In December, inflation experienced a slight rise, which stood out as a minor anomaly in an otherwise promising year characterized by decreasing prices. Surveys consistently reveal that despite positive economic indicators, Americans feel worse off. What is the underlying reason for this discrepancy between economic trends and public sentiment?

The highlights and analysis of the Bureau of Labor Statistics press release, Consumer Price Index – December 2023, are summarized below.

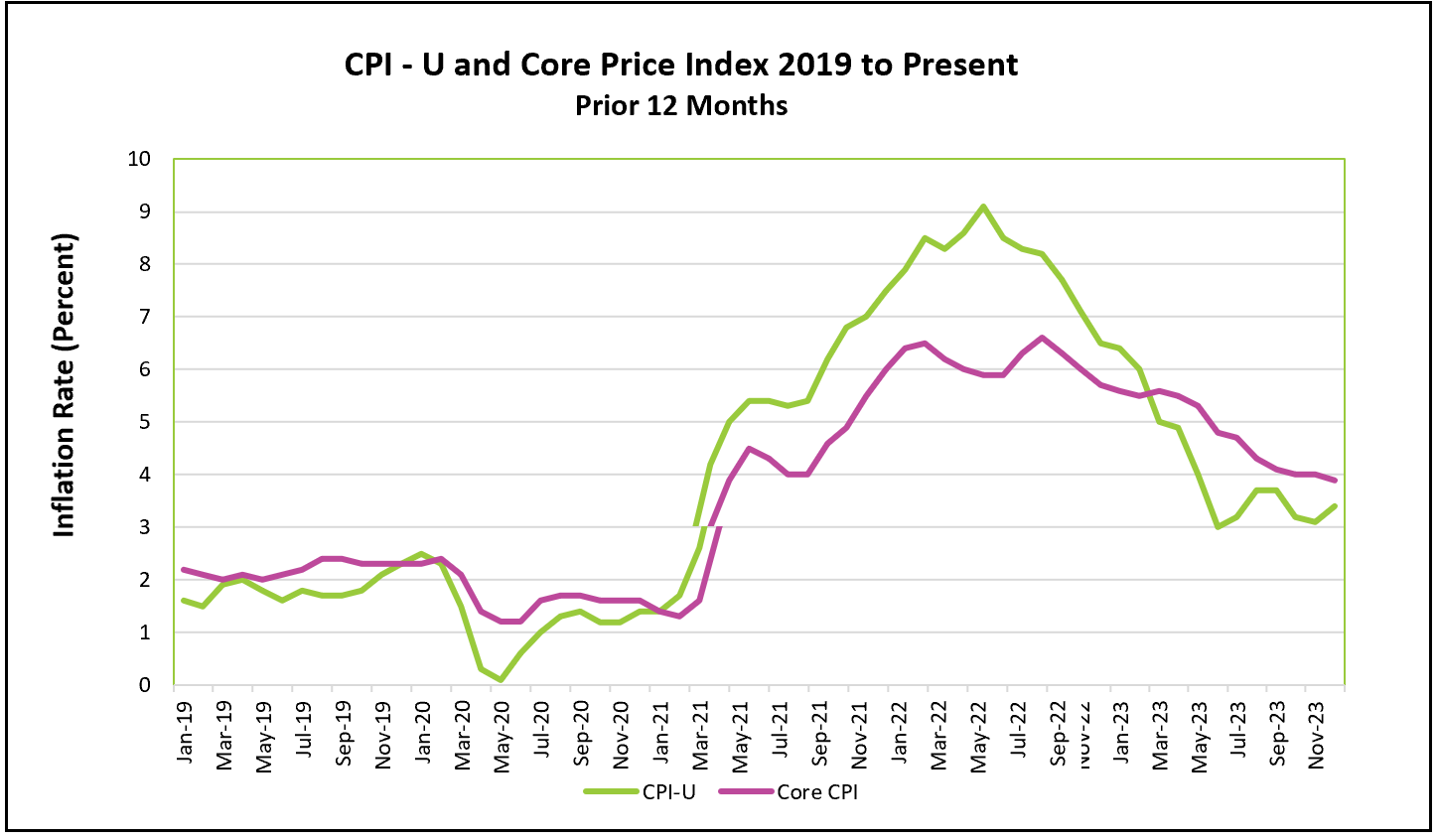

The 12-month all-inclusive inflation rate for December experienced its first uptick in the fourth quarter, predominantly influenced by the persistent stickiness of the shelter index despite a downward trend in housing costs throughout the year. The shelter index started with a monthly increase of 0.8% in February, but gradually leveled off, fluctuating between 0.4% and 0.5% in the latter half of 2023. Many economists anticipate a further decline in the shelter index. Its resilience is attributed to its calculation, which uses existing rents rather than new ones. New lease rates have been more stable and are even declining in many regions. For additional insights into the rental market, refer to the Nerdwallet article provided.

The energy index rose by 0.4%, driven by a 1.3% increase in electricity prices and a reversal in the downward trend of gasoline prices. Energy prices had fallen more than 2% in October and November, so the upswing in December’s energy prices contributed significantly to the overall CPI increase.

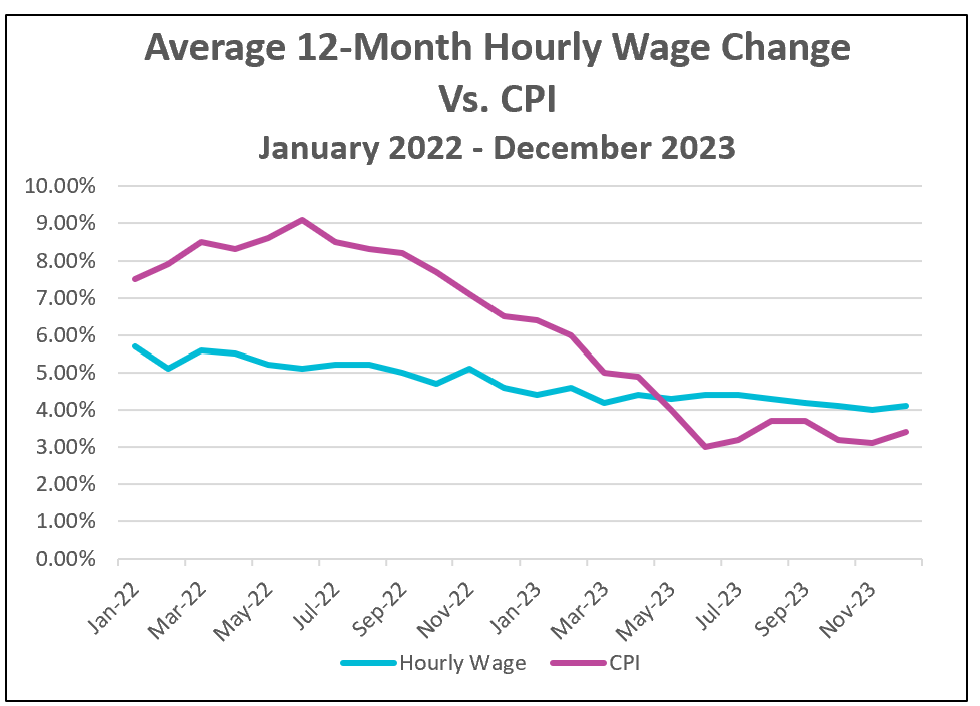

Stubborn service prices remain a significant concern of policymakers. Services less shelter is a guage watched closely by policymakers because labor is the largest expense of most service providers. The index increased by 0.6% in December, which places policymakers in a dilemma. A tight labor market compounds inflation because employers increase compensation to attract and retain employees. Higher wages have prompted many companies to increase their prices to cover their increase in costs and protect their profit margins. Wage appreciation has exceeded the CPI since April. A looser labor market would contribute to taming inflation – but it would also risk triggering a recession.

Economists are encouraged by the 0.1% drop in the core price index. Economists regard the core price index as a more reliable measure of inflationary trends due to its exclusion of volatile energy and food prices. Despite remaining above the all-inclusive index, the core index consistently decreased throughout 2023, reaching its lowest rate since May 2021, with only March showing a slight increase.

As we enter 2024, significant strides have been made in tackling inflation while sustaining a robust economy. Inflation has receded and is now nearly one-third of its peak at 9.1% in June 2022. The labor market continues to thrive. It added 2.7 million jobs in 2023, and unemployment remains near a four-decade low. Real wages have increased, consumer spending persists, and the Dow Jones Industrial Average recently reached a new high.

However, despite these positive indicators, a prevailing sentiment among most Americans is dissatisfaction with the economy. Consistent polls reveal that many believe the economy is not improving, with a notable percentage perceiving it as worsening. According to an Economist-YouGov poll, 22% of Americans think the economy is improving, 27% believe it’s about the same, and 45% feel it’s getting worse—a sentiment echoed in a Sienna poll.

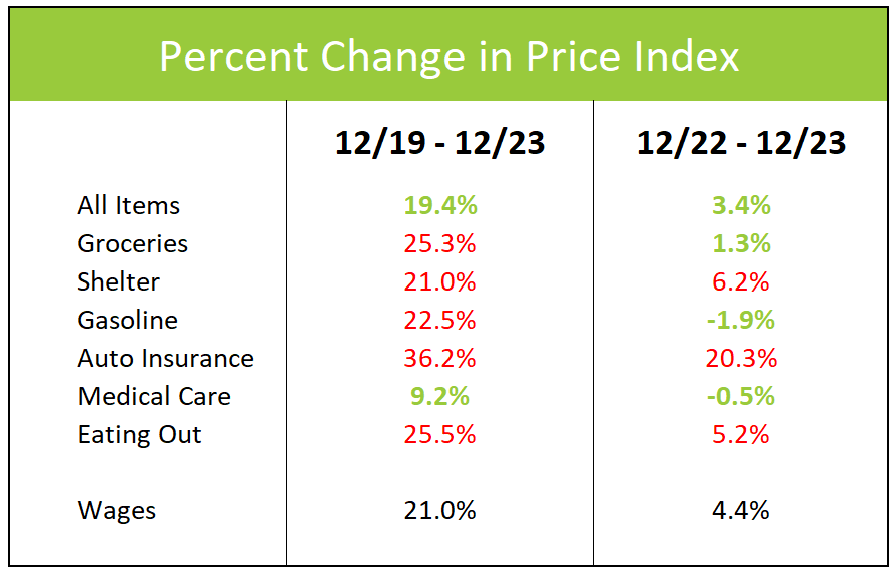

In fact, it is easy to understand why Americans are downbeat on the US economy. Many feel their compensation has not kept pace with inflation and their budgets are more strained – especially when paying for essential items. They make a good point. The table below compares the wage growth to the CPI and the change in prices of several essential items, including groceries, shelter, gasoline, automobile insurance, and medical care for the periods December 2019 through December 2023 and December 2022 through December 2023. Items marked in green indicate the price increased less than wages, making them relatively more affordable, while those in red signify items whose price changes surpassed wages, making them harder to afford. Between December 2019 and December 2023, the average hourly wage increased by 21%, slightly outpacing the 19% rise in the price level. However, the prices of most essential items, including groceries, housing, energy, and automobile insurance, exceeded the 21% wage growth during this period. Although the situation has improved since then, the price for shelter and automobile insurance continue to increase at a faster rate than wages.

For many, taming inflation implies a return to prepandemic price levels, a scenario necessitating deflation rather than disinflation. Deflation, marked by a general decrease in prices, is detrimental, while disinflation, the slowing of the inflation rate, is presently desirable. Deflation is most prevalent during severe recessions or depressions. Consumers delay purchases in anticipation of lower prices, and businesses hold off on investments until equipment costs decrease. Such behaviors can impede economic growth and potentially worsen a recession, underscoring why most economists prefer moderate inflation over deflation.

Inflation accelerated in December, but it appears to be a bump on the path to an acceptable level. The less volatile core index continued tracking lower. Wages are increasing at a faster pace than essentials such as groceries and gasoline. Even the cost of housing is increasing at a slower pace, albeit too fast. Fed officials are expected to keep interest rates the same when they meet on January 30th and 31st.

On January 25th, the Bureau of Economic Analysis will release its Advance Estimate of GDP for the fourth quarter of 2023. The report will include the 2023 PCE-price index—the preferred inflation index among Federal Reserve policymakers. It usually is lower than the CPI and is expected to register slightly above the Federal Reserve’s 2% target. For a concise summary and analysis of this release, visit HigherRockEducation.org shortly after its publication.