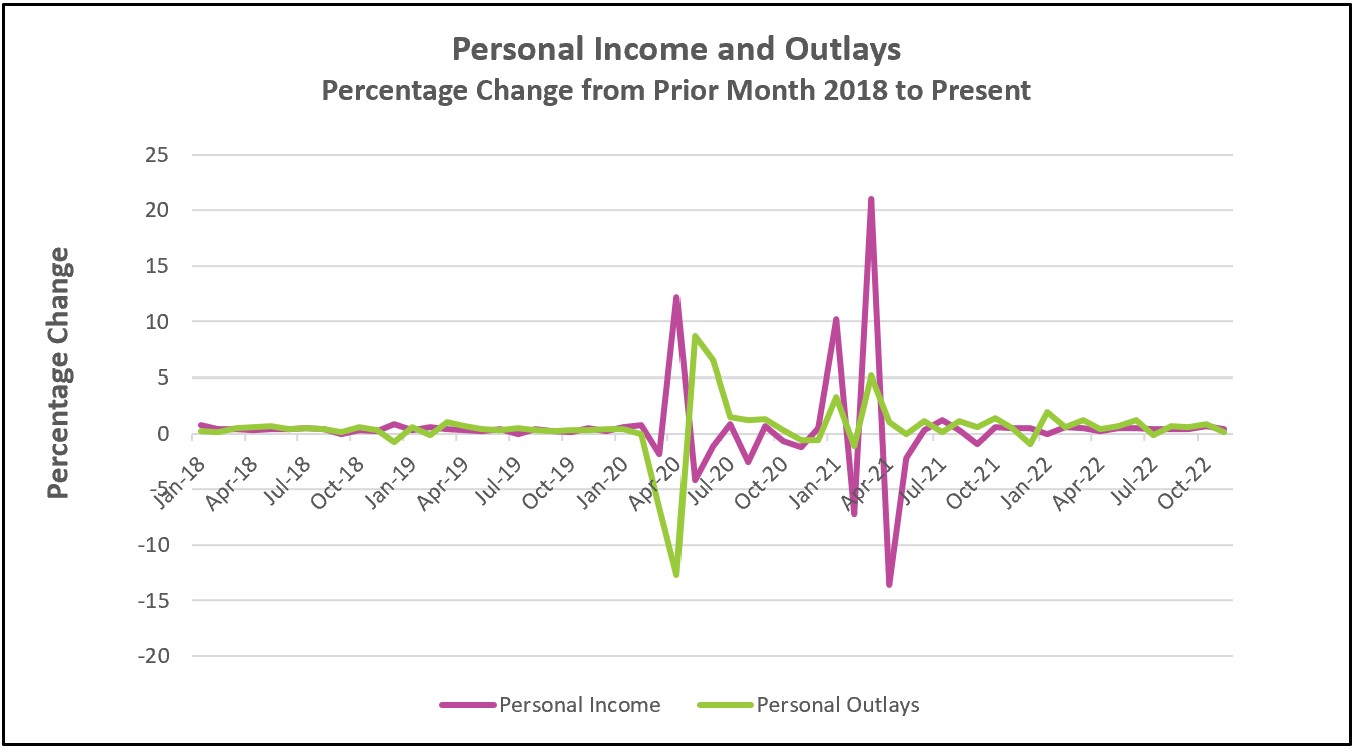

The economy’s growth in consumer spending slowed in November, contributing to the largest drop in prices since October 2021, suggesting that inflation has peaked. Income gains continue to outpace inflation, supporting continued growth in consumer spending. Inflation remains well above the 2% target set by monetary policymakers at the Federal Reserve, making it very likely they will continue to increase their benchmark rate next year.

The highlights of the Bureau of Economic Analyses’ full report, Personal Income and Outlays – November 2022, are listed below.

Consumer spending increased only 0.1% in November, the smallest increase since July. Overall, sales of goods fell 1.0% last month, while services grew 0.7%. October’s spending was revised upward to 0.9%. Each month, the significant change is attributable primarily to motor vehicle sales. New car sales jumped in October, only to fall in November. October’s new car sales were likely attributable to growing inventories and a pent-up demand resulting from significant shortages following the COVID pandemic. The National Automotive Dealers Association reported that “the average monthly payment for a new vehicle in September 2022 rose to $708, up $52 year-over-year and the third straight month of average payments above $700 since breaking the $700 barrier for the first time in July 2022”. Higher rates reduced November’s sales.

According to the National Association of Realtors, existing home sales tumbled 7.7% in November. The recent declines in car and home sales show that higher interest rates have slowed sales of interest-sensitive goods. However, sales of services have shown little evidence of slowing. November’s household consumption expenditures for services increased every month in 2022 after adjusting for inflation. (See Table 2.3.6U)

Higher incomes have supported sales of services and non-interest-sensitive goods. Real disposable income increased or remained flat in every month since July, when it reversed a trend of income gains not keeping up with inflation. November also marked the first time since July that gains in real disposable income exceeded real consumer spending, which partially explains the slight increase in the personal savings rate in November. It also explains the persistence of inflation because past increases in aggregate demand have pushed up prices. November’s deceleration of spending eased inflationary pressures and helped lower the inflation rate to the slowest pace since October 2021. The personal consumption expenditures price index, the inflation measure preferred by the policymakers, rose 5.5% in November from the prior 12 months after increasing 6.1% in October. Monthly prices fell from 0.4% to 0.1%. Core prices were also lower. The annual rates fell from 5.0% to 4.76%, while the monthly rate fell 0.1% to 0.2% between October and November. Core prices decreased for three consecutive months. However, inflation remains more than 2.5% above the Federal Reserve’s target.

Last week the BEA increased its growth estimate for the third quarter to 3.2% after the economy contracted during the first two quarters. (It will release its advance estimate for the fourth quarter on January 26th.) The economy has probably lost momentum moving into 2023. Rate increases have slowed the economy during the fourth quarter, and most economists believe the economy will continue the trend into the new year. Fortunately, inflation will also subside, relieving many households who have struggled to maintain their budgets.

Consumer spending drove the economy in 2021 and 2022. A higher aggregate demand that was difficult for suppliers to meet pushed inflation to a 40-year high. Policymakers at the Federal Reserve responded with seven rate hikes, including four consecutive 0.75% increases, before reducing their increase to 0.5% at their December meeting. They raised the targeted federal funds rate from 0% in February to 4.25% - 4.5% today. Their objective is to slow economic growth to return inflation to 2%. The rate increases have influenced home and car sales, but there is little evidence that they have impacted service sales. Chairman Jerome Powell has stated several times that a softening of the labor market is necessary to contain inflation in the service sector because labor is a significant component of the cost of providing a service. Unfortunately, available jobs continue to far exceed available workers, adding pressure on wages. Policymakers hope to balance the supply and demand for labor, which they believe will lessen pay gains and lower inflation. Until then, expect more rate increases.

Will a tight labor market continue to push incomes higher, making the policymaker’s job to contain inflation more difficult? We will learn more when the Bureau of Labor Statistics releases The Employment Situation – December 2022 on January 6th. Check back to HigherRockEducation.org for our summary and analysis of this important data.

Have a Happy and Safe New Year.