Tariff

View FREE Lessons!

Definition of a Tariff:

A

tariff is a tax on imported goods.

Detailed Explanation:

A tariff is a protective measure imposed by governments to restrict trade and protect domestic employees and companies. Foreign goods are still imported, but because of the tariff, fewer are sold. Tariffs increase the price of imported goods, reducing the quantity demanded of the imported good. Instead, consumers purchase more domestically produced substitutes. The employees and companies of these producers benefit. Tariffs also provide an income to the government. Tariffs may result in trade wars. One country may impose a tariff on a good. The second country may retaliate by imposing a tariff on another good. Most economists believe these measures have long-term costs that policymakers frequently ignore, including higher prices and a misallocation of resources.

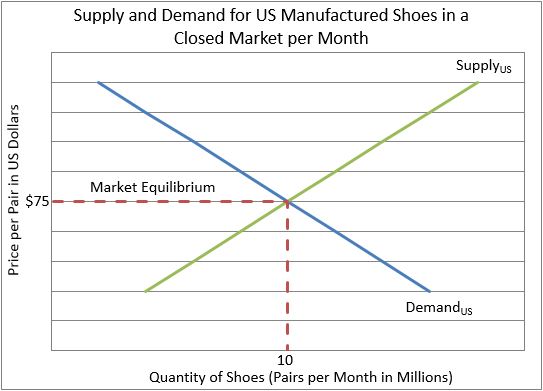

Supply and demand analysis helps explain the consequences of imposing a tariff. Let’s use the United States’s shoe industry to illustrate. Begin by assuming that the market is closed, and all shoes sold in the United States must be produced domestically. In other words, all shoes purchased in the United States are manufactured in the US. Furthermore, producers are forbidden to export any of their shoes. Assume the resulting supply and demand curves below. American consumers would pay $75 per pair and purchase ten million pairs per month. All would be produced by US companies.

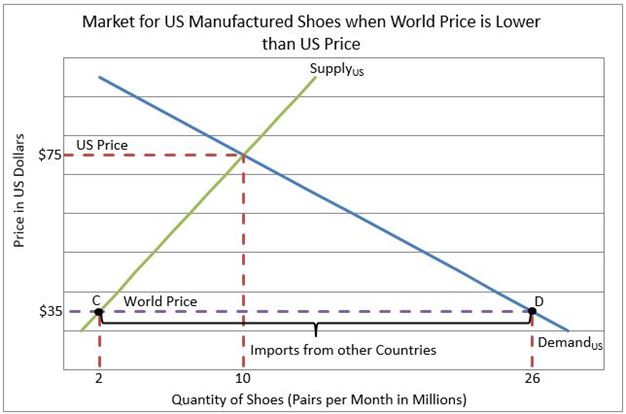

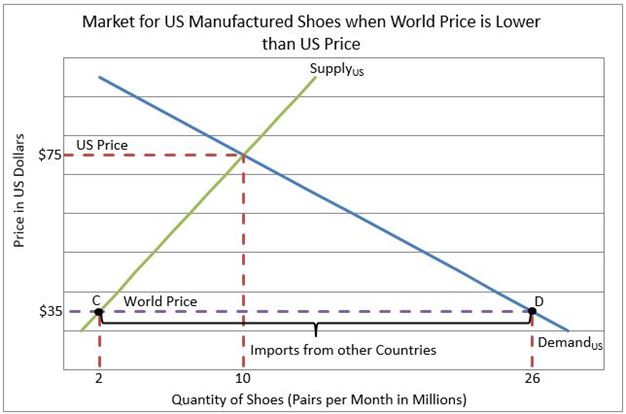

Assume free trade is permitted, and the world equilibrium price for shoes is $35 per pair. Shoe retailers are permitted to import shoes and US producers are allowed to export shoes. The resulting supply and demand for the US market and American producers are illustrated below:

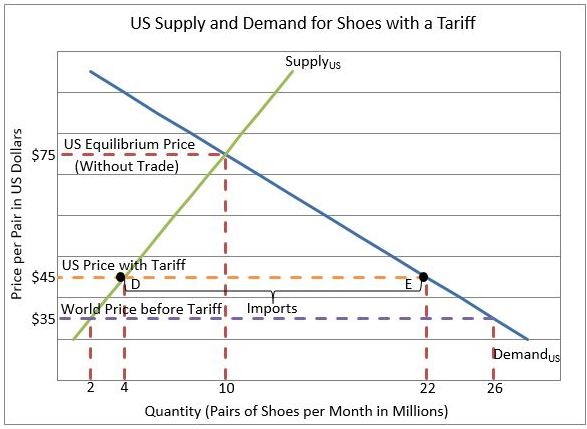

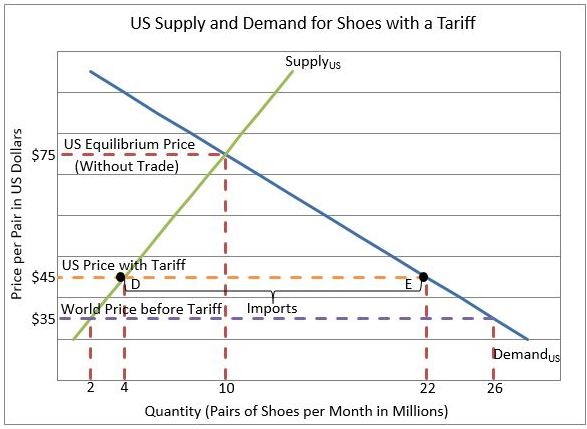

In this scenario, where the world price equals $35 per pair of shoes, US producers provide two million pairs of shoes per month. Meanwhile, American consumers purchase 26 million pairs of shoes. Twenty-four million pairs of shoes are imported. American companies either close or move their production overseas. Workers lose jobs and the economies of communities that had the manufacturing plants suffer. Companies, unions, and laid-off workers lobby Congress to protect their jobs. Congress complies with a $10 tariff per pair of shoes. The expected results are:

The tariff is passed through to consumers and the price jumps to $45. At $45 a pair, US producers increase production to four million pairs of shoes a month. Some workers are rehired, but consumers now pay $45 for a pair of shoes. Government is also a winner. They receive the tax revenue generated by the tariff...in this case $18 million a month. Is paying an additional $10 per pair of shoes worth creating a few jobs? These are questions politicians need to consider.

Dig Deeper With These Free Lessons:

Managing Supply Using Outsourcing, Tariffs, Subsidies, Quotas & LicensesSupply And Demand – Producers and Consumers Reach Agreement

Supply And Demand – The Costs And Benefits Of Price Controls

Production Possibilities Frontier