The velocity of money is the average frequency a unit of currency is used to purchase a final good or service annually.

If a $5 bill has been used three times in a year, then the velocity of money equals three and the total purchases using the $5 bill must equal $15. Velocity is one of the variables in the quantity theory of money equation, M x V = P x Y, used to predict and explain inflation. In the equation, M is the money supply, V is the velocity of money, P is the price level, and Y equals the number of transactions in a given period of time.

The velocity of money has been remarkably stable over short periods so economists generally view V as being constant when using the quantity theory of money to explain inflation. (As we will see, this was not true since the Great Recession.) This means that an increase in the money supply must result in an increase in prices, output, or a combination of both. During periods of little or no growth, any significant increase in the money supply must manifest itself by a rising price level or increase in production.

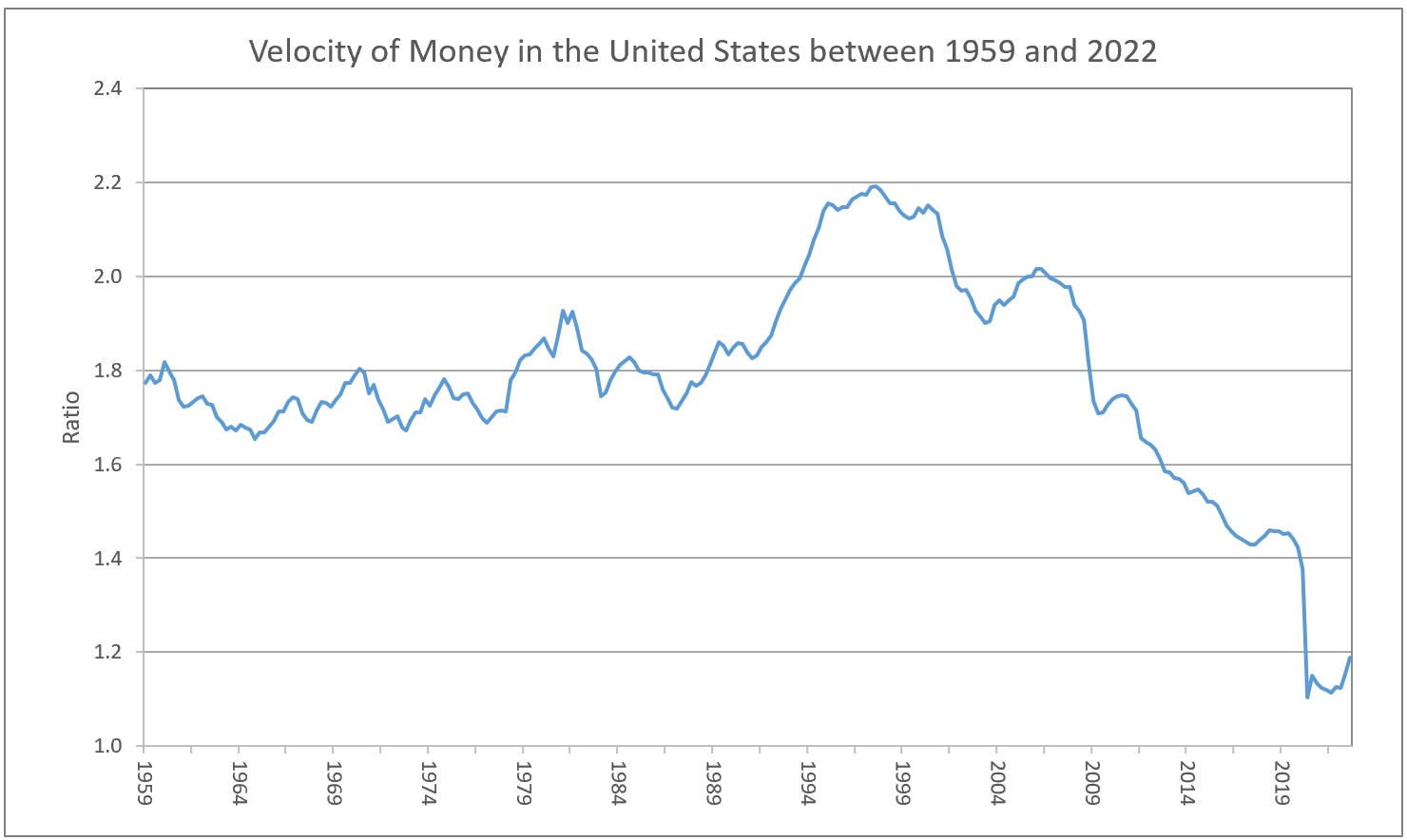

Sometimes a decrease in the velocity of money offsets an increase in the money supply. Many economists were surprised the price level did not increase substantially following the infusion of money into the economy (an increase in the money supply) during the Great Recession as part of the stimulus package to revive the economy. After all, when looking at the formula M x V = P x Y, if Y does not increase substantially, then P must. This is not the case if the velocity of money drops when the supply of money increases. During this period the velocity dipped to some of the lowest levels in recent history. The graph below reveals that the velocity of money in the US decreased from 2.2 in the third quarter of 1997 to a low of 1.1 in the second quarter of 2020.

Source: Data in the graph above is from St. Louis Federal Reserve

Source: Data in the graph above is from St. Louis Federal Reserve

Another reason for the relatively stable price level between the Great Recession and emerging from the COVID-19 pandemic is companies increased production as the American economy emerged from the Great Recession. Returning to the quantity theory of money formula, a drop in the velocity of money (V) and an increase in production (Y) can diminish the impact of a growing money supply on increases in the price level. During the early stages of a recovery, people tend to spend less and save more out of fear they may need the money if the economy weakens again. These behaviors slow down the velocity of money. The velocity of money is also slowed when lenders become more restrictive on who they lend to and how much they lend. Increasing the money supply itself slows down the velocity of money because there is more currency that needs to turn over. Most economists believe the velocity of money will increase as consumers gain confidence, banks increase lending, and the growth rate in the money supply is reduced. Inflation is expected to increase when this occurs.

Causes of Inflation

Inflation

Monetary Policy – The Power of an Interest Rate