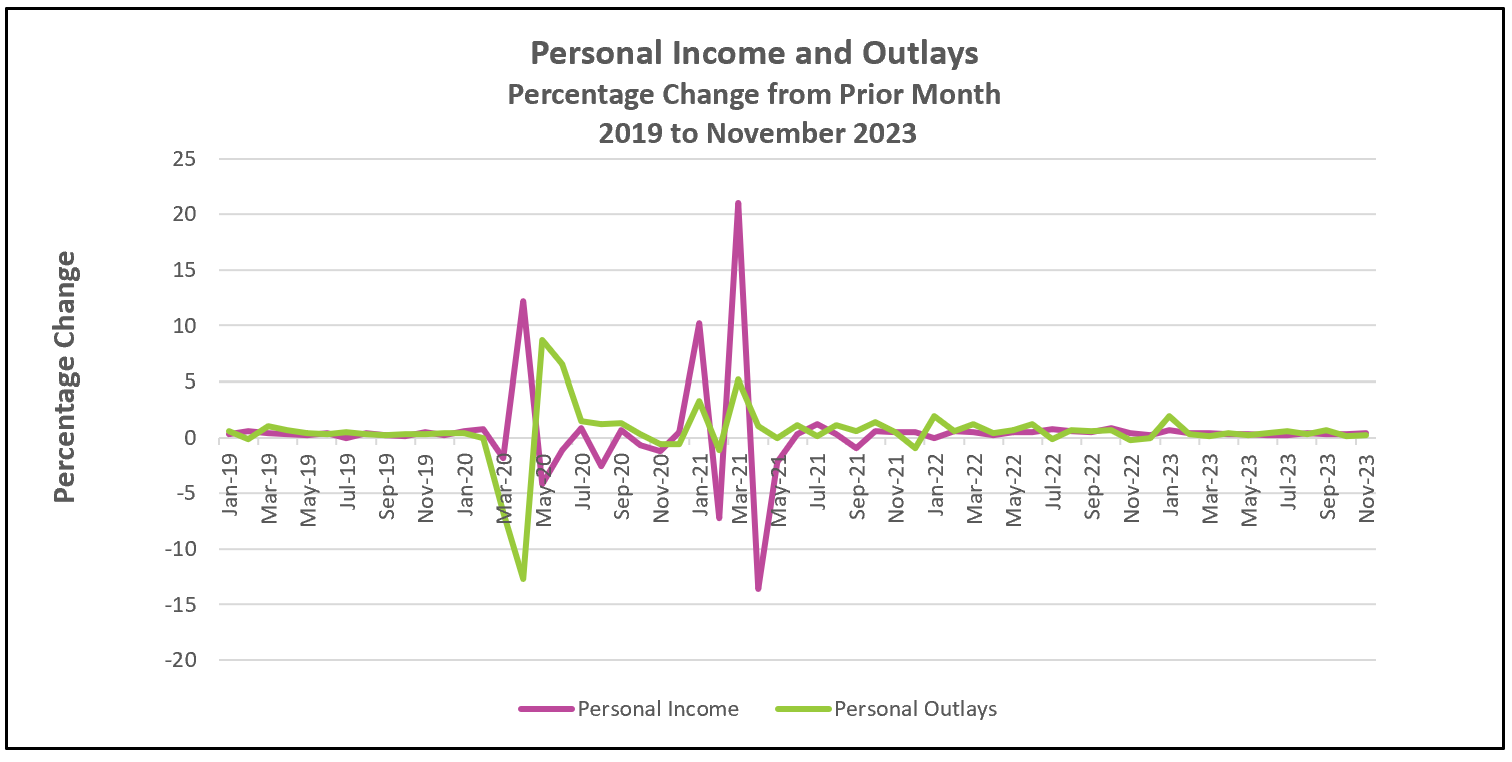

Recent improvements in inflation boosted inflation-adjusted income, which has fueled a rise in consumer spending.

The highlights of the Bureau of Economic Analyses’ full report, Personal Income and Outlays – November 2023, are listed below.

Inflation is nearing the Federal Reserve’s 2.0% target. In fact, the annual rate is 1.9% when measured over the last six months. While prices declined in November, primarily due to a significant drop in gasoline prices, it’s noteworthy that the increase is modest when the impact of gasoline prices is excluded. The core index for November registered a 0.1% rise.

The 12-month PCE core price index, the preferred rate among Federal Reserve policymakers, reached its highest point at 5.2% in September 2022 but has subsequently declined to 3.2%. Moreover, this downward trend has persisted consistently. Since the start of 2023, the monthly core rate has either remained unchanged or decreased every month except for September.

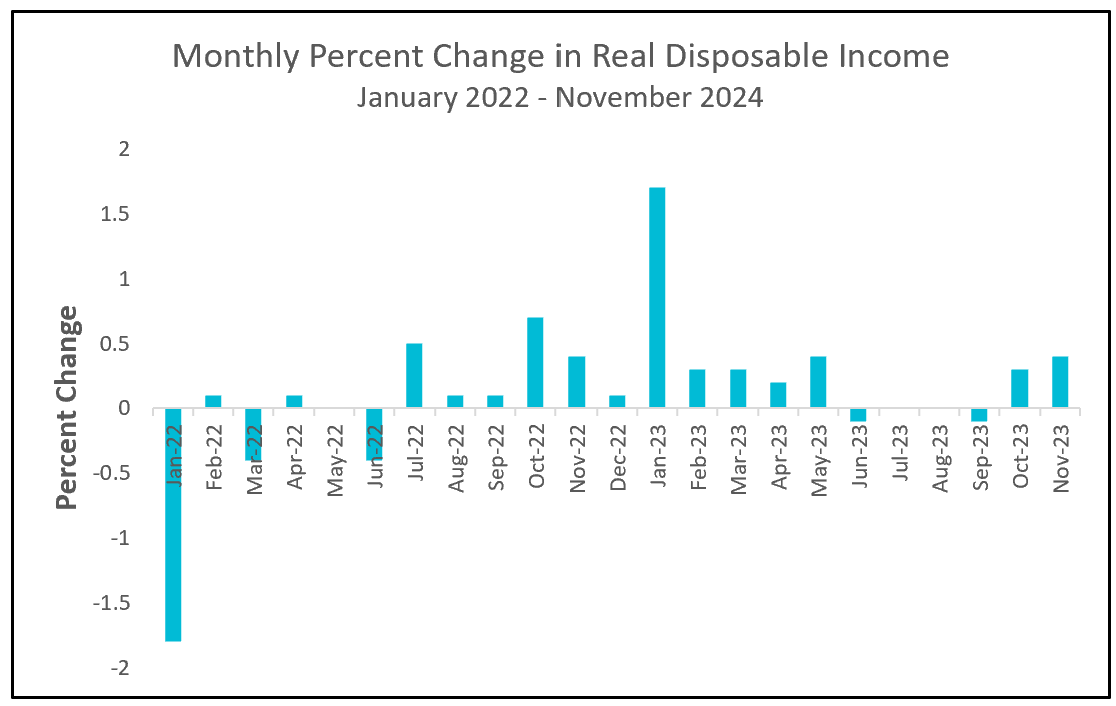

Many households are in a more favorable financial position today compared to 2022. In the preceding year, disposable income—income after taxes—struggled to keep up with inflation. However, in 2023, disposable income surpassed inflation. The graph below illustrates the percentage change in real (inflation-adjusted) disposable income. Instances where the bar dipped below zero indicate that disposable income failed to match inflation. Notably, the graph depicts that inflation-adjusted disposable income remained negative for a significant portion of 2022 and turned positive for most of 2023.

Consumer spending has retained its strength throughout the fourth quarter. Rising wages and a growing labor force have increased the total money in the economy, providing the financial backing for sustained spending increases. However, monthly hiring trends are lower. November’s employment growth equaled 199,000, in contrast to the average monthly gain of 240,000 recorded over the previous 12 months. Despite the easing, hirings remain above 151,000; the average employment increased before COVID-19. Hiring also continues to exceed the number of people many economists believe should be added to the payroll to keep up with the population’s growth.

Consumers had a more positive outlook on the economy in the fourth quarter, as reported by The Conference Board’s Consumer Confidence Index. Americans are more optimistic regarding inflation, job prospects, and the overall economy. A growing number of individuals are planning substantial purchases or vacations. The heightened confidence and rising wages set a favorable tone for sustained growth in consumer spending.

A soft landing is more plausible than a few months ago. Economists use the term “soft landing” to describe a scenario where a central bank effectively slows down an overheated and inflationary economy without triggering a recession. Many economists and analysts now anticipate that policymakers have concluded their rate hikes and will initiate a rate cut in the latter part of the first quarter of 2024. While Federal Reserve officials emphasize that inflation remains significantly above the 2% target, they acknowledge the possibility of further rate hikes if inflation deviates from its current downward trend. A key focal point will be the Bureau of Labor Statistics’ Employment Situation report for December, scheduled for release on January 5th. The question looms: will the labor market sustain its resilience while showing signs of modest softening? Following its publication, you can find our summary and analysis on HigherRockEducation.org.

HAPPY HOLIDAYS!