Recent pullbacks in consumer spending, declining real wages, and upward trending jobless claims point toward a designed and expected cooling of the US economy and inflation.

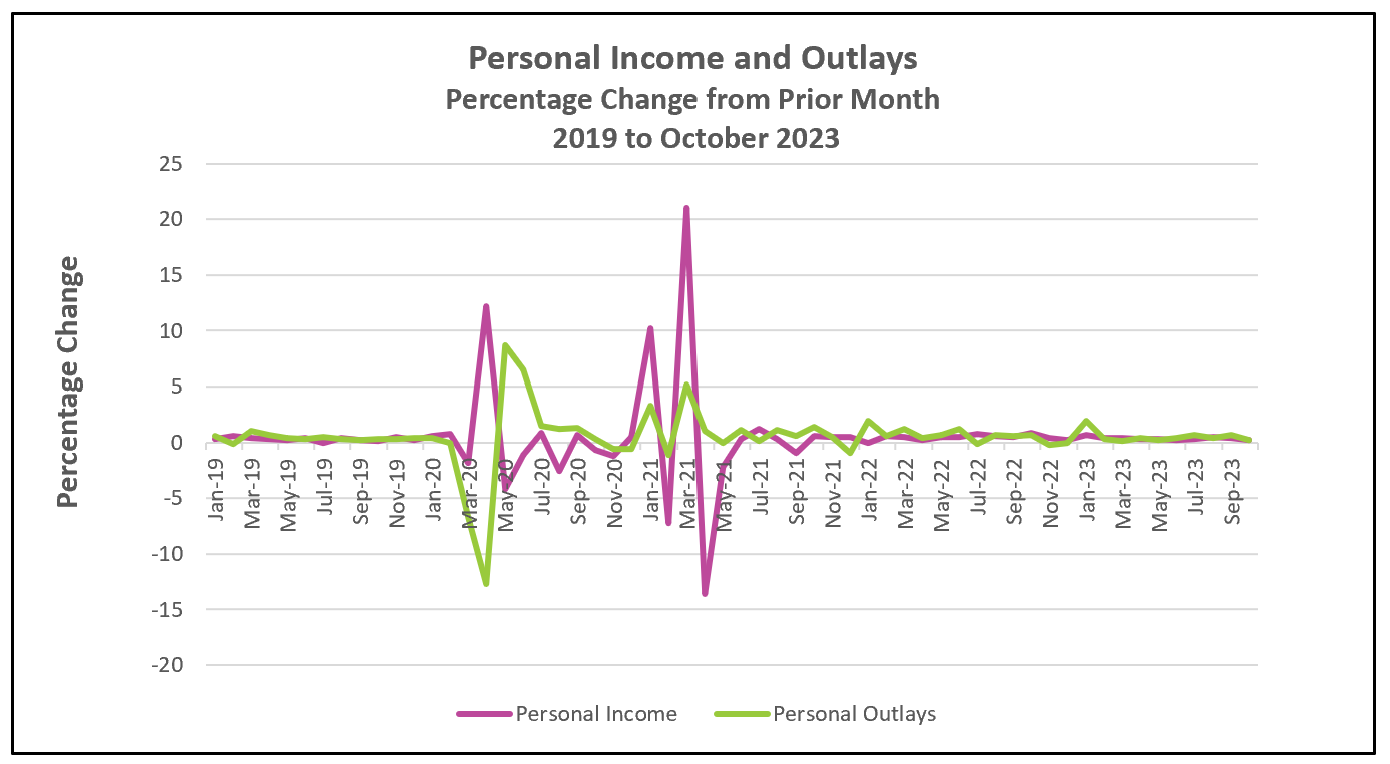

The highlights of the Bureau of Economic Analyses’ full report, Personal Income and Outlays – October 2023, are listed below.

Since March 2022, policymakers at the Federal Reserve raised their target benchmark interest rate eleven times from near zero to a 20-year high of between 5.25 and 5.5%. At the time, inflation was intensifying. The Fed’s preferred measure, the PCE price index, peaked at 7.1% in June 2022. The policymakers’ objective was to tame inflation by slowing the growth of the economy’s aggregate demand. Higher interest rates restrain consumer and business spending. Their strategy is working. Since its peak, the PCE price index has fallen to 3.0%, but it remains above the Fed’s 2% target.

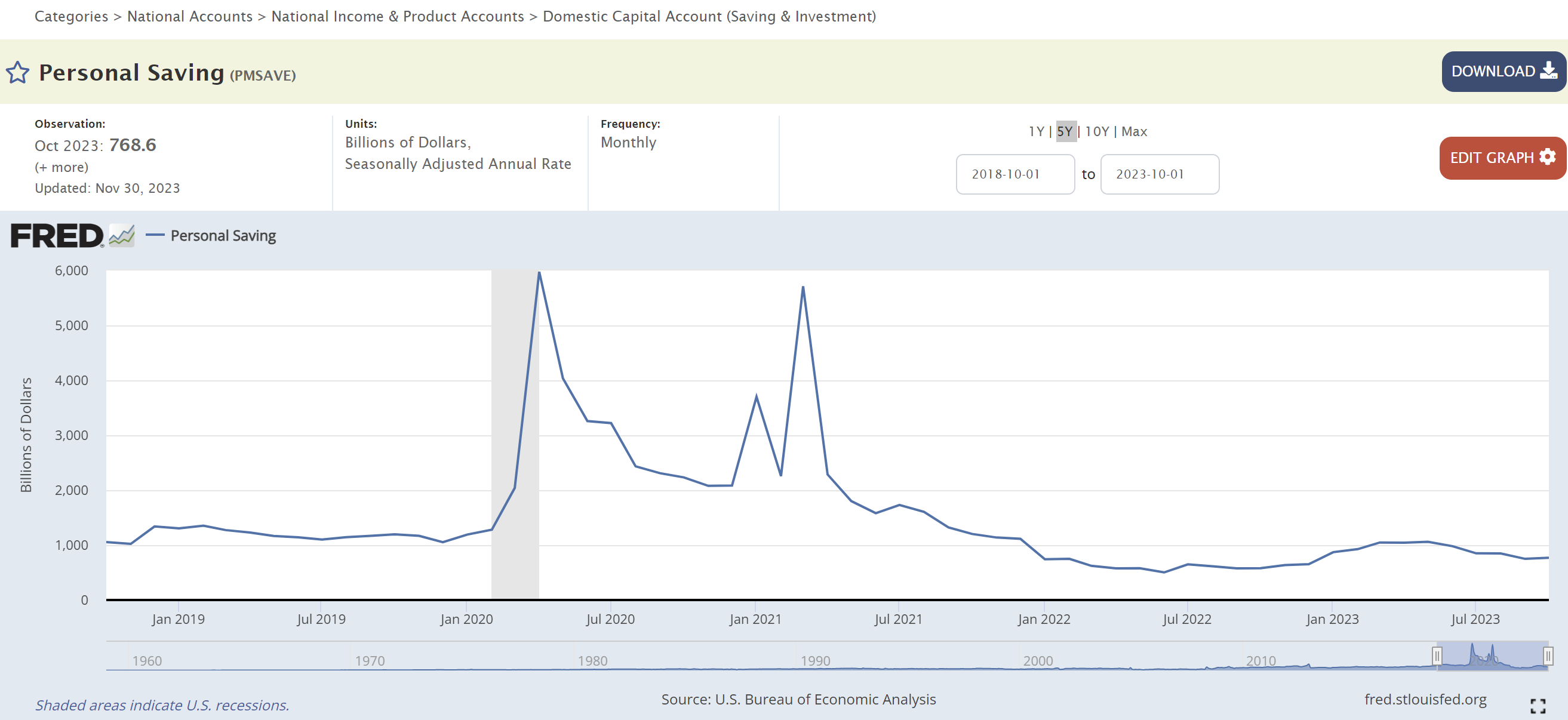

Consumer spending, the lion’s share of the economy, has been resilient. In September, it gained 0.7%, 0.3% more than the average monthly increase in the 12 months before the COVID-19 pandemic. Rising incomes, low interest rates, government transfer payments, and borrowed money financed much of the surge. The influence of each of these has moderated. Personal income did not keep pace with inflation during 2021 and the first quarter of 2022, but consumer spending remained resilient. Consumers borrowed and dipped into the savings they accumulated from the government transfer payments during the pandemic. Beginning in 2022’s second quarter, rising wages and lower inflation led to positive real wages, which helped support the growth in consumer spending. However, since June 2023, modest growth in personal income has not kept pace with inflation. October’s 0.3% jump reflected a significant increase in interest and dividend income rather than wages.

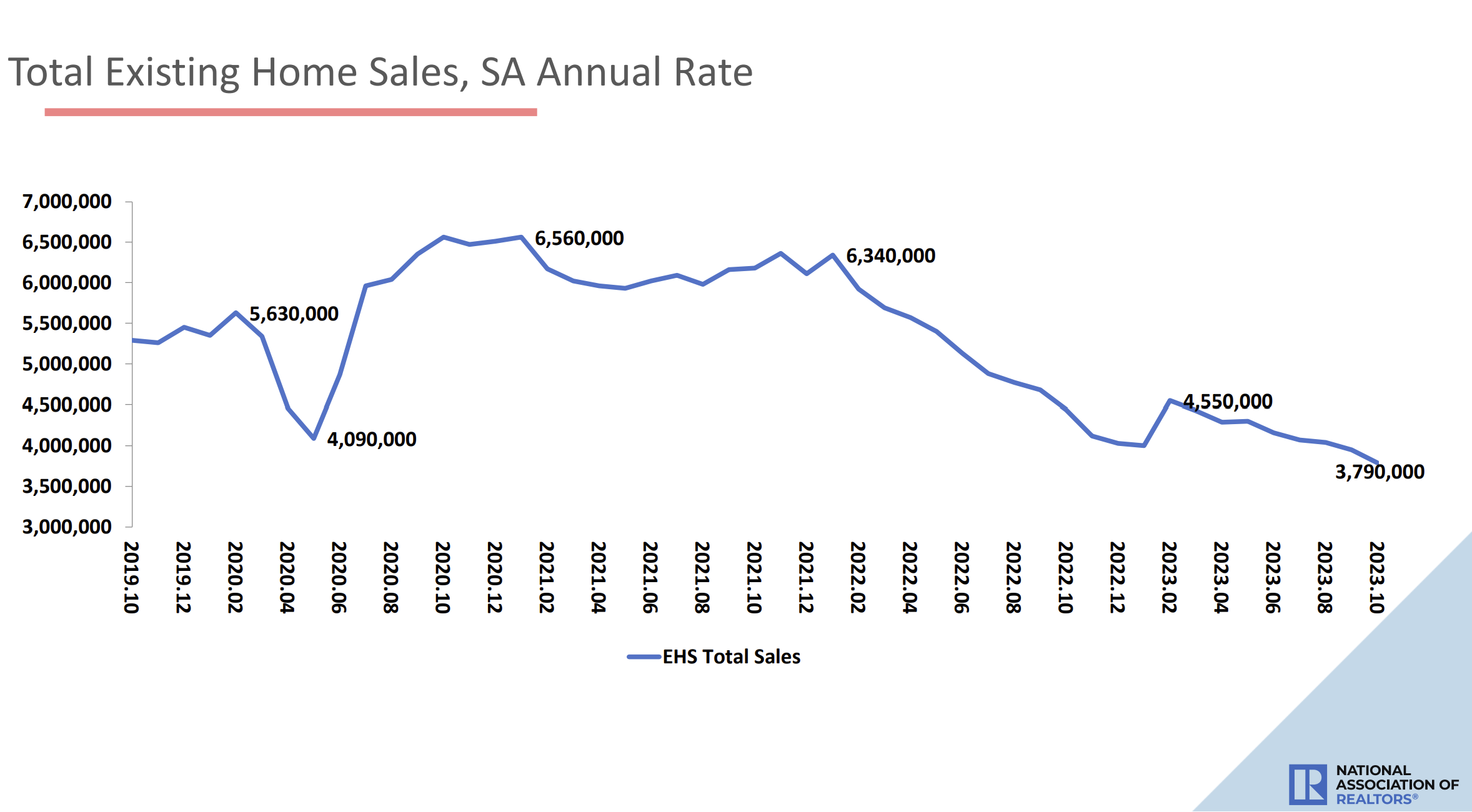

Higher interest rates have slowed spending – especially in interest-sensitive items such as cars and homes. New car sales dipped 1.7% in October and are 5.6% lower than in January. Existing home sales fell to an annual rate of 1.39 million units. They have fallen since February and have not been this low since 2010. Homeowners are choosing not to sell because buying a new larger home would likely mean a significant jump in their monthly payment since they would finance the new purchase with a high-interest rate mortgage. Their reluctance to sell has reduced the housing inventory, which has pushed up prices of existing homes. Also, higher prices and higher mortgage rates result in fewer people qualifying for a mortgage to purchase a given home.

Savings are down and debt is up, so consumers are more likely to not dip into savings or borrow to finance items.

October marked the resumption of student loan payments for millions of borrowers. Bloomberg reported that the resumption of payments could reduce consumer spending by $9 billion a month. If true, consumer spending would have increased by 0.27% in October rather than 0.22%.

A robust job market bolstered wages and improved job security. However, the job market is cooling. The number of people receiving unemployment benefits reached a two-year high of 1.93 million people the week ending November 18th. (BLS) The number of applications for unemployment insurance has been rising since September, suggesting that newly unemployed workers are having a more challenging time finding a job.

The Federal Reserve released its Beige Book last Wednesday. Six districts reported declines in economic activity, while four had modest growth. Data add to the likelihood policymakers will continue their pause of rate increases when they meet December 12-13. Many economists and analysts believe the Fed is done raising its benchmark rate and will begin easing it late in 2024’s first quarter. Fed officials are quick to point out that inflation remains significantly above its 2% target, and further rate hikes may be needed if inflation reverses its current downward trend. They will be particularly interested in December 8th’s release of the Bureau of Labor Statistics’ Employment Situation – November. Will the labor market continue to soften? Visit HigherRockEducation.org shortly after its publication for our summary and analysis.