Stagflation

View FREE Lessons!

Definition of Stagflation:

Stagflation occurs when there is inflation accompanied by little or no economic growth.

Detailed Explanation:

Stagflation is the miserable combination of rising prices and a stagnant economy, which in turn leads to higher unemployment. It is an outcome of cost-push inflation.

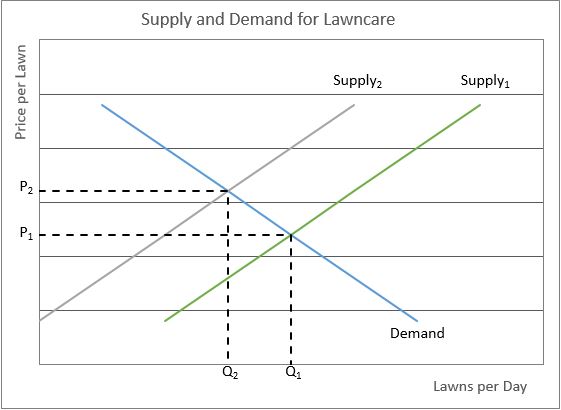

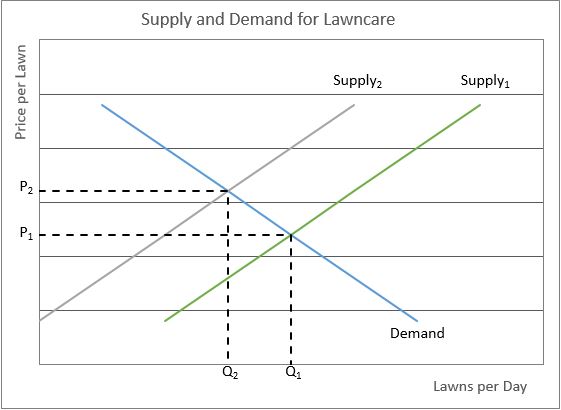

Imagine you own a lawn care business. Suddenly the price of gasoline jumps 50 percent! Gasoline is an essential input for the services you provide. Your cost to drive to your customers’ homes and power your equipment increases so much that you will actually lose money if you continue to service customers who live 30 miles away. Your supply curve has shifted to the left. You choose to charge your customers a higher price even though you know you will lose a few of them. The graph below illustrates your quandary. Your supply curve shifts from Supply

1 to Supply

2. Your equilibrium price increases from P

1 to P

2, and you are only willing to service Q

2 customers.

Other businesses share your pain and raise their prices. The added operating cost pushes up the cost of production for most businesses, so they pass the cost increase through to consumers as higher prices. Consumers are not willing to purchase as many goods and services at the higher prices, so production decreases. The economy is in a period of stagflation.

In the early 1970s, the Arab oil-producing countries embargoed the United States and its allies for supporting Israel in the Yom Kippur War. Trade in oil between the Arab oil-producing countries and the American allies suddenly ceased. The dramatic decrease in supply propelled oil prices higher. Higher energy costs were quickly felt throughout the economy. Every product requires energy to produce and energy to deliver to the marketplace, so virtually every product was impacted by the sudden increase in energy costs.

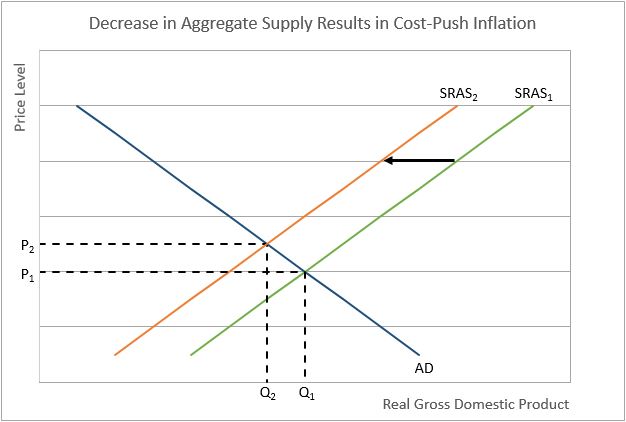

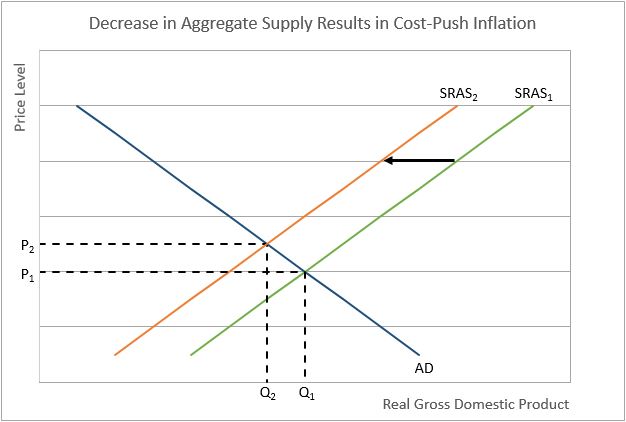

The graph below illustrates this for the entire economy using the aggregate demand and aggregate supply model. Short-run macroeconomic equilibrium is achieved where the short-run aggregate supply (SRAS) and aggregate demand (AD) intersect. SRAS1 is the initial aggregate supply. Initially, the economy's equilibrium price level and real gross domestic product (RGDP) are PL1 and RGDP1. The short-term aggregate supply curve shifts to SRAS2 after a supply shock pushes the manufacturer’s costs higher. Inflation follows. The price level jumps to PL2. Output drops to RGDP2.

Economists differ on the best way to remedy stagflation. Usually prices decrease during recessions because lower output results in lay-offs, which in turn decreases income and an economy’s aggregate demand, thus pulling prices lower. The normal fix is to use fiscal and monetary policies to stimulate the economy by increasing the aggregate demand. Unfortunately, increasing the aggregate demand increases inflation. The opposite also poses a dilemma. Normally inflation is reduced by raising interest rates. This in turn slows the economy, thereby reducing the aggregate demand and alleviating inflationary pressures. However, slowing the economy increases unemployment.

Stagflation causes greater hardship than demand-pull inflation because both unemployment and the price level increase. Fortunately, these periods normally do not last for very long. Most economists view cost-push inflation as troubling but not sustainable because a slowing economy will eventually lead to reduced pressure on prices.

Dig Deeper With These Free Lessons:

Causes of InflationInflationGross Domestic Product – Measuring an Economy's Performance