Transfer Payment

View FREE Lessons!

Definition of a Transfer Payment:

Transfer payments are payments made by the government for which no good or service is exchanged. Transfer payments redistribute wealth by transferring money from one group to another.

Detailed Explanation:

Transfer payments make up approximately 40 percent of the US budget. Social Security is the largest transfer payment in the United States and totaled 24 percent of federal government spending in 2015. Other payments assist the elderly, such as Medicare and disability payments. Food stamps, unemployment insurance, Medicaid, and Temporary Assistance to Needy Families (TANF) are examples of transfer payments intended to help low-income families. Student grants and scholarships are transfer payments with the objective of assisting students. (Note that student loans would not be considered a transfer payment because the loan is repaid.)

The government makes transfer payments, not in exchange for a good or service, but rather to help the recipients. Think of transfer payments as an exchange of money from the government to individuals so that the individual can pay for goods and services. There is no added production associated with the payments, so transfer payments are excluded from GDP. (In Canada transfer payments are made by the Federal Government to the Provincial governments.)

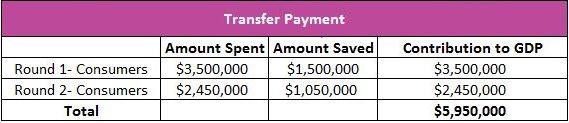

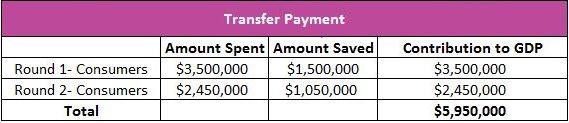

In addition to directly assisting those who receive payments, transfer payments increase the economy’s aggregate demand more than the actual payment. Money invested by the government immediately enters the economy. In subsequent steps, consumers save a portion and spend the rest. The amount depends on the marginal propensity to consume. (The marginal propensity is the percentage of a consumer’s disposable income that is used to purchase consumer goods or services.) Consumers will save a portion of the transfer payment, and those savings are not used immediately to increase aggregate demand. To illustrate, assume the government chooses to make a transfer payment of $5 million to the elderly, and the average marginal propensity to consume is 70 percent. The recipients would choose to spend $3.5 million and save $1.5 million. In the second round of spending, the consumers receiving the $3.5 million would spend $2.45 million ($3.5 million x .70), and save $1.05 million. A $5 million dollar investment would increase the aggregate demand by $5.95 million. Direct purchases by the government increase aggregate demand more than transfer payments or tax reductions. The table below illustrates how a transfer payment contributes to GDP after two rounds. The cycle continues indefinitely. Ultimately the increase in GDP depends on the marginal propensity to consume. The more recipients spend, the higher the multiplier.

During recessions, lower tax rates diminish the leftward shift in aggregate demand. At the same time, transfer payments increase as more families need help. This too reduces the leftward shift in the economy’s aggregate demand. The combination of lower progressive tax rates and an increase in transfer payments increases consumers’ disposable income.

Dig Deeper With These Free Lessons:

Gross Domestic Product – Measuring an Economy's Performance

Supply and Demand – Producers and Consumers Reach Agreement

Change in Demand – When Consumer Tastes Change

Economic Systems

Fiscal Policy – Managing an Economy By Taxing and Spending

The Federal Budget and Managing the National Debt