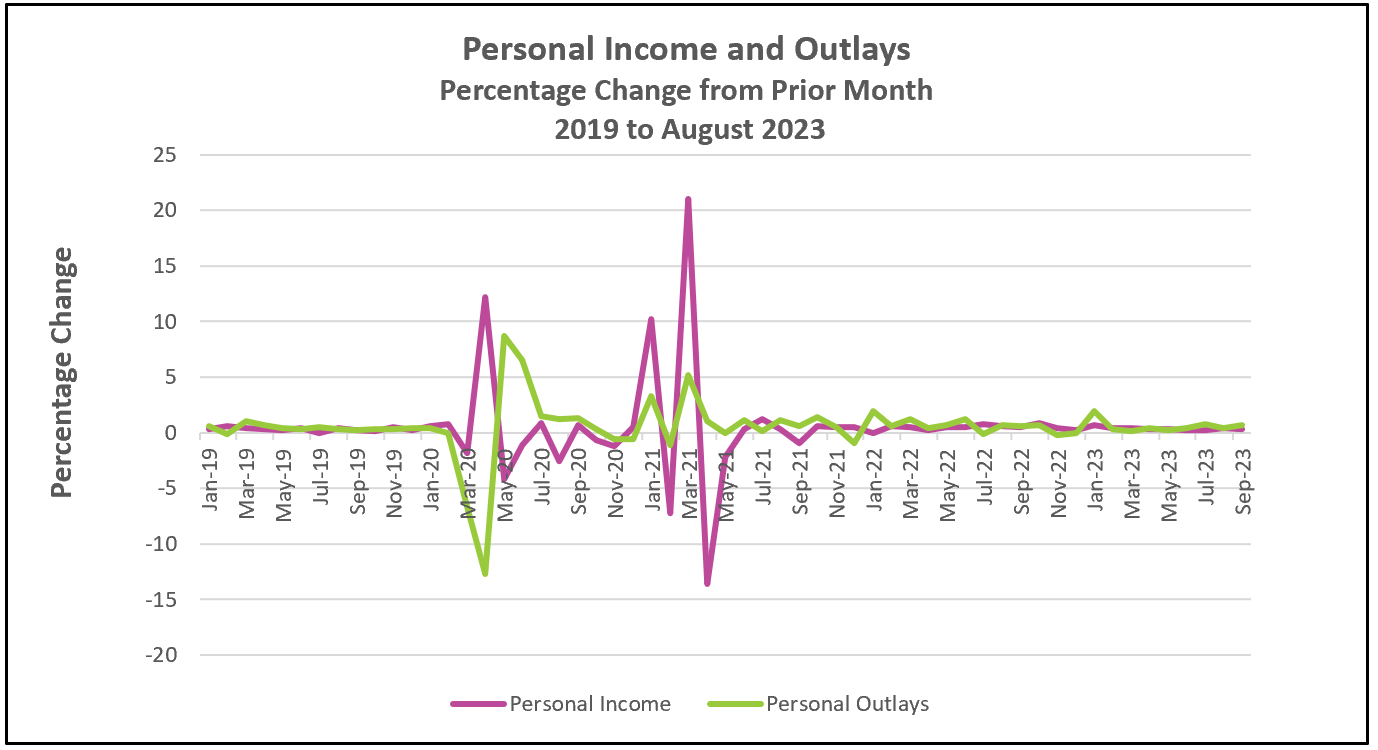

The all-inclusive PCE price index has been stuck at 3.4% for three months, while the core index, which excludes food and energy prices, has been drifting lower. Consumers continued to spend despite their disposable income failing to keep pace with inflation.

The highlights of the Bureau of Economic Analyses’ full report, Personal Income and Outlays – September 2023, are listed below.

Policymakers at the Federal Reserve meet on Tuesday and Wednesday to chart their strategy for taming inflation, which doubled to 0.4% in September. However, the 12-month rate has fallen from a peak of 7.7% in the first quarter of 2022 to 3.5%. Policymakers must surmise whether inflation will fall to their 2% target without lifting rates further. The answer is ‘No” if the economy maintains the strength it showed in September. Consumer spending rose sharply. Continued substantial growth in consumer spending can lead to higher prices as businesses respond to growing demands. An increase in demand will also strengthen the labor market because companies must hire to meet the added demand. The rise in payrolls, wages, and low unemployment rate have sustained the surge in consumer spending for the past year.

However, most economists expect consumer spending to subside in the coming months, in which case inflation would decelerate further. Spending exceeded disposable income every month in the third quarter. Consumers needed to reduce their savings or borrow to finance their spending. Beginning October 1st, approximately 28 million borrowers will be left with less cash to continue their buying spree when they resume payments on their student loans for the first time since they were paused during the pandemic, leaving them with less cash to continue their buying spree.

Long-term yields are near 5%, the highest they have been since 2007, and 25% higher than in July. Lenders frequently tie their long-term rates to the 10-year Treasury yield. The higher rates will discourage some people from borrowing to purchase a home and businesses from borrowing to expand. In other words, higher long-term Treasury yields will assist the Fed in slowing the economy.

The uptick in long-term rates and drop in real disposable income, combined with the resumption of student loan payments and other possible disruptions, including the wars in Ukraine and Gaza and a potential government shutdown, make it very unlikely policymakers will increase their benchmark rate when they meet today and tomorrow. Instead, they will continue to monitor the impact of their prior rate increases. They will be particularly interested in November 3rd’s release of the Bureau of Labor Statistics’ The Employment Situation - October 2023. Will a strong labor market continue to support a rise in consumer spending? For an overview and analysis of this release, visit HigherRockEducation.org shortly after its publication.