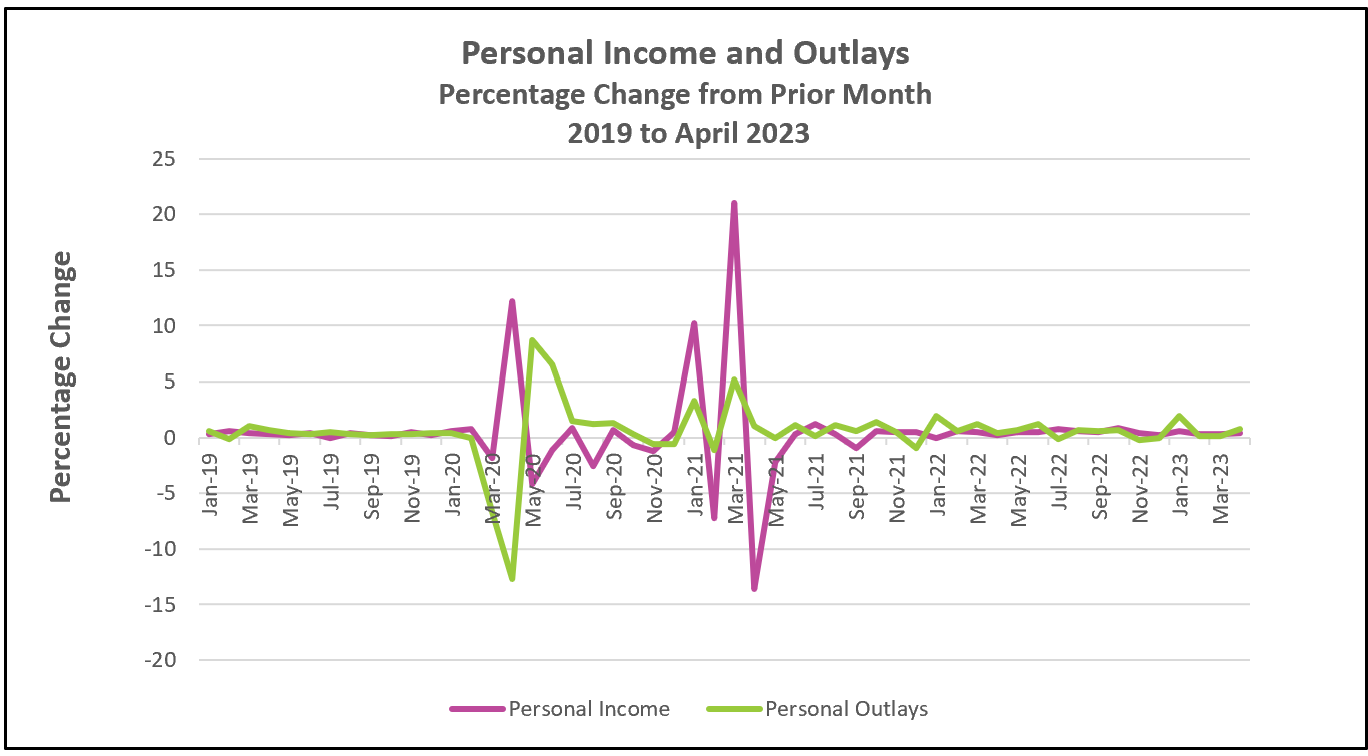

The strength of the US economy continues to exceed most economists’ predictions and poses additional challenges to policymakers in taming inflation. Consumers and businesses continue to spend. Consumer spending surged 0.8%, the most since January, while in a separate release, the Commerce Department reported business durable goods orders rose 1.1% in April. The higher aggregate demand pushed prices higher than in March.

The highlights of the Bureau of Economic Analyses’ full report, Personal Income and Outlays – April 2023, are listed below.

The economy’s aggregate demand continues to increase in the consumer and business sectors. Consumer spending rebounded in April, jumping 0.8%, the largest increase since January, and the second largest in eleven months. Durable goods sales led the way after falling in February and March. New motor vehicles were the largest contributors to a 1.6% jump in durable goods sales. But sales in service industries continue to show strength, rising in each of the last three months. Businesses reported that new orders for durable goods rose 1.1% in April. (U.S. Census Bureau, Manufacturers’ Shipments, Inventories, and Orders, May 26, 2023)

Personal income has remained equal to, or slightly more than the inflation rate every month this year. A strong labor market has sustained the economy’s strength. Employers have consistently increased compensation, fearing the loss of workers given an abundance of available jobs and low unemployment rates. Economic policymakers are paying close attention to wages because of their direct correlation with inflation, particularly in the service industries, where labor is typically a company’s highest cost. Businesses frequently increase their prices to recover their added expense, while consumers are more willing to pay a higher price when their incomes have also increased. Service prices jumped 5.5% in the past year. The price of goods increased by 2.1% during the same period. Goods prices rose 0.3% in April, while services cost 0.4% more.

Inflation peaked in June 2022, shortly after Russia invaded Ukraine. Gasoline and food prices surged. Since then, the 12-month PCE price index has fallen from its peak of 7.0% to 4.4%, slightly up from its low of 4.2% in March. Lower food and gas prices have contributed to the deceleration since the beginning of the year. However, policymakers are more interested in the core PCE price index because it excludes volatile food and energy prices. The core index has dropped slightly since November 2022, when it equaled 4.8%, despite ten increases in the federal funds rate within the past 12 months.

Recent events could slow the economy. Will the fallout from the collapse of Silicon Valley Bank, Signature Bank, and the troubles at First Republic and Credit Suisse deter other banks and venture capital companies from making loans or funding new ventures? It is too early to tell. The application process can take months. There is some evidence that funding projects is more difficult. (Bank Turmoil Squeezes Borrowers, Raising Fears of a Slowdown, The New York Times, April 10, 2023)

Unfortunately, there is a time lag between the recognition of a problem, the implementation of monetary policy, and its impact on the macroeconomy. Companies do not immediately lower their prices following a rate increase by the Federal Reserve, nor do most people choose to curtail their purchases. Instead, the rate increase must filter its way throughout the economy. A lender may raise its rates, which may discourage businesses from borrowing on marginal projects. The lag period is unknown. Estimates range from one year to twenty-nine months. Federal Reserve Chairman, Jerome Powell, suggested that policymakers will not increase their benchmark rate when they meet in June. A pause will provide time to assess the impact of past rate increases and bank failures. Several government releases, including May’s CPI report, information on the state of the labor market, and consumer spending, will be released before the Fed’s next meeting.

Economists are almost unanimous in that it would be catastrophic if Congress fails to raise the US debt limit and the US defaults. Immediately, many federal government workers would temporarily lose their incomes. Nonessential services would cease. The longer it takes to reach an agreement, the more dire the consequences become. Policymakers would have to decide who gets paid if the government cannot pay its bills. It is possible, though unlikely, that Social Security recipients and military personnel would not be paid on time. Income and spending would plummet and send the economy into a recession.

Friday’s report indicates the economy remains strong despite the efforts by the Federal Reserve to dampen it. Growing wages and higher incomes strengthened and sustained consumer spending, which drives the economy. The Bureau of Labor Statistics will release its Employment Situation – May 2023 on June 2. A higher participation rate and smaller wage increases would be welcome news. Check back to HigherRockEducation.org for our summary and analysis of this important data.