Have you ever purchased or sold a home? If so, then you probably understand the concept of transaction costs. A buyer or seller may negotiate a purchase price of $200,000. But by the time the buyer pays all the transaction costs, the home may cost $205,000. The seller may only receive $188,000 after paying to prepare the house for sale and a real estate commission. The mentioned costs do not include nonmonetary transaction costs, such as the stress, time, and energy it takes to close a sale.

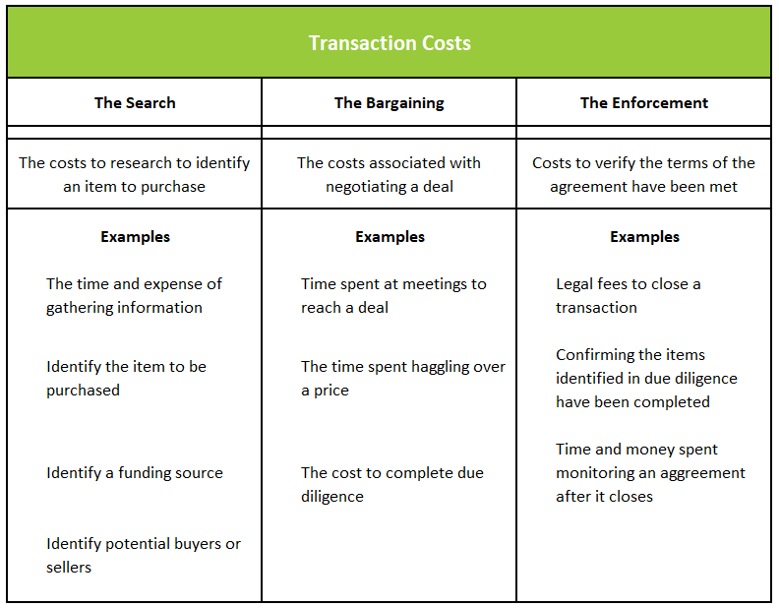

Transaction costs are generally broken into three categories.

Before a trade can occur, a person must identify what will be purchased or sold and the party with whom the transaction will be made. Identifying a good or service to buy frequently requires an investment in time and money. For example, most homebuyers do extensive research before purchasing their home. What are other similar homes in the area selling for? Is the house in a good school district? Can the buyer secure a mortgage with an acceptable payment? These are a few of the most common questions buyers research before visiting any potential homes. The quest of driving and touring each home can be time-consuming and stressful.

A seller also incurs expenses to find a buyer. For example, the seller may make some repairs or cosmetic improvements before putting a home on the market. A seller may place an ad in local publications and arrange for listing the property. Arrangements may need to be made to vacate the home when an interested buyer wants to visit.

There is frequently a cost to meet the terms of an agreement. Buyers want to be sure the house is structurally sound and the utilities are in good working order. Another stipulation may be that the buyer can secure a mortgage. The lender will require an appraisal and may charge processing fees. The costs incurred for an inspection and financing are examples of transaction costs.

Legal fees and real estate commissions are also transaction costs. Real estate commissions are another transaction cost.

Most economic theory assumes that transaction costs are zero. However, many potential transactions never occur because the transaction costs are too high. I may be willing to pay $75 to see a rock band but choose not to purchase a ticket when I consider the traffic and trouble of getting to and from the concert.

High transaction costs are frequently a problem when there are externalities and many individuals bear the costs or reap the benefits. The large number of people makes it difficult to negotiate an agreement to internalize the cost. For example, suppose Factory A pollutes a lake. The equipment to clean up the pollution costs $100,000. Assume there are no government regulations, and Factory A continues polluting rather than paying for the equipment. However, Factory A would be willing to install and maintain the equipment if another party paid for it. Suppose 20,001 unidentified fishermen would be willing to contribute $5 for the equipment to clean up the lake. In this example, entering a contract to solve the problem would be possible. Sadly, the transaction cost of identifying and collecting $5 from each fisherman is probably too high, and Factory A would continue polluting the lake. A government frequently enters the market in circumstances like this, where the transaction costs of finding a contractual solution are too high.