The inflation figures from the Bureau of Labor Statistics (BLS) Press Release: Consumer Price Index (CPI) – August 2025.

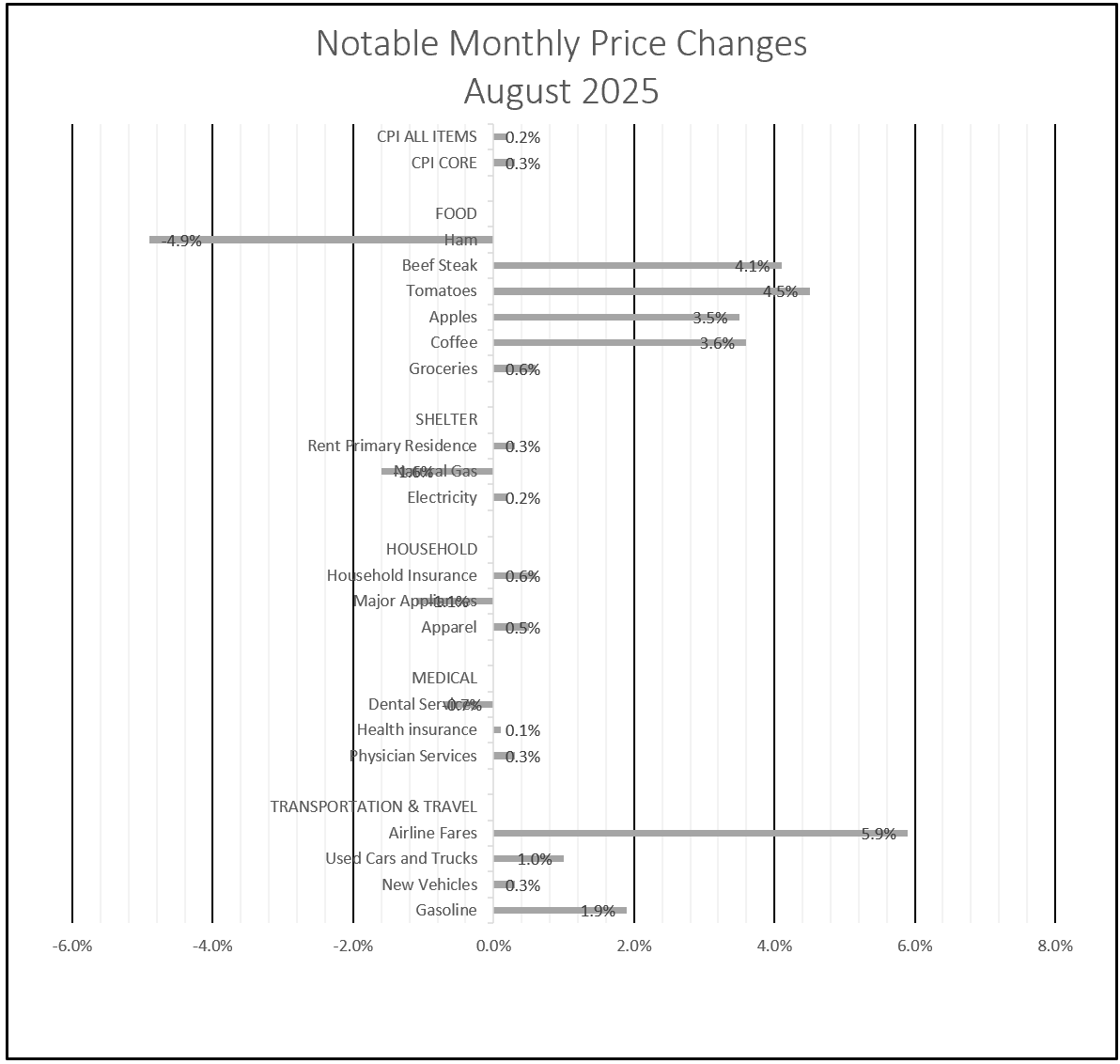

In August, inflation accelerated more sharply than expected, with the all-inclusive consumer price index rising 0.4%, the largest monthly increase since January. That followed a 0.2% rise in July, pushing the 12-month inflation rate from 2.7% to 2.9%. The increase was driven primarily by higher shelter, food, and gasoline prices.

Grocery costs jumped 0.6% in August, the most since 2022, and tariffs on imported goods played a significant role. Coffee prices surged 3.6% in August and are now up more than 20% from a year ago, while tomatoes rose 4.5% and beef steak 4.1%. At the same time, ham prices fell 4.9%.

Travel costs rose significantly in August. Gasoline prices surged 1.9%, airline fares jumped nearly 6%, and hotel rates increased 2.3%. However, it is worth noting that gasoline prices are 6.6% lower than a year ago.

Despite these pressures, the core index—which excludes volatile food and energy—rose 0.3% for the second straight month, suggesting that despite tariffs, the underlying inflationary momentum has not accelerated. Economists consider the core rate a better indicator of future trends since it excludes volatile food and energy prices. Housing costs, the index’s largest component, rose slightly. Rent of a primary residence was unchanged, while the owner’s equivalent rent increased by 0.1%.

Tariffs remain a complicating factor, adding to the cost of imported goods and domestically produced goods that import some of their inputs. These costs are passed along to consumers, reinforcing inflationary pressures at a time when demand may already be fragile. For example, many American farmers feel the impact of tariffs in two ways. Retaliatory tariffs have reduced the demand for many American-grown crops in other countries, while American tariffs have increased the cost of imported fertilizer, chemicals, and equipment. While tariffs have raised costs on various goods, from food to vehicles and clothing, their overall impact on inflation has been less severe than expected. However, most economists believe their full impact has not been felt yet.

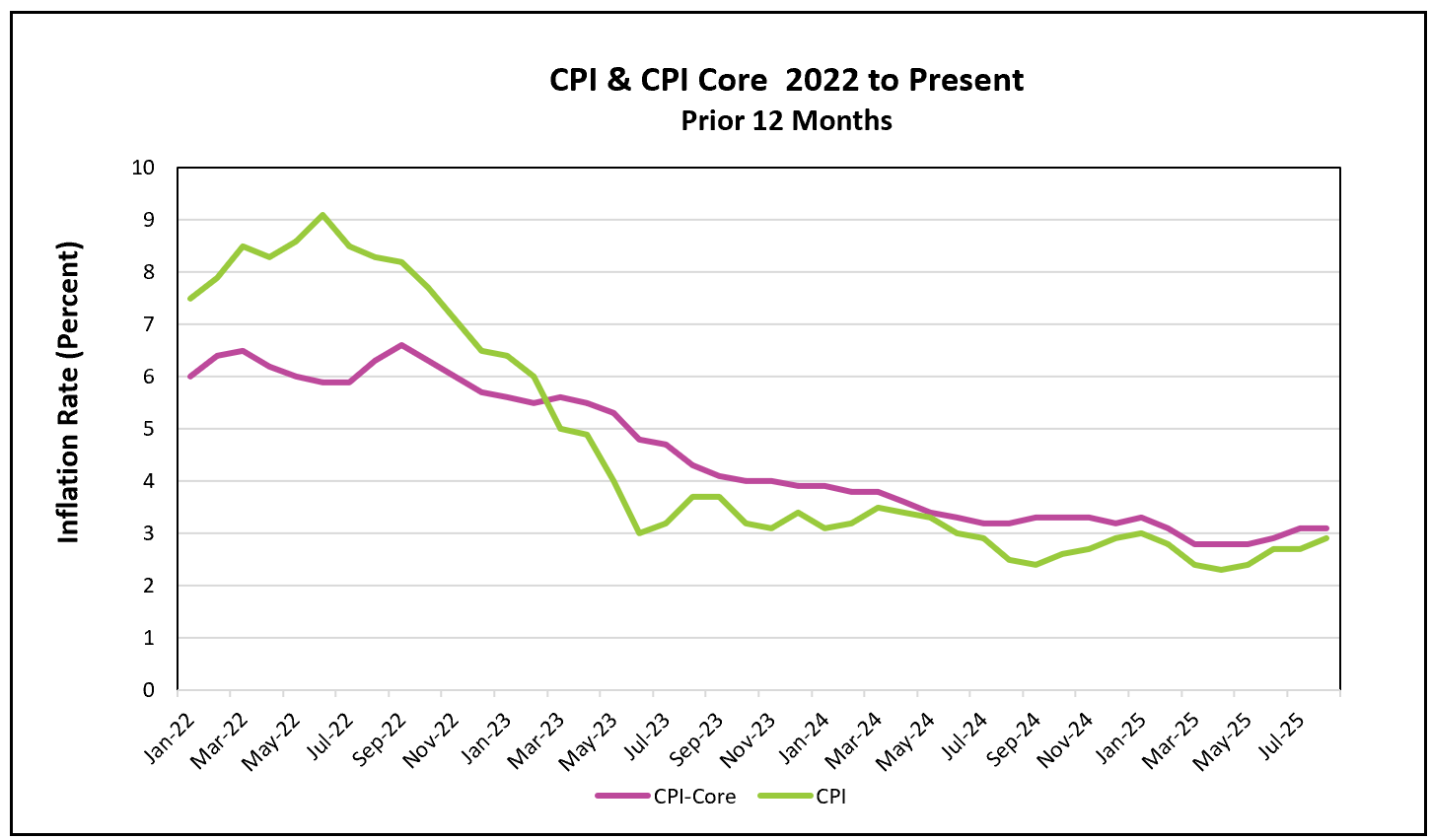

The greater concern for policymakers has changed to the weakening labor market and slowing economy. Hiring has slowed dramatically in recent months, the unemployment rate has risen, and real wage growth has slipped to just 0.7% (DOL)—the lowest pace in over a year. Initial jobless claims have also climbed to a four-year high, signaling further softness ahead. This backdrop raises the risk of stagflation: the problematic combination of persistent inflation and sluggish growth. While inflation is still above the Fed’s 2% target, it has cooled significantly from earlier peaks, leaving the central bank balancing the risks of keeping rates too high against the need to support an economy that is losing steam.

As a result, the Fed faces a policy dilemma—reducing rates to stimulate growth could risk fueling inflation, while keeping rates elevated could worsen the slowdown. The recent steadiness of the core index implies that the threat of tariffs to inflation has been overstated, which makes it unlikely that the latest uptick in prices will prevent the Federal Reserve from moving ahead with an interest rate cut at its upcoming meeting, given the recent trends in employment and economic growth.

The Fed meets next week. While policymakers are widely expected to reduce their benchmark rate, their course for the remainder of the year will depend on the economy’s strength. The BEA will release its Income and Outlays report on September 29th. It will include August’s PCE price index, the inflation index policymakers prefer, and consumer spending and income data. HRE will publish its summary and analysis shortly after it is released.