The key findings from the Bureau of Economic Analysis’s Personal Income and Outlays for April 2024 are outlined below:

Economists and Federal Reserve policymakers were likely pleased that the US economy is showing signs of moderating, thereby reducing the likelihood of a resurgence of inflation. In 2023’s fourth quarter, the economy showed tremendous resilience as household income bolstered consumer spending. Inflation-adjusted disposable income increased for much of the second half of 2022 and the first half of 2023 after falling in most of 2021 and early 2022. When household income growth outpaces inflation, it is easier for households to spend without straining their budgets, and businesses are more likely to increase their prices with less resistance. However, since February, after-tax income has not kept pace with inflation. Real disposable income fell 0.1% in April, the second monthly drop in 2024.

A fall in real income makes it harder for households to meet their budgets. Their response is to cut spending, incur debt, or dip into savings. Credit card and revolving debt have recently surged (FRED), but so have delinquencies (FRED), indicating that households are reaching their borrowing capacity. Meanwhile, many households are saving less. In April, the savings rate, measured as a percentage of disposable income, equaled 3.6% (FRED), which is significantly lower than before the pandemic.

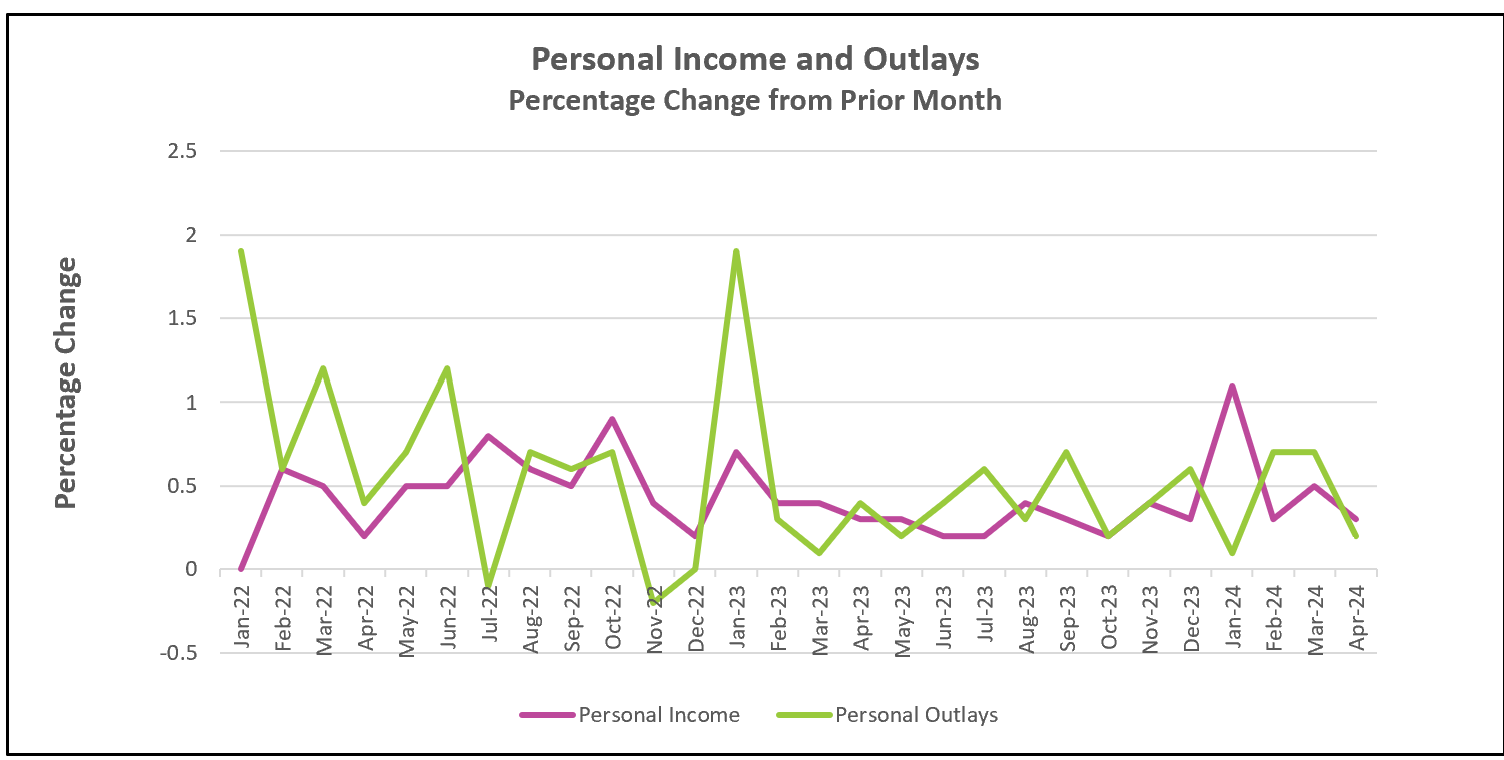

Growth in consumer spending slowed significantly in April, rising 0.2% after surging 0.7% in March. (March’s increase was revised downward from 0.8%.) In fact, spending fell when adjusted for inflation. April’s rise was the smallest since January. The sale of goods decreased, while consumers spent more on services, particularly housing and healthcare. Businesses are reluctant to raise prices when the demand for the goods or services they offer is stationary or falling.

With household debt growing, delinquencies mounting, high interest rates, and stagnant incomes, it is doubtful consumers can continue to sustain the economy’s growth at last year’s pace. On Thursday, the Commerce Department released a report with a downward revision of growth in the first quarter from an annualized rate of 1.6% to 1.3%. Beginning in March 2022, policymakers at the Federal Reserve raised their benchmark rate to slow the economy and alleviate inflationary pressures. Recent data suggest they have succeeded. Inflation, as measured by their preferred PCE price index, has fallen significantly since it peaked in early 2022. It fell slightly in April – but inflation remains considerably above their 2% target. Should policymakers lower rates soon? Waiting too long risks propelling the economy into a recession, but lowering too soon risks reigniting inflation. Chairman Jerome Powell has been clear that he is data-driven and patient. He wants further evidence that inflation is trending lower before lowering rates.

The Bureau of Labor Statistics will release May’s Employment Summary on June 7th. The strength of the labor market has bolstered the economy. Fewer gains in payrolls would support a cooling economy. However, it is doubtful that this report and the Employment Summary will provide sufficient evidence to begin lowering rates when the Federal Reserve meets on June 11-12. Following its release, our comprehensive summary and analysis will be accessible on HigherRockEducation.org.