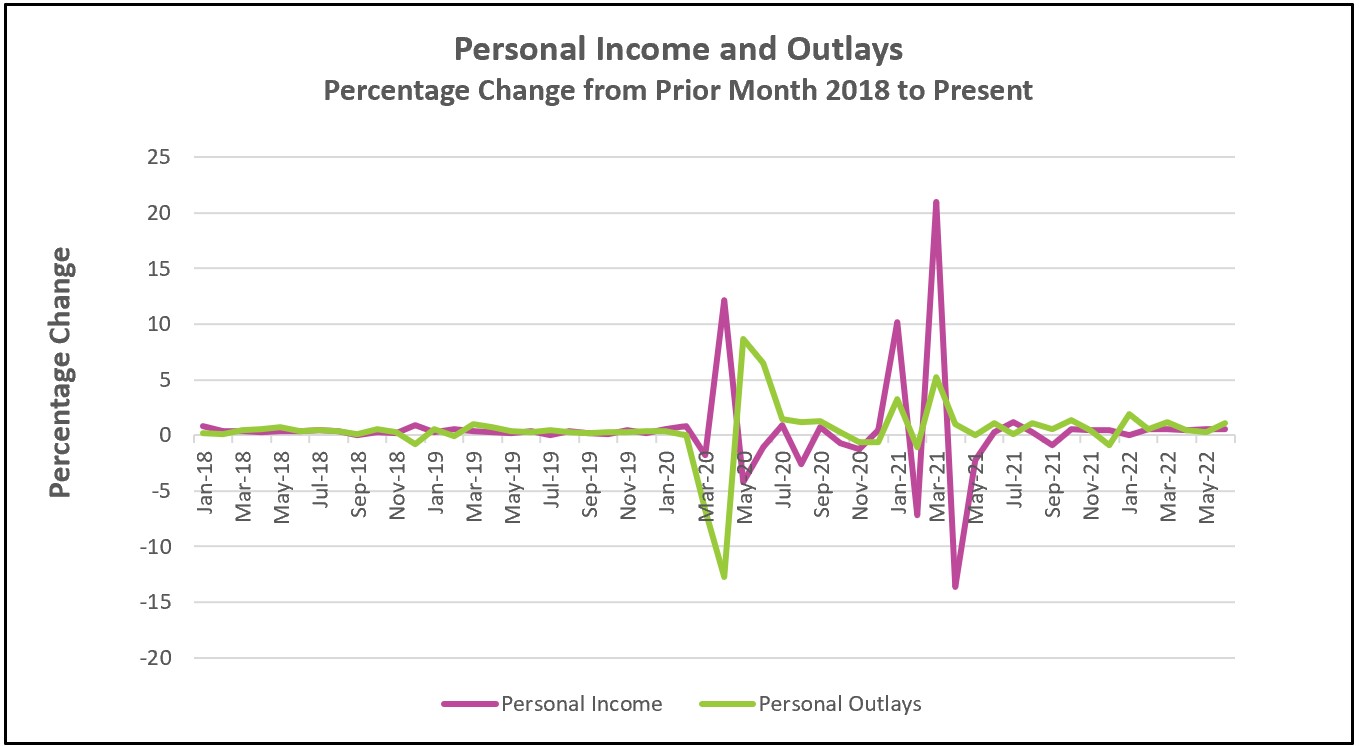

Personal income grew in June but at a slower pace than spending. America’s buying power continues to deteriorate because disposable income has not kept pace with inflation. Families cannot increase their purchases without dipping into their savings or borrowing. They did both in June, and spending increased, even after adjusting for inflation. Nevertheless, spending growth has slowed when taking inflation into account. The surge in prices and diminishing real income are starting to impact how consumers spend.

Read the Bureau of Economic Analyses’ full report Personal Income and Outlays, June 2022. The highlights are listed below.

The American consumer has continued to spend despite the pandemic, containment measures, supply interruptions, a worker shortage, and the Russia – Ukraine war. Since March 2021, consumer spending has fallen once, in December 2021, and only four times after factoring in inflation. The American consumer has prevented the US from entering a recession since consumer spending accounts for roughly two-thirds of total economic output. May’s report showed many signs that the consumer is growing cautious, but June’s report showed renewed optimism as real spending increased. It also made the Fed’s job of reducing inflation a little more challenging.

Inflation continues to threaten the economy. The PCE price index rose 1.0% in June, propelled by a per gallon price exceeding $5.00 and large increases in food prices. While gasoline and food got the headlines, inflation increased throughout most of the economy. Policymakers were probably encouraged by the gradual decline in the core index until the June report, which reported that the core price index increased 0.6% in June, the greatest increase in over a year and up sharply from 0.3% in the prior four months.

Wages are up 5.7% from a year ago, but wage gains have begun to slow. They increased 0.5% in May, matching the smallest increase in 2022. Employers have bid up wages to attract and retain workers as there are two job openings for every worker. While sustained growing wages are good news for workers, they also pose challenges for the Fed. It is unlikely that companies will lower their prices while wages continue to increase.

Inflation and less disposable income are changing spending patterns. Americans are spending more on essentials like gasoline and food, even though they are buying less of each. Consumers are trading down, opting for a less expensive brand. For example, they may substitute chicken for steak or purchase a store-brand item rather than a name brand. Outlays for services only increased 0.1%, but like goods, most purchases were for shelter, health care, and utilities. Spending on most nonessential services, such as financial services, suffered in June. Walmart recently reported that higher prices are forcing consumers to cut back on nonessentials, resulting in rising inventories.

American consumers are not optimistic. The University of Michigan’s Consumer Sentiment Index reached its lowest level on record. Inflation is their greatest concern: 47% of those polled believed inflation had lowered their quality of life. Fear usually stifles consumer spending. A significant drop could push the economy into a deeper recession.

Inflationary pressures may be easing. Gas prices dropped in July. Mounting inventories will force retailers to lower prices. Future prices in commodities such as wheat and corn have already fallen, and many employers are freezing hiring or laying off workers.

We will get some inkling of employer sentiment and employment when the Bureau of Labor Statistics releases its Employment Summary for July on August 5th. Reviewing the labor market’s strengths will provide valuable insights into whether the economy will continue its slowdown. Check back to HigherRockEducation.org for our summary and analysis of this important data.