Consumers get relief from lower food and energy prices and higher wages. However, the core rate, which the Fed prefers when monitoring trends, improved slightly, making it likely the Fed will increase rates at its next meeting later this week.

The highlights of the Bureau of Economic Analyses’ full report, Personal Incomes and Outlays – March 2023, are listed below.

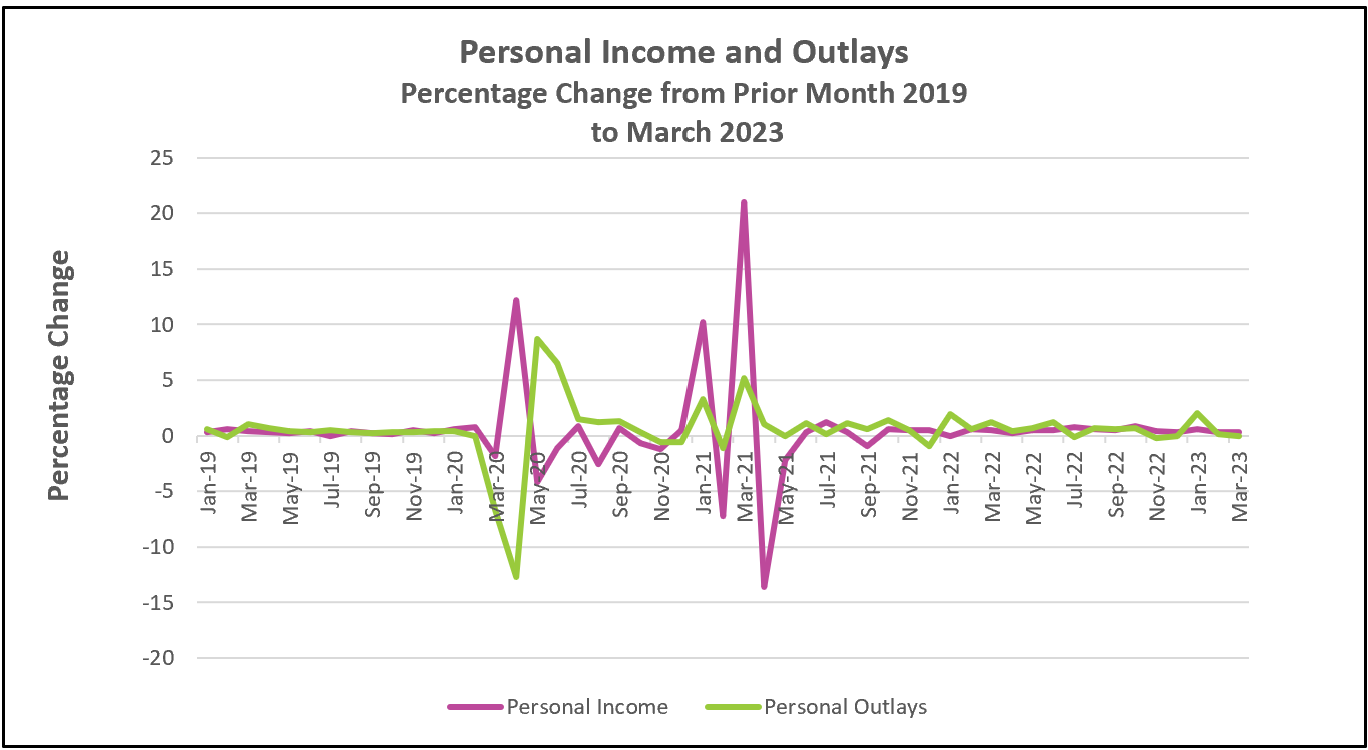

Consumer spending has stagnated over the past five months. Only January had a significant increase. But spending patterns have changed, making the Federal Reserve’s fight to control inflation harder and pointing toward a long struggle to return to 2% inflation. Consumers are cutting their spending on goods while increasing their consumption of services. Since January, personal consumption expenditures increased by 0.1%. Goods sales fell 0.8%, while service consumption rose 0.6%.

Recent rate hikes have reduced sales of interest-sensitive items such as homes and cars but have done little to curtail spending on services. Policymakers have increased interest rates nine times since last March. Their objective was to slow the growth of the economy’s aggregate demand. Their strategy has succeeded in reducing sales of interest-sensitive items such as cars. A 1.8% drop in motor vehicle sales was one of the most significant contributors to March’s slight decrease in the sale of goods. However, lower rates have not deterred consumers from dining out and traveling. Other purchased meals rose 3.6%, and Americans spent 2.4% more on hotel accommodations in March. (See Table 2.4.5U) Income has kept pace with inflation. Real per capita income has increased monthly since June 2022, financing much of the spending on services.

As the demand for services has increased, so has the need for labor, creating many job openings. Unfortunately, there has also been a shortage of available workers, so employers have bid up wages to attract and retain employees. The Bureau of Labor Statistics reported compensation costs increased by 4.8% since last March. Labor is the highest cost of most service companies, so service providers frequently increase prices to maintain their profit margins. The cycle of an increasing demand for services and higher wages is not conducive to subduing inflation, which is why policymakers are watching the labor market closely. They want to see job growth slow and wage increases subside as more people return to the workforce.

Inflation has been trending lower. Prices increases decelerated from 0.3% in February to 0.1% in March, the smallest increase since July. The 12-month index decelerated from 5.1% to 4.2%, the lowest in nearly two years. However, inflation decelerated because food and gasoline prices fell. (Food prices fell 0.2%, while energy prices fell 3.7%.) Economists prefer the PCE core inflation rates when evaluating trends because food and gasoline prices can be very volatile. This month’s news was not as encouraging when the core index is considered. The monthly core index was unchanged; the 12-month index only fell 0.1%.

Most analysts expect policymakers to increase its benchmark when it meets later this week. Some are concerned higher rates combined with the recent bank failures will push the economy into a recession. Many banks will increase their reserves and tighten their lending guidelines – which would have the same impact as raising rates.

The Bureau of Labor Statistics will release its Employment Situation – April 2023 on May 5. A higher participation rate and smaller wage increases would be welcome news. Check back to HigherRockEducation.org for our summary and analysis of this important data.