Higher gasoline prices contributed to over half of the increase in August’s CPI index. However, August’s 12-month core index, which excludes energy and food prices, fell. While the large jump in the overall rate is worrisome, it is unlikely to provide policymakers at the Federal Reserve with ample reason to increase its benchmark rate when it meets next week.

The highlights and analysis of the Bureau of Labor Statistics press release, Consumer Price Index – August 2023, are summarized below.

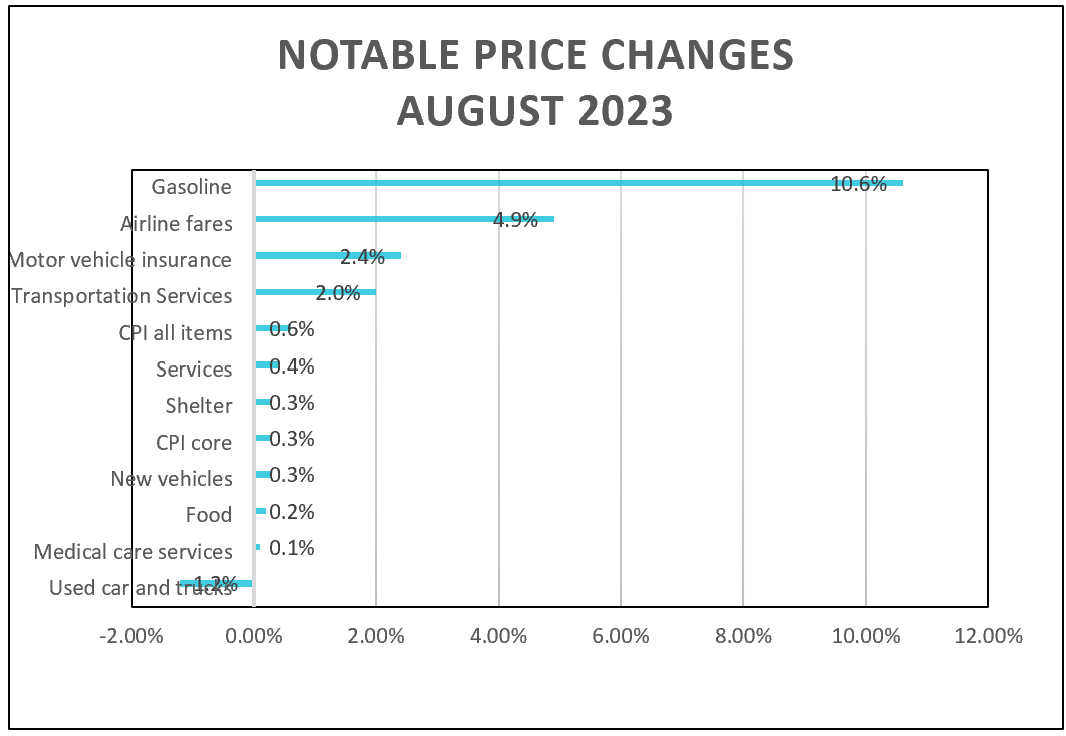

Recent crude production cutbacks by Saudi Arabia have pushed gasoline prices higher at the fastest rate since June 2022, when gasoline prices peaked. Gas prices contributed over half of the 0.6% monthly consumer price index increase. However, price increases were broad-based and sent the monthly core index, which does not include gas and food prices, 0.3% higher in August. That was up from 0.2% in June and July and was the largest acceleration in three months. It also marks the first time the gains have not decelerated since February. Fortunately, one month does not define a trend. The 12-month core index continued its six-month deceleration, reaching its lowest rate since September 2021.

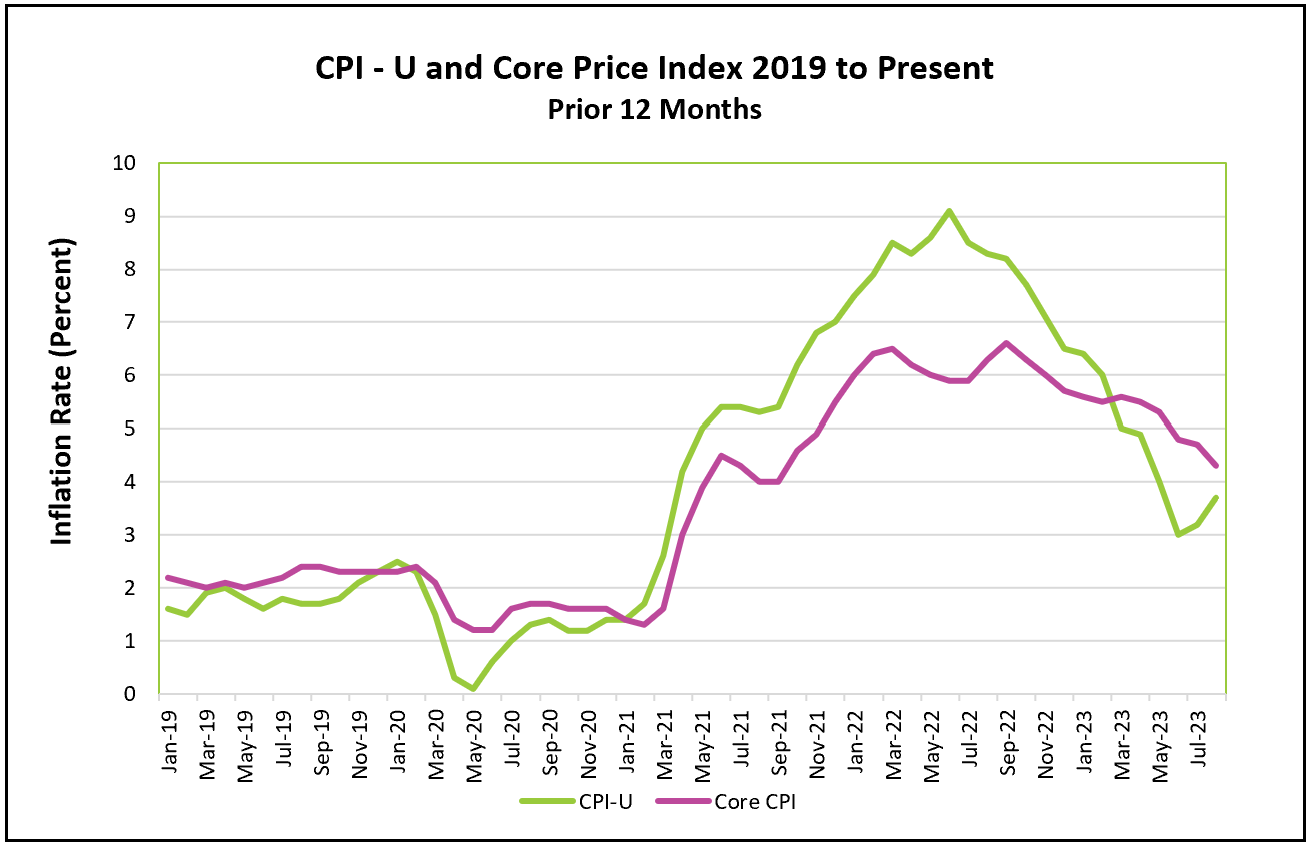

Economists focus on the core indexes when identifying a trend. The core index omits food and energy prices because they can be volatile, as seen by swings in gasoline prices in the past year. Higher gasoline prices last June pushed the CPI to a historical high. Until recently, falling gasoline prices contributed to the deceleration of prices during the second half of 2022. The trend has reversed again, although gasoline prices remain lower than a year ago. Meanwhile, the core index has consistently trended lower.

Shelter is another essential, and shelter costs have increased for 40 consecutive months, although August’s increase was the smallest since early last year. Furthermore, the shelter index has fallen or remained the same every month since May. Economists expect the trend to continue. The shelter index includes rental figures for all homes, not just new leases, and the rental market has recently softened. Moderating the shelter index is critical in reducing inflation’s hardship because housing is the largest expense for many households. The shelter index has consistently been a leading contributor to the rise in the CPI price index because it contributes roughly one-third of the CPI index.

The services less energy index rose 0.4% in August, up slightly from June and July but significantly lower than a year ago. Policymakers consider reducing wage growth in the service sector a key to curbing inflation. Businesses frequently increase prices to protect their profit margins when labor costs increase. The BLS reported wage increases have been trending lower. In August, they rose 0.2%.

Notable changes in August’s price indexes are listed in the table below.

Unacceptable inflation levels spurred policymakers at the Federal Reserve to raise their benchmark rate eleven times since March 2022. Their objective is to lower inflation by reducing the economy’s aggregate demand by making it more expensive for households to purchase a home or car and for businesses to expand. However, the impact takes months to filter throughout the economy, adding to the challenge of raising rates high enough to slow the economy without sending it into a recession. Policymakers paused their rate hikes following their last meeting to evaluate the impact of their policies. The resumption of student loan payments in October will decrease the economy’s aggregate demand by reducing many households’ disposable income. They will also want to gauge the effect of the return of student loan payments. It is doubtful that this report will cause sufficient alarm to sway them to increase rates.

On September 29th, the BEA will release August’s Personal Income and Outlays report, which will provide the PCE price index, the inflation measure favored by policymakers at the Federal Reserve. For a summary and analysis of this release, visit HigherRockEducation.org shortly after its publication.