Here are the key highlights from the Bureau of Economic Analysis’s Personal Income and Outlays report for July 2025:

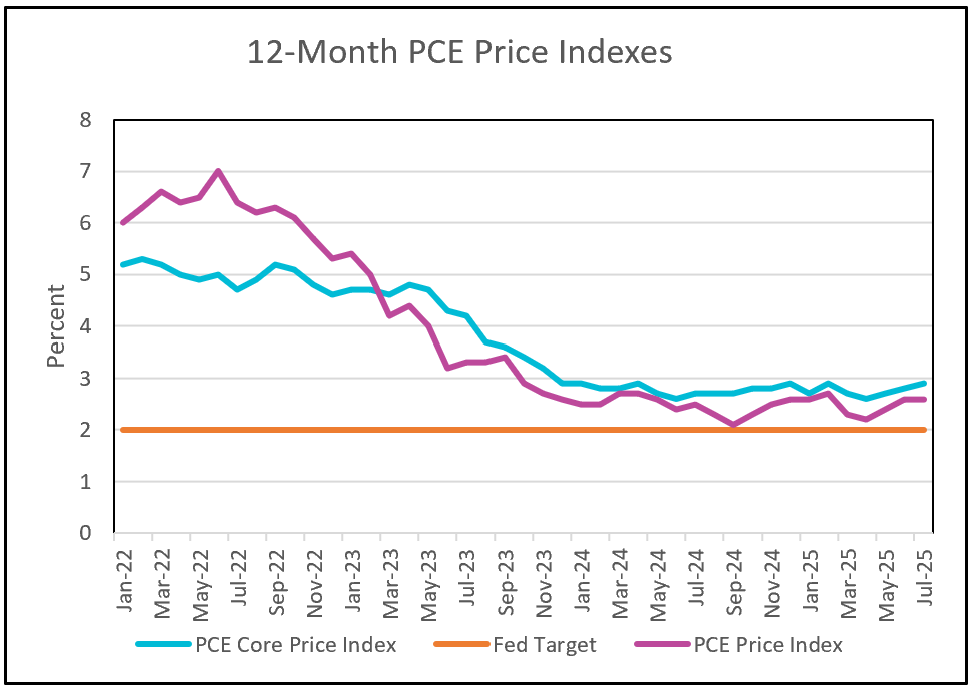

Inflation remained elevated in July, showing little evidence of easing. The all-inclusive monthly index edged down to 0.2% from 0.3%, but the decline was not enough to reduce the annual increase, which held at 2.6%—the highest since February and still above the Federal Reserve’s 2% target. The modest drop largely reflected lower gasoline prices. By contrast, the core index, which excludes energy, was unchanged on a monthly basis, while its 12-month rate rose from 2.8% to 2.9%, also matching February’s peak. Price pressures shifted in composition: goods prices, which spiked in June, fell back in July, leaving services as the primary driver of inflation.

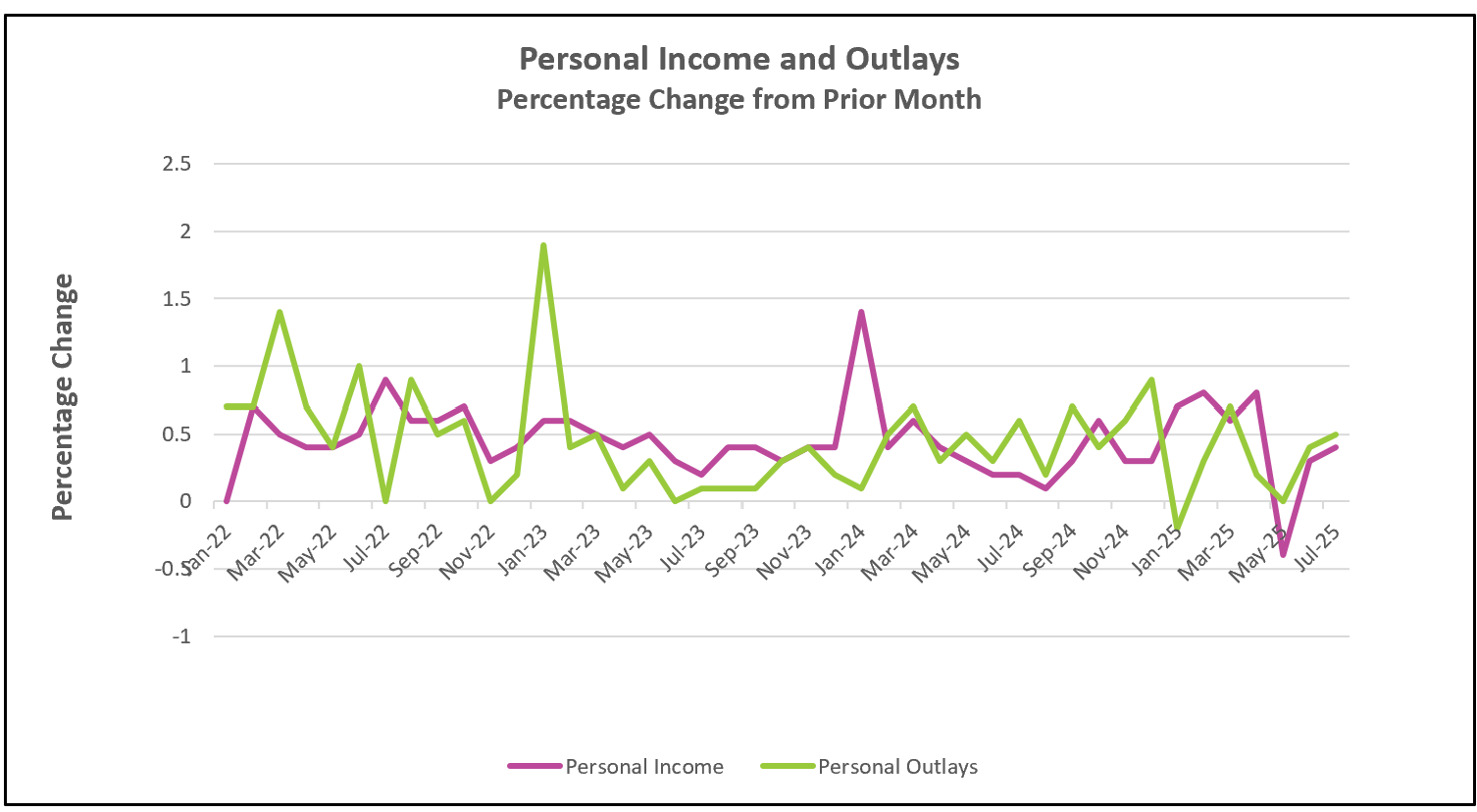

Economists note that rising incomes have helped sustain higher consumer spending, which in turn is fueling price pressures. Real disposable income gained steadily through the first quarter, fell sharply in May, and rebounded to levels that now outpace inflation. Consumer spending followed a similar path—rising early in the year, slowing in May and June, and then strengthening again over the past two months.

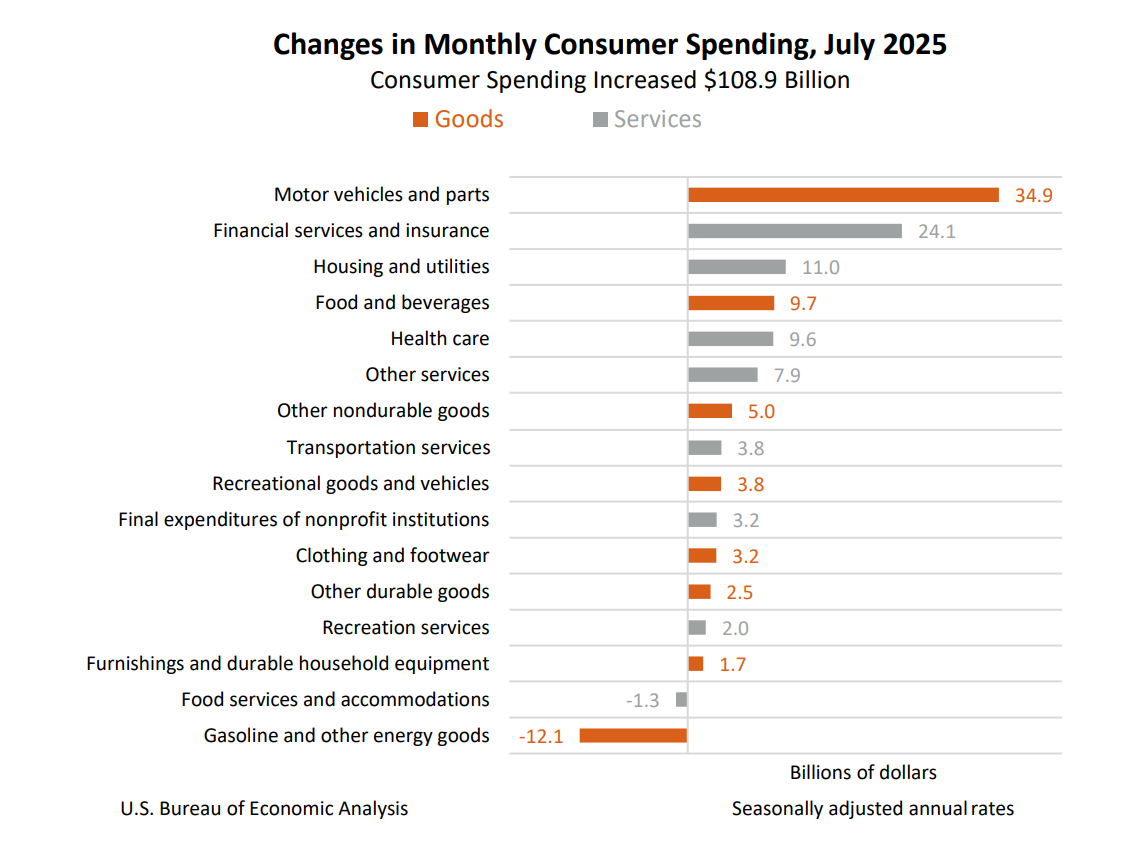

Buying patterns shifted slightly in July. Consumers opened their wallets to purchase goods, especially durable items such as automobiles, which surged nearly 2% in the latest report. Earlier in the year, spending on durable goods fell, while spending for services grew more modestly.

Consumer sentiment has played a significant role in these spending swings. Early in the year, concerns about President Trump’s tariffs weighed heavily on confidence, but sentiment later improved, fueling stronger demand. However, the University of Michigan’s latest survey, taken between July 29th and August 25th, showed a renewed decline in confidence. July’s employment data revealed a weakening labor market, adding to worries about the economy’s strength. Economists warn that softer sentiment could soon translate into softening spending.

Consumer spending continues to support growth, but concerns persist over its sustainability amid weaker job gains and declining confidence. With inflation showing signs of stabilization and the labor market under strain, many analysts expect the Federal Reserve to begin cutting interest rates soon, a move Chairman Powell has already hinted at. Still, some economists argue that easing policy now could be premature. They warn that tariffs may not yet be fully reflected in consumer prices, raising the risk of renewed upward pressure on inflation. Lowering rates, they caution, could fuel aggregate demand and ultimately reignite price growth.

The Bureau of Labor Statistics will release its August Employment Summary on Friday, providing fresh insight into the labor market’s health. Signs of further softening would strengthen the case for the Federal Reserve to lower its benchmark rate at its meeting later this month. HRE will publish a summary and analysis shortly after the report’s release.