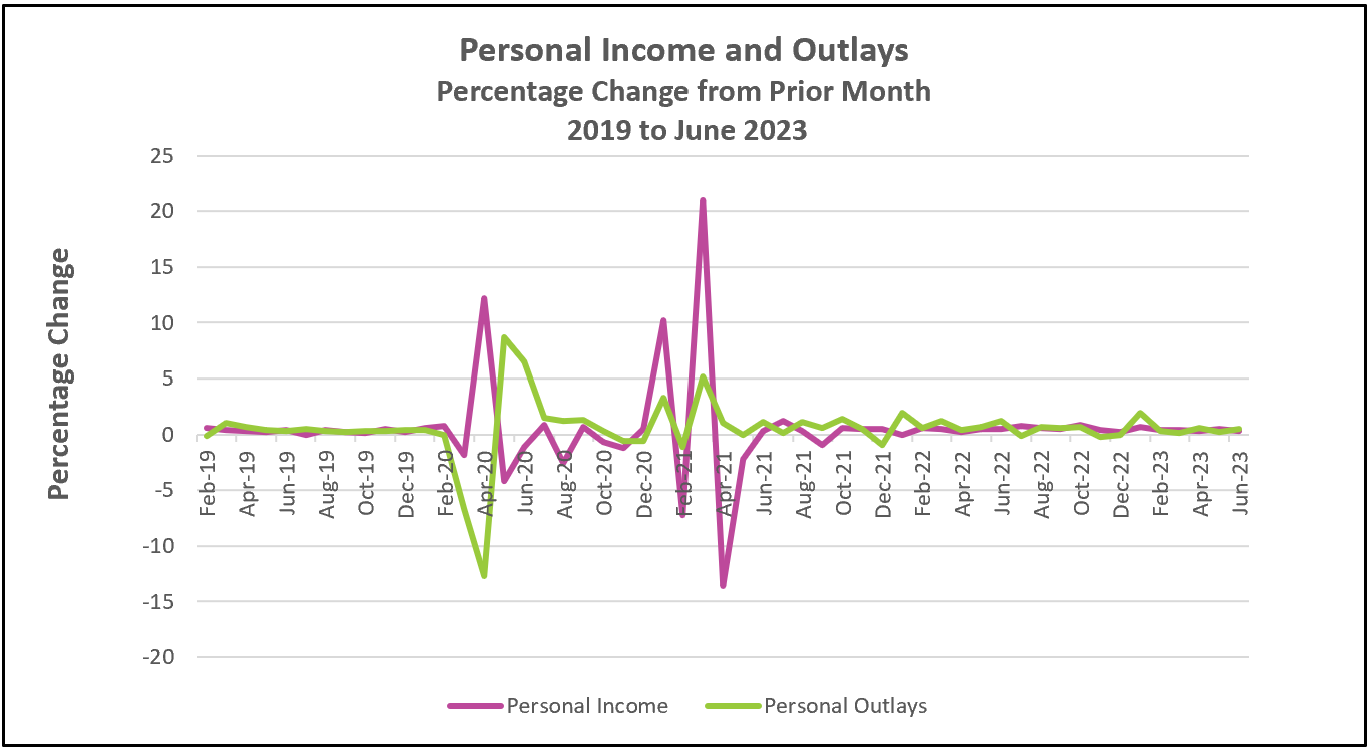

Consumer spending and real disposable income increased while inflation subsided. June was a good month for the US economy. Inflation remains above the Federal Reserve’s target, but it is more plausible that policymakers will succeed in a “soft landing” by lowering inflation to two percent without throwing the economy into a recession.

The highlights of the Bureau of Economic Analyses’ full report, Personal Income and Outlays – June 2023, are listed below.

Consumer spending is the bedrock of the US economy, providing approximately 70% of economic activity. The US economy has remained resilient because consumer spending has remained strong. Higher disposable income has provided the means for households to spend more for nine consecutive months. In addition, disposable income has increased more than inflation, so households have more money to spend on goods and services after paying higher prices. One beneficiary was truck sales, which jumped 4.3%.

Policymakers at the Federal Reserve have been monitoring labor costs because they are the largest expense of many service companies, and businesses frequently raise their prices to maintain their margins when their labor expense increases. That is one reason prices for services rose at three times the rate of goods. But service prices have been trending lower since the beginning of the year, and there are signs that inflationary pressures are moderating in the service sector. The Bureau of Labor Statistics reported on Friday that the employment cost index rose 1.0% in the second quarter, the smallest increase in two years. Wages and salaries were 4.6% higher than a year ago. Policymakers would like this closer to 3.5%, 2.0% for the target inflation rate, and 1.5% for productivity gains.

A soft landing is a foreseeable possibility. Eleven rate hikes by the Federal Reserve have slowed inflation. Consumers are more optimistic than a few months ago and continue to spend despite high inflation and higher interest rates. Spending has increased the economy’s aggregate demand, which has continued to push up prices – but at a slower pace. Meanwhile, companies continue to hire to meet the higher demand for their goods or services. They have increased wages to attract and retain employees – but this has also subsided as the demand and supply for labor have become more balanced, bringing the employment cost index to its lowest point since 2021. Lower labor costs have helped slow inflation. Hopefully, they will continue to do so.

The Bureau of Labor Statistics will release, The Employment Situation – July 2023 on August 5th. This report will provide valuable insights into trends in the labor market. Keep an eye on HigherRockEducation.org for our summary and analysis shortly after it is released.