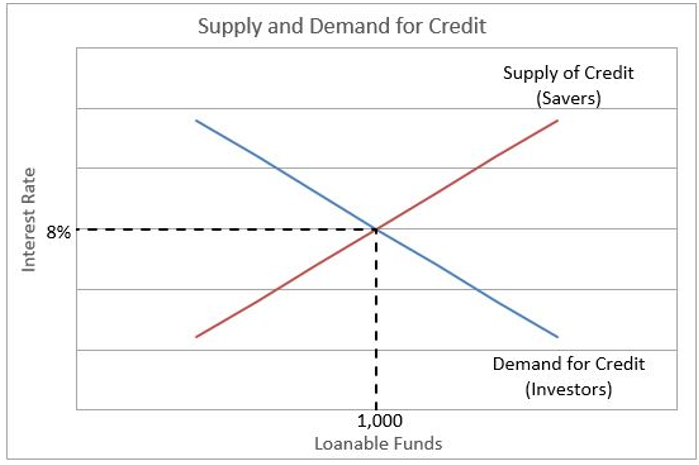

Savers supply money to fund capital growth. For example, bankers use money deposited in a savings account to make loans to businesses. Investment in stock (a form of savings) provides companies with the capital they need to grow. Households, businesses, and even the government compete for investment money (savings). Rates vary depending on the risk and time horizon – but in each case, the investor (saver) expects a return. To simplify our analysis, assume there is only one market interest rate, eight percent. That rate is determined by the laws of supply and demand. For example, when banks have excess funds to lend, there is a surplus of loanable funds and they reduce their interest rate to attract borrowers. More cars and homes are sold at lower rates. Likewise, more projects become financially worthwhile. Lower rates attract more borrowers because lower payments mean more projects become viable. In other words, the quantity demanded of loanable funds increases as the market interest rate decreases.

The suppliers of funds (savers) are less willing to invest their money at low rates. For example, people may be more interested in purchasing consumer goods and services if the opportunity cost to save is too low. But if the quantity demanded exceeds the quantity supplied, a shortage of loanable funds exists, and bankers may need to increase the rates they pay on savings to attract deposits. The quantity of investment money increases as the interest rate increases. On the graph below the equilibrium rate is eight percent, and $1,000 equals the loanable funds.

A distinction should be made between savings and saving. Savings is the accumulated funds from saving. Saving is a flow of money into savings. Consumers save when their disposable income exceeds their personal expenses. They invest the money they save into savings. Saving can be either positive or negative. A family living paycheck to paycheck may have negative savings if an emergency requires them to borrow money using a credit card. Public saving occurs when a government’s tax revenues exceed their spending, which means the government has a budget surplus. The US government runs a budget deficit most years because it is a negative saver.

Because savings are invested, the amount a country saves affects its growth. As noted above, savings equal investment, and if savings are invested in capital that improves a nation’s productivity enabling the nation’s economy to grow faster. Productivity is the output achieved per unit of input over a defined period. Long-term economic growth and improvements in a country’s standard of living depend on increasing productivity. Economic growth can be achieved by employing more people, but real wages would remain stagnant without an improvement in productivity. Governments monitor savings rates because of the importance of productivity. The personal saving rates in the United States can be accessed on a graph furnished by the Federal Reserve Bank of St. Louis. (

FRED) The personal saving rate differs from the marginal propensity to save, which economists use in evaluating economic policies. The marginal propensity to save is the proportion of the next dollar received that a consumer would save. One of its uses is estimating how a tax increase or decrease will impact consumer spending.

Dig Deeper With These Free Lessons:

Monetary Policy – The Power of an Interest Rate

Capital – Financing Business Growth

Fiscal Policy – Managing an Economy by Taxing and Spending

Fractional Reserve Banking and The Creation of Money

Production Possibilities Frontier