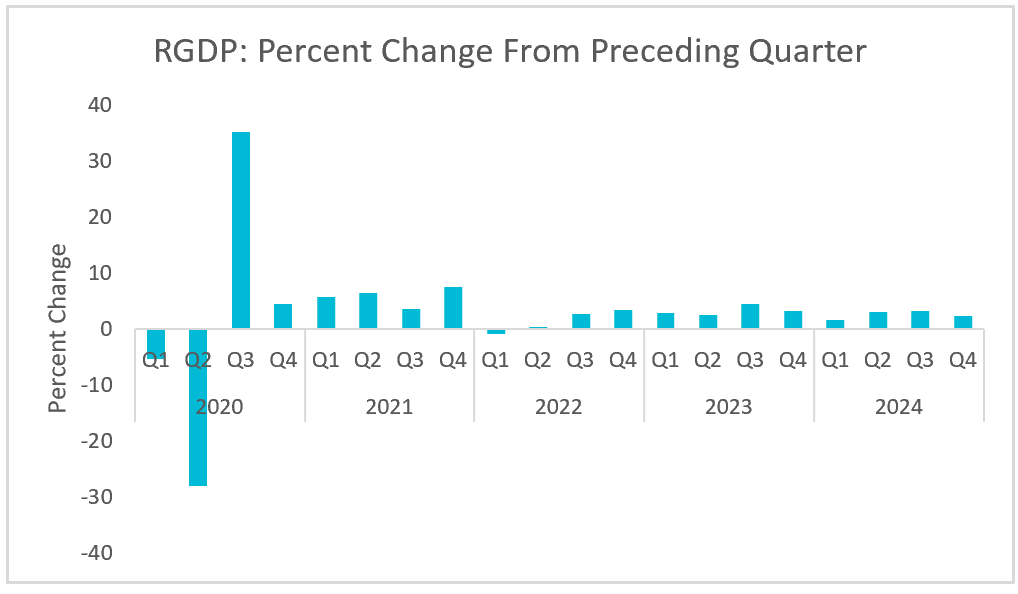

When President Biden was inaugurated in January 2021, the United States was still grappling with the effects of COVID-19. The failure to contain the virus led to a record contraction of 31.4% in the second quarter of 2020; however, this was followed by the largest recorded recovery of 34.4% in the third quarter. At the beginning of 2020, the unemployment rate was at a historic low of 3.5%, but it soon surged to 14.8%, the highest level since the Great Depression. During the week ending March 28th, nearly seven million people were laid off.

In 2021, Real Gross Domestic Product (GDP) surged by 6.1%, bouncing back from the significant decline at the end of 2020. Accumulated savings from stimulus checks contributed to a substantial increase in consumer spending. However, from 2022 to 2024, economic growth moderated as the initial recovery momentum waned. Rising interest rates and global uncertainties, including geopolitical tensions and energy market volatility, slowed expansion, resulting in annual growth rates between 2% and 3%, which are more in line with historical norms.

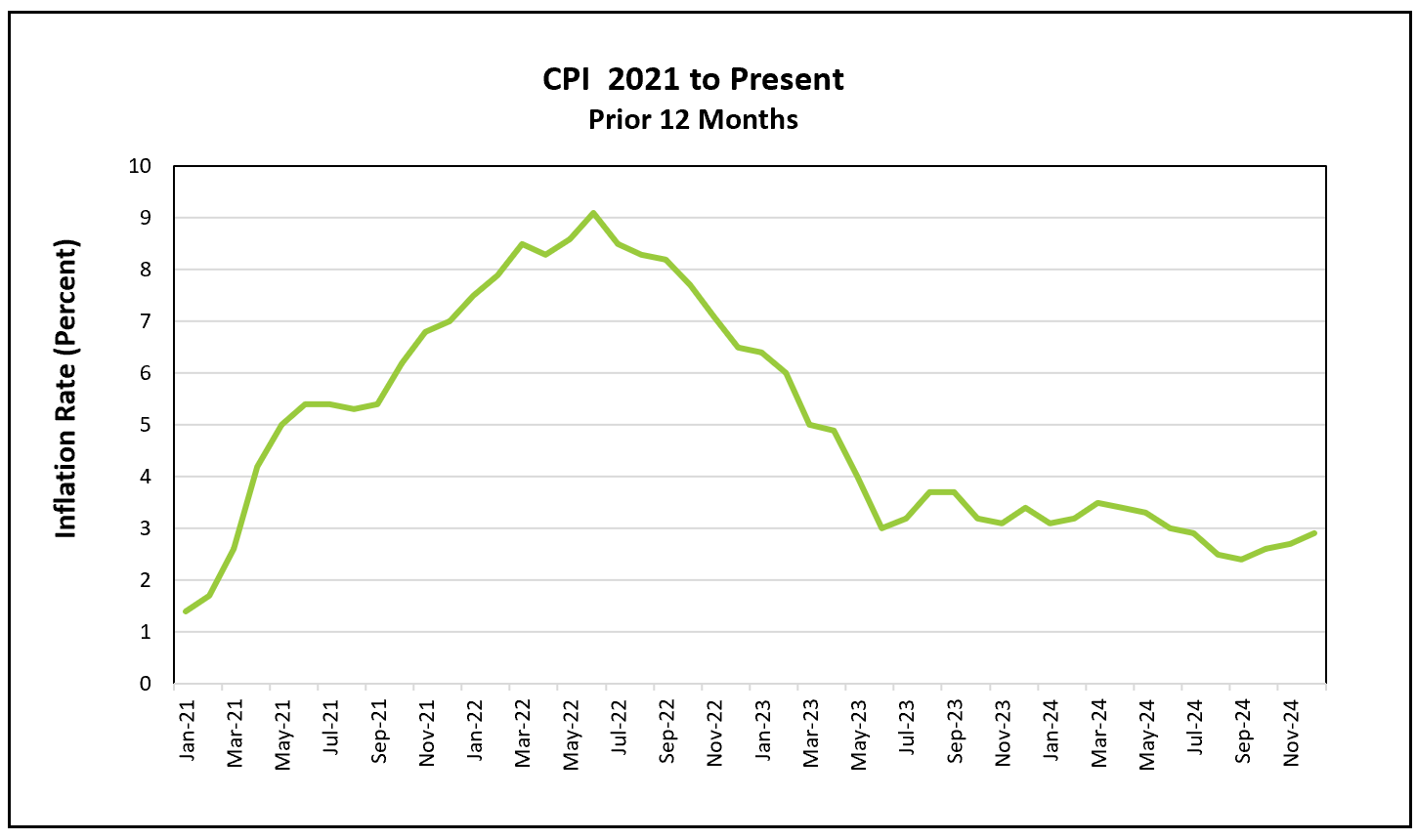

Prices rose 19.2% during President Biden’s term. The CPI soared to 9.1% in June 2022, marking the highest inflation in four decades. Supply chain challenges and heightened aggregate demand contributed to both cost-push and demand-pull inflation. Federal Reserve policymakers responded by raising interest rates. Inflation decelerated but remains stuck at 3%, above the Federal Reserve’s 2% target. Energy costs contributed significantly to the upswing in inflation in 2022 when the Ukraine war disrupted Russia's oil supply. Falling gasoline prices helped lower inflation in 2023 and 2024. However, stubborn housing costs helped prevent inflation from falling in 2024. President Trump inherits an economy where rising energy prices, proposed tariffs, and fewer workers will hinder prices from reaching the Federal Reserve’s 2% target.

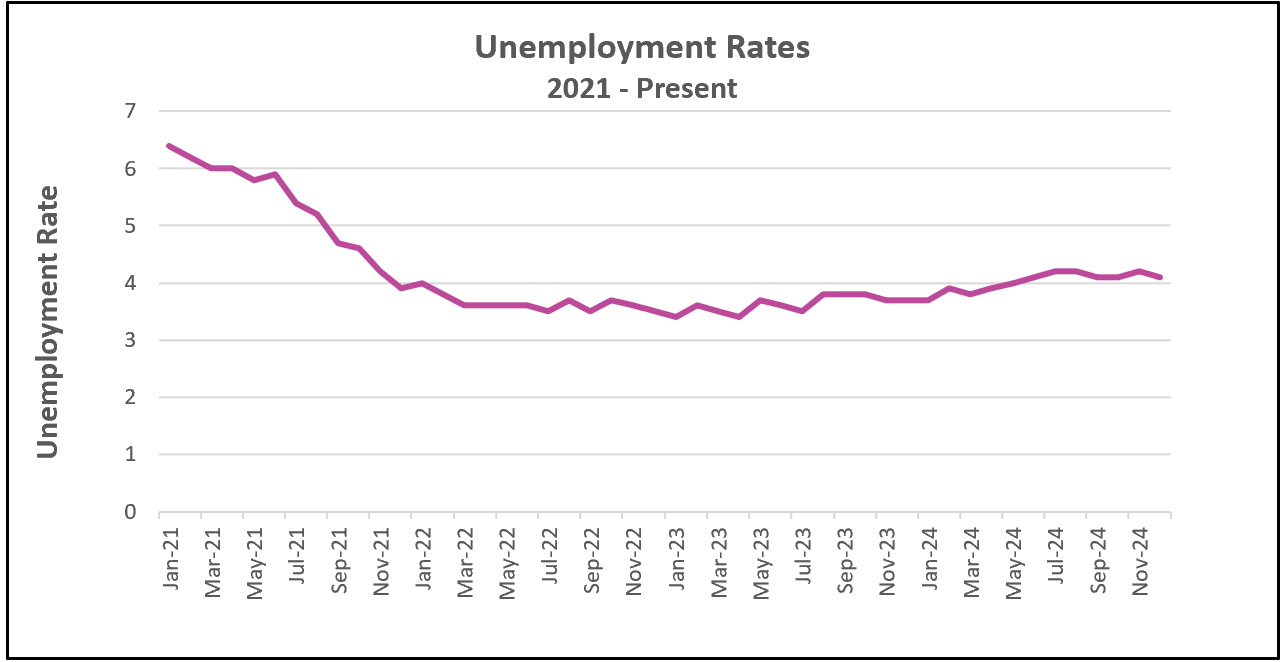

President Trump inherits a healthy labor market. In the last six months of 2024, businesses added an average of 165,000 jobs per month, surpassing the 100,000 jobs economists estimate are needed to replace retiring workers and support economic and population growth. The Federal Reserve’s Jobs Calculator estimates the employment change needed to reach a target unemployment rate, indicating the economy must add 196,000 jobs per month to achieve a 3.5% unemployment rate.

Although the unemployment rate edged higher in the latter half of 2024, this was driven by a gain of 542,000 people in the workforce.

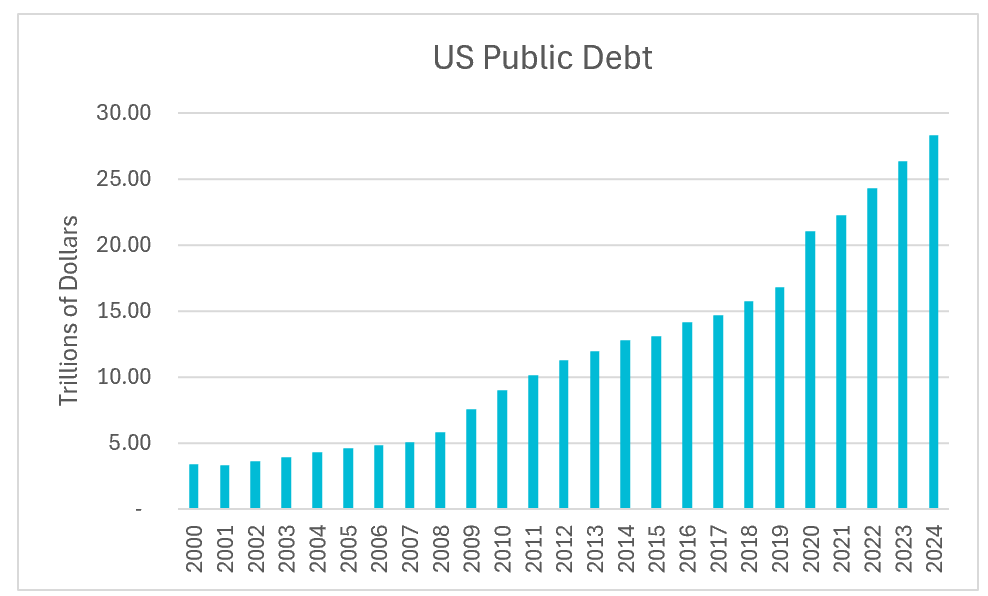

The US public debt reached record levels during President Biden’s administration. The COVID-19 pandemic significantly increased public debt as governments worldwide implemented massive fiscal stimulus measures to support individuals, businesses, and healthcare systems. Lockdowns and economic disruptions led to decreased tax revenues, while emergency spending on unemployment benefits, stimulus checks, and business aid programs surged. In the US, public debt rose sharply as a percentage of GDP due to multi-trillion-dollar relief packages. The Federal Reserve kept interest rates low to support borrowing, but as economies recovered and inflation rose, higher interest rates increased debt servicing costs. The pandemic accelerated long-term debt challenges. Annual budget deficits are added to the public debt. In fiscal year 2024, the deficit equaled $1.8 trillion. High deficits threaten to keep interest rates high while hampering government spending.

The stock market struggled during the COVID-19 pandemic but rebounded strongly during the recovery. By the end of President Biden’s term, the S&P 500 had risen 58%, compared to a 67% increase during President Trump’s first term. Biden’s term saw growth driven by economic recovery efforts, substantial fiscal stimulus, and advancements in technology and healthcare. However, challenges such as supply chain disruptions, rising inflation, and geopolitical tensions led to periods of market volatility.