The inflation figures from the Bureau of Labor Statistics (BLS) Press Release: Consumer Price Index (CPI) – December 2025.

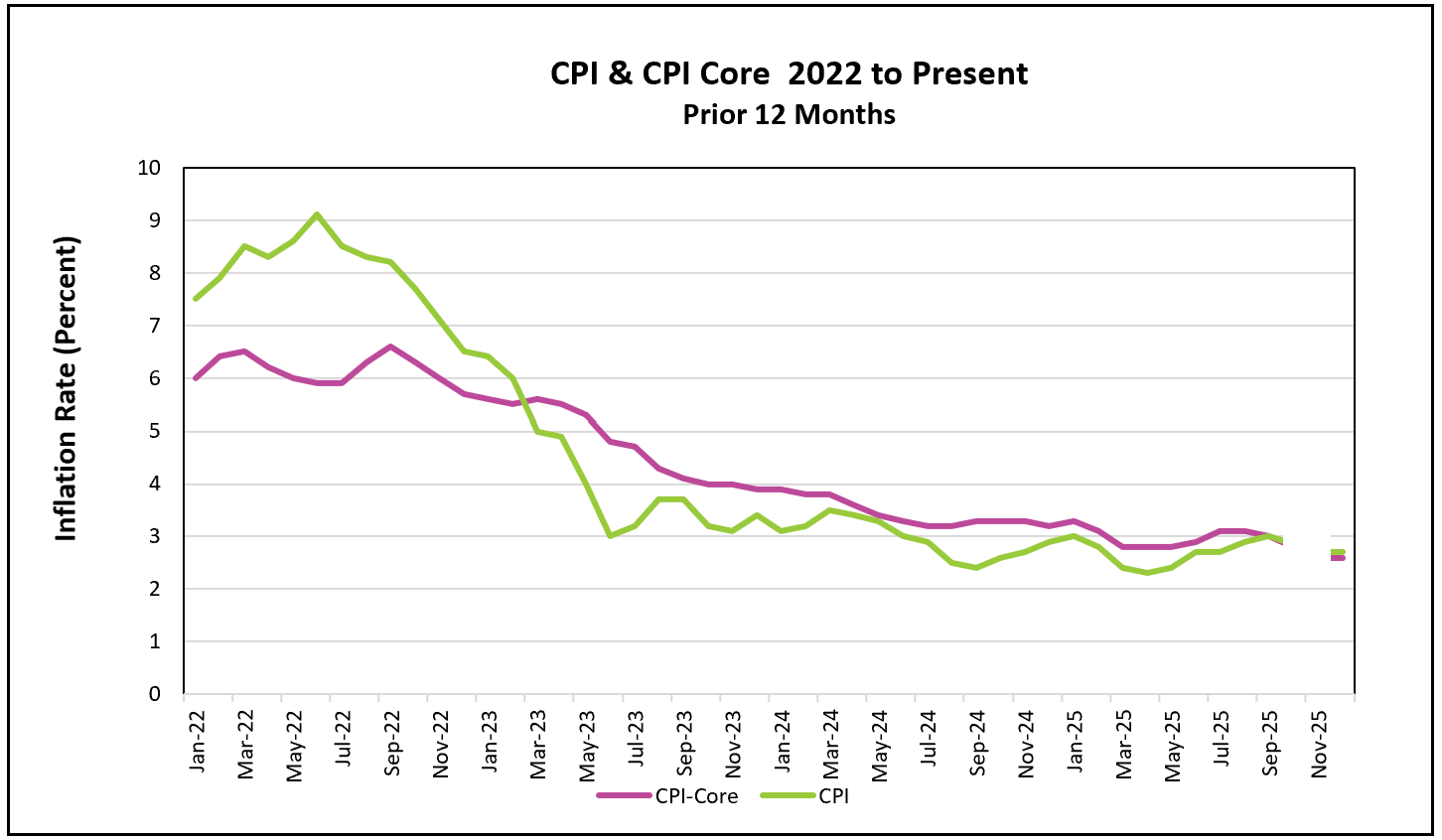

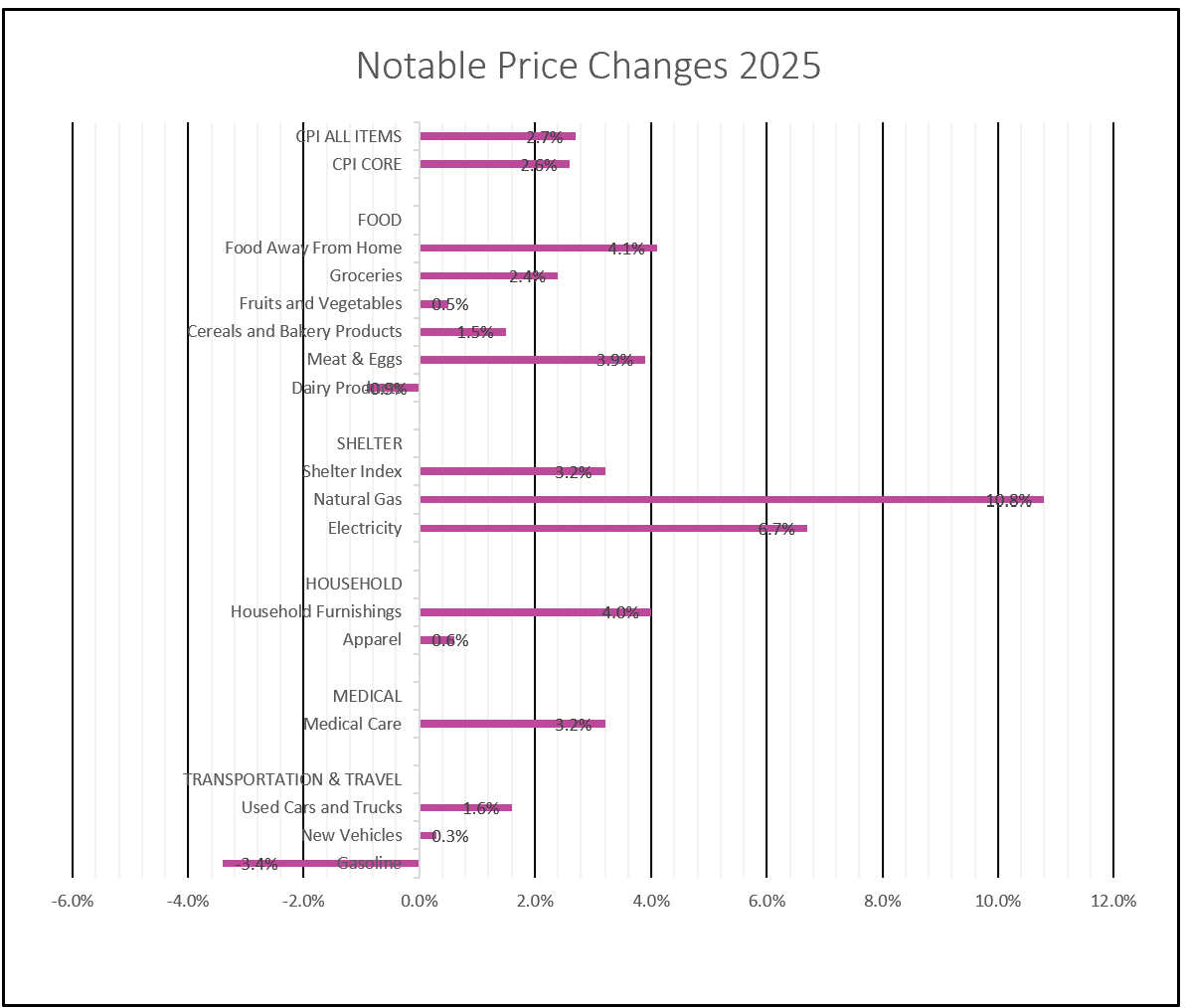

Inflation rose less than expected in December, offering some reassurance that price pressures continue to cool, even as inflation remains above the Federal Reserve’s 2% target. For many households, however, the easing has been uneven. Throughout 2025, higher prices for necessities such as food, shelter, and medical care steadily eroded purchasing power, adding to the financial strain faced by many families and keeping the cost of living a central economic and political concern.

Food prices were a particular source of pressure late in the year. While household budgets were stretched throughout 2025, December delivered the sharpest blow, with food prices jumping 0.7%, the largest increase since August 2022. Meats, dairy products, and coffee led the surge, underscoring how even modest overall inflation can mask significant increases in essential categories that households cannot easily avoid. Egg prices bucked the trend, falling 8.2% in December. Still, the price of eggs surged earlier in the year when bird flu reduced egg supply.

Shelter costs once again accounted for the largest contribution to the consumer price index. Shelter prices rose 0.4% in December, the biggest monthly gain since August, with both rent and owners’ equivalent rent increasing 0.3%. A notable 2.9% spike in hotel rates also pushed the monthly index higher. Despite this monthly acceleration, shelter inflation has been trending lower over the year, with rents up 3.1% and overall housing costs rising 3.4% on a 12-month basis, down from 4.6% in 2024.

Several goods categories also moved lower in December, including appliances (4.3%), women’s dresses (2.7%), jewelry (3.1%), used cars and trucks (1.1%), and vehicle repairs (1.3%), offering some relief to consumers.

Energy prices provided some offset to broader inflation pressures. Gasoline prices declined 0.5% in December, down 3.4% from a year earlier, shaving roughly one-tenth of a percentage point off the 12-month CPI and helping to restrain headline inflation for much of the year. Within the broader energy category, however, price movements diverged sharply: while gasoline prices fell, electricity costs climbed 6.7% and natural gas prices surged 10.8%.

Many economists had expected a firmer increase in December after considering November’s inflation report as having a low bias due to data-collection disruptions tied to the government shutdown and the influence of holiday discounts. Instead, December’s results reinforced the view that inflation is easing, lending credibility to November’s softer reading. Even so, the pace of improvement remains gradual rather than dramatic.

Looking ahead, economists broadly expect inflation to continue easing through 2026 as the cumulative effects of several years of tight monetary policy further restrain demand. Slower wage growth should leave households with less spending power, reducing aggregate demand, while aggregate supply is expected to improve as the impact of tariffs fades. A pending Supreme Court ruling that challenges the president’s authority to issue tariffs could also influence price trends, though tariffs to date have had a smaller effect on inflation than many economists anticipated, in part because companies built up inventories ahead of their implementation and have since been drawing them down.

The December inflation report is unlikely to alter the Federal Reserve’s near-term policy stance. Despite ongoing political pressure from President Trump for lower interest rates, the Fed is widely expected to wait for January’s inflation data before considering any change, particularly because prices often rise early in the year as businesses reset pricing. January’s inflation indexes will therefore be closely watched, especially against a backdrop of slowing hiring alongside a slight decline in unemployment.

In summary, inflation has fallen substantially from its 9.1% peak four years ago, but progress has slowed in recent years. A year ago, the 12-month CPI stood at 2.9% and core inflation at 3.2%, highlighting how stubborn price pressures have been. The Bureau of Economic Analysis will release the Fed’s preferred inflation gauges—the PCE price indexes for November—on January 22, and Higher Rock will summarize and review the data shortly after publication.