Stock Certificate

View FREE Lessons!

Definition of Stock:

A

stock certificate represents a share in the ownership of a company, which explains why stocks are frequently referred to as "shares."

Detailed Explanation:

Companies raise capital by selling stock to investors. In return, investors receive an ownership interest in the company and are able to participate in the company’s success or failure. Stock is equity, so the issuing company is not obligated to pay its shareholders. This differs from debt (borrowed money) where the company is obligated to pay the lender back with interest.

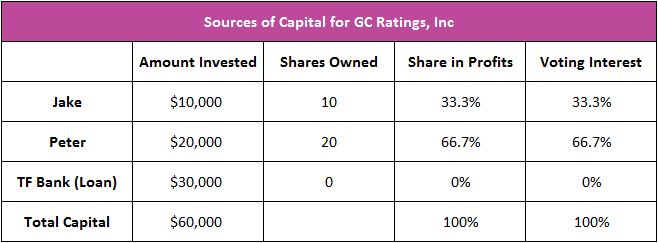

Jake is an entrepreneur. He plans to open a new business GC Ratings. Unfortunately, he needs $60,000 and only has $10,000. In raising the additional $50,000 he needs, Jake considers both debt and equity financing. Jake’s bank, TF Bank, is willing to lend GC Ratings $30,000 at an interest rate of 5 percent over a period of four years. In addition to the $10,000 that Jake has to invest, he still requires $20,000. Fortunately, Jake’s friend, Peter, agrees that GC Ratings could be highly profitable and is willing to invest $20,000 in Jake’s business. Thus, Jake’s new company will be financed with $30,000 in debt and $30,000 in equity. Peter acts only as an investor. Jake is the manager, for which he receives a salary in addition to being an investor. Jake and Peter decide to sell 50 shares of stock at $1,000 each. Table 1 summarizes Jake, Peter, and TF Bank’s interest in GC Ratings.

Ownership interest is decided by the percentage of shares owned by an investor. Peter owns 66.7% of the shares, so he owns 66.7% of GC Ratings. Jake owns the remaining 33.3% of the shares, so he owns one-third of the company. Note that TF Bank does not have any ownership interest because it does not own any stock.

Companies can issue common stock or preferred stock. Common shareholders participate more in a company’s success or failure. Generally, when income increases companies pay a higher dividend and the stock appreciates. However, when income decreases, a company’s board of directors may choose to cut the dividend, and the stock’s value may depreciate. Common shareholders also elect their company’s board of directors and may vote on other important corporate matters.

Preferred shareholders are also owners of a company, but they normally do not have a voting right. Investors may buy a preferred stock because it has a higher level of protection than common stock. It is possible for owners of common and preferred shares to lose their entire investment if a company becomes insolvent, but preferred owners have an added layer of protection. If a company files for bankruptcy and sells off its assets, the preferred shareholders are paid before the common shareholders. However, creditors are paid first, so they line up behind bondholders and other creditors. Preferred shareholders receive fixed dividend payments, which must be paid before the common shareholders. This is added protection, but also offers less potential for growth than common shares, which is why the price of preferred stock normally fluctuates less than the price of common shares.

Dig Deeper With These Free Lessons:

Capital – Financing Business Growth

Understand a Stock’s Performance Using Supply and Demand

Factors of Production – The Required Inputs of Every Business