Here are the key highlights from the Bureau of Economic Analysis’s Personal Income and Outlays report for September 2025:

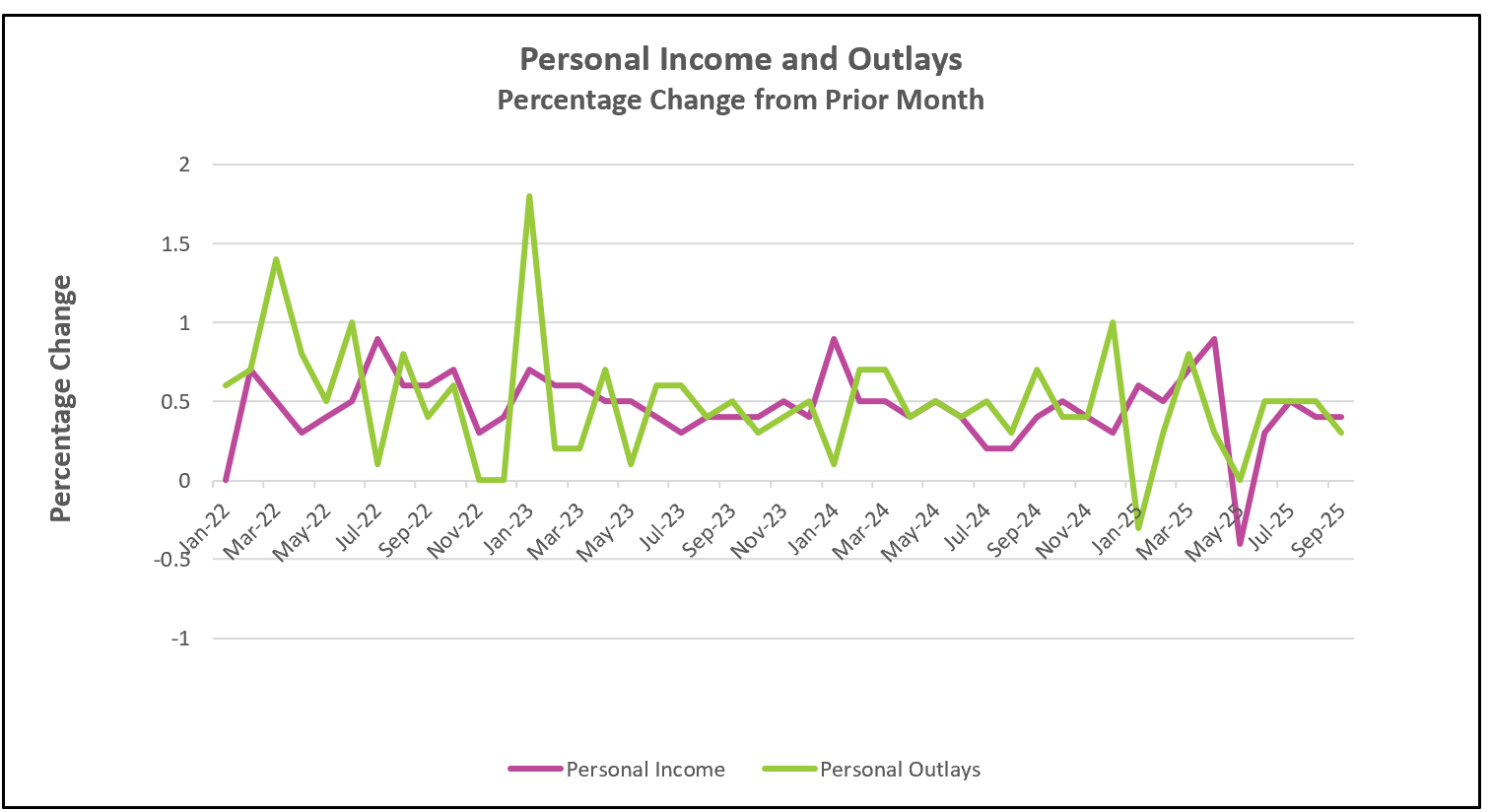

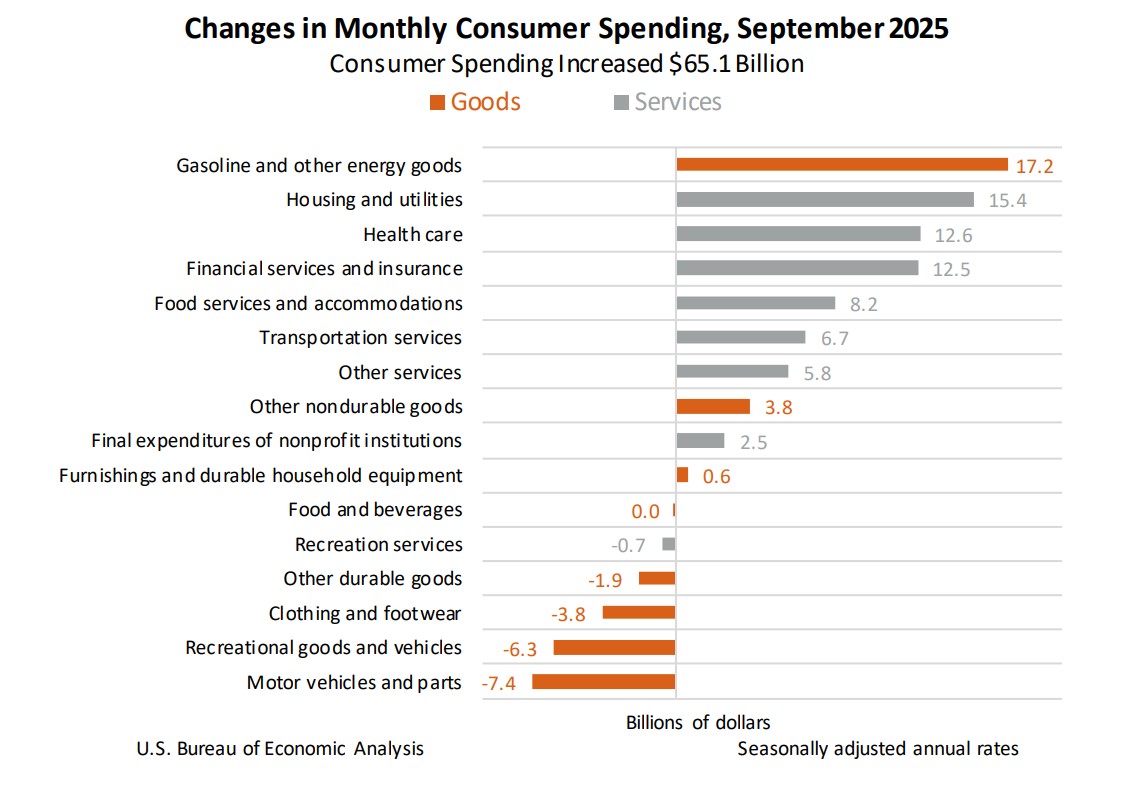

Consumer spending showed signs of slowing as the Holiday Season approaches. After adjusting for inflation, spending remained essentially flat in September, and the August figures were revised lower to a 0.2% gain, according to a BEA release that was delayed five weeks by the government shutdown. A significant 0.4% increase in service sales helped offset the weak demand for goods, particularly durable products, where spending fell sharply amid rising prices. Sales of cars, recreational goods, and apparel fell, while gasoline sales surged. Although the surge in gasoline sales is somewhat misleading, as the increase was primarily due to a 4.1% rise in gasoline prices in September, according to the Bureau of Labor Statistics. (BLS CPI – September)

The combination of higher inflation for goods and a slight increase in real disposable income, up only 0.1% overall, suggests households may be growing more cautious about the economy. With consumer purchases accounting for roughly 70% of U.S. economic activity, a sustained pullback could signal broader weakening. Declining consumer sentiment reinforces those concerns. According to the University of Michigan’s sentiment index, Americans are becoming increasingly wary of both the job market and inflation, a troubling sign as the holidays approach, when many retailers depend on stronger sales. The index rose slightly in December, but was 12% below its year-end level.

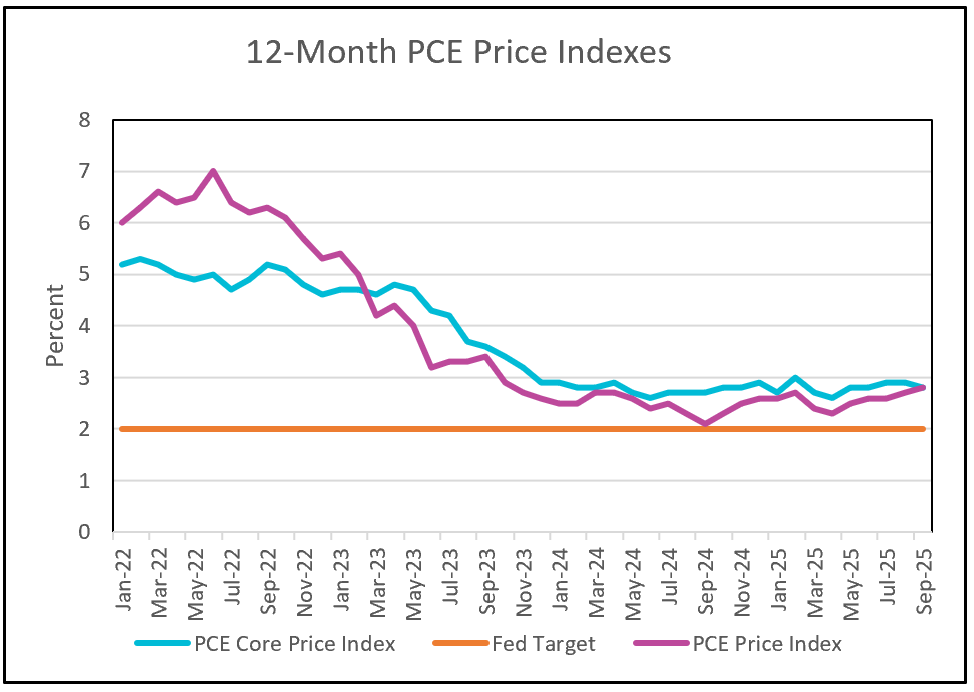

The Federal Reserve’s preferred inflation index, the PCE price index, remains above the Fed’s 2% target, though well below its 6.6% peak in 2022. Overall prices rose 0.3% in September and are up 2.8% from a year ago. Core inflation sits at the same 2.8% annual pace, down from a 2022 high but creeping higher in recent months. Most economists expect policymakers at the Fed to reduce its rate later today. But there is a growing sentiment that they should wait until they have more data.

The combination of a weaker labor market and an uptick in inflation has heightened the divide among policymakers at the Federal Reserve. Some governors argue that they should reduce their benchmark rate to support a softening labor market. In contrast, others fear that cutting could fuel inflation and deepen financial strain for middle-income households. They fear higher prices will deter them from spending. Much of the growth in spending has been supported by higher-income families. Meanwhile, there is growing evidence that lower-income families are struggling to meet their budgets. (Bloomberg, November 6, 2025)

A recent decline in core inflation over the past year has strengthened the case for lowering interest rates. These policymakers argue that the US economy would benefit from lower borrowing, given the slowing job growth and rising unemployment. They point to payroll figures released by ADP, which show that private employers shed 32,000 jobs in November. (The Wall Street Journal, December 3, 2025) They view inflation as less of a threat than economic softening.

Other policymakers prefer holding rates steady. They caution that because inflation has ticked up again recently, battling inflation should be the primary concern. Higher prices only add to the current financial strain on consumers. Rising service prices indicate that inflationary pressures extend beyond the impact of tariffs on the price of taxed goods, raising concerns that price pressures may be becoming more widespread.

The Bureau of Labor Statistics will release its October Employment report on December 16th. It should provide key data on the health of the jobs market. Higher Rock will provide its summary and analysis shortly after its release.