A trade deficit occurs when a country’s balance of trade is negative. In other words, countries with a trade deficit import more than they export.

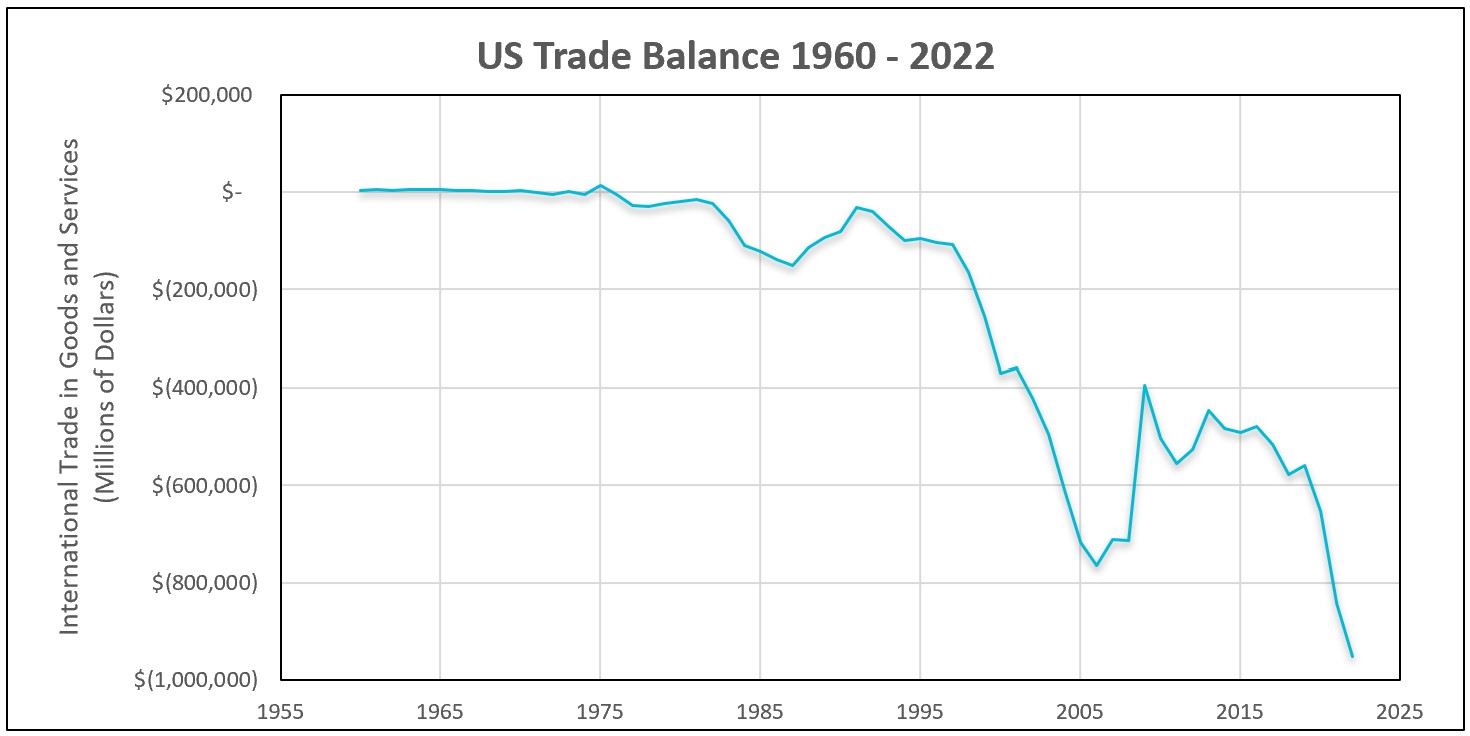

A country’s balance of trade reflects the connection between its exports and imports. Mathematically, it is computed by deducting the value of imports from the value of exports. A trade deficit occurs when a country’s balance is negative, signifying that imports exceed exports. Conversely, a trade surplus emerges when exports outpace imports. The United States has experienced a trade deficit since 1975, when a heightened reliance on foreign oil and escalating oil prices led to a significant increase in the value of imports.

Source: US Census Bureau Foreign Trade Statistics

What causes trade deficits?

The US trade deficit surged between 2004 and 2008 and again during the global COVID-19 pandemic when the rapid growth of the US economy outpaced that of many other nations and resulted in an increased demand for imported goods and services in the US, surpassing the demand for US goods and services in other countries. The graph provides the United States balance of trade between 1960 and 2022.

Trade deficits with China increased following the Chinese government’s intentional manipulation of the yuan’s exchange rate to promote exports. Had the yuan appreciated against the dollar, Chinese goods would have become more expensive for Americans, while US goods would have become more affordable for Chinese consumers and producers.

In 2019 and 2020, a severe recession in Asian countries, notably Japan, led to a depreciation of their currencies. This caused the prices of their goods to decrease relative to the prices of US goods. Consequently, US imports from Asian countries rose, and US exports declined, contributing to an expansion of the trade deficit in the US. Some governments resort to currency devaluation during recessions to stimulate exports and discourage imports.

A trade deficit can be beneficial during business expansions by reducing inflationary pressures because the imports add competition. Recessionary periods benefit from surpluses because the added exports create jobs and boost GDP.

Gross Domestic Product – Measuring an Economy's Performance

Business Cycles

Comparative Advantage and Specialization

Opportunity Cost – The Cost of Every Decision

What is Money