The inflation figures from the Bureau of Labor Statistics (BLS) Press Release: Consumer Price Index (CPI) – January 2026.

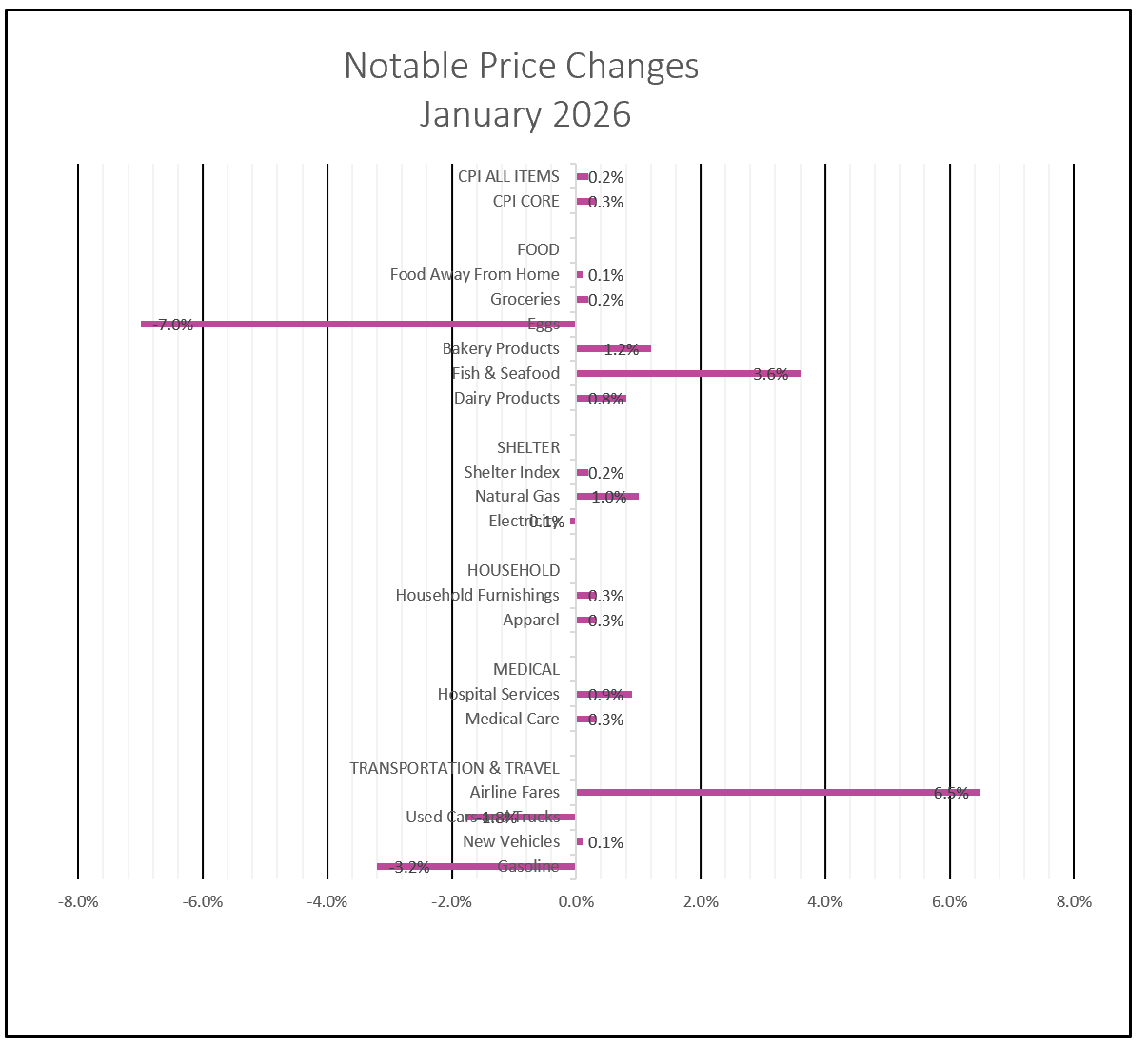

Americans saw some welcome relief in January as the cost of several everyday essentials eased. The consumer price index (CPI) rose just 0.2% for the month—the smallest increase since July—helped by a 1.5% decline in energy prices. Gasoline prices fell 3.2%, the third drop in four months, and are down 7.5% from a year earlier, while electricity prices also declined. Overall energy costs are now 0.1% lower than a year ago. Food prices rose a modest 0.2%, with grocery prices increasing at the slowest pace since July after December’s 0.6% jump; grocery costs are up 2.1% from a year earlier. Clothing prices edged up 0.3% in January and are 1.7% higher than a year ago.

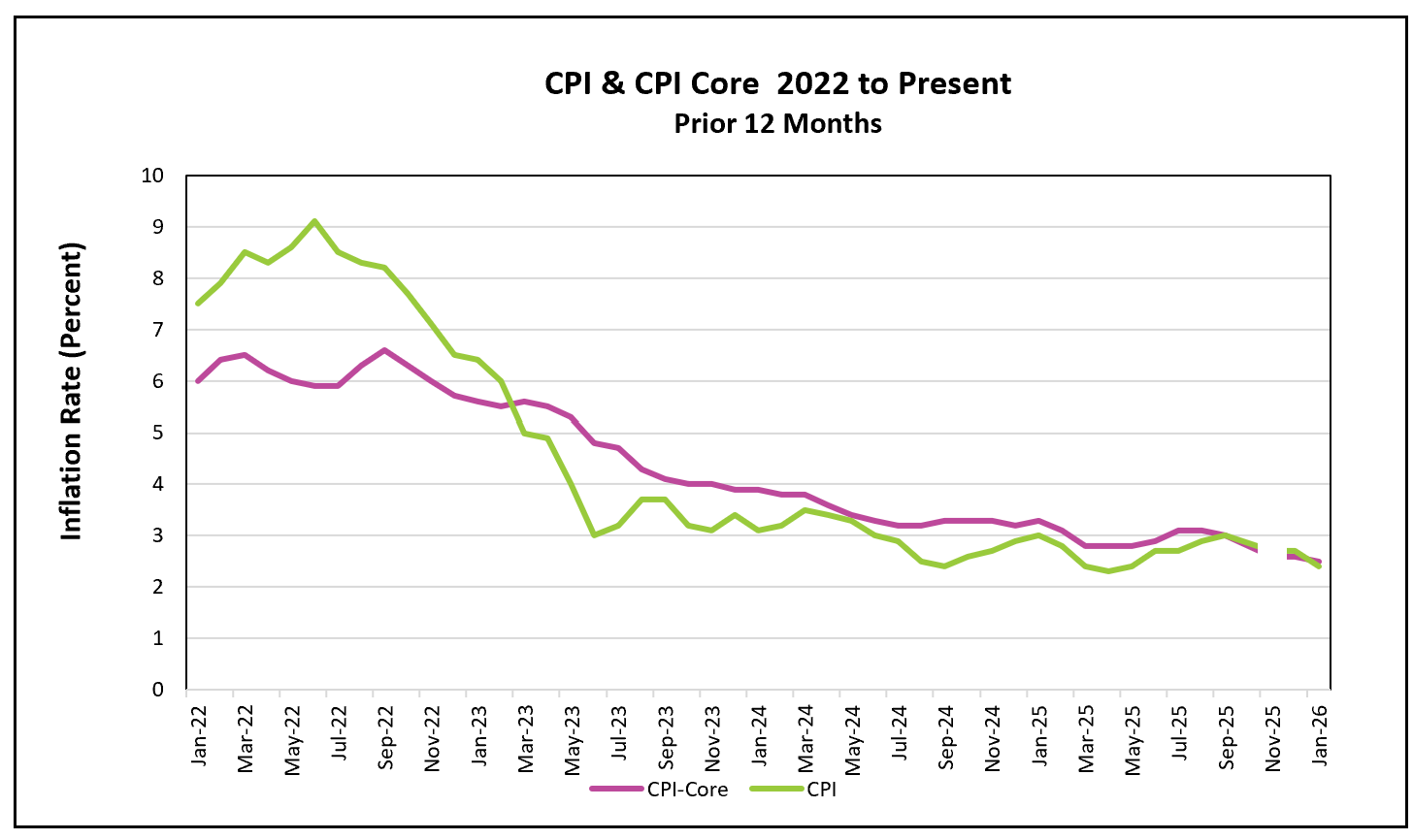

On a year-over-year basis, inflation continued to moderate. The CPI increased 2.4% over the prior 12 months, down from 2.7% in December. Core inflation—which excludes food and energy—rose 0.3% in January and is up 2.5% from a year ago, the lowest annual rate since March 2021. A sharp 1.8% decline in used-car prices helped restrain the monthly core reading. The indexes for used cars and trucks, household furnishings and operations, and motor vehicle insurance were among the major categories that declined. At the same time, shelter costs, the single largest contributor to the overall index, rose just 0.2%, the smallest increase in several months, signaling continued deceleration in housing inflation. Rents are up 2.8% from a year ago—far below the more than 8% annual increases seen in 2022.

However, inflation pressures have not disappeared. Service prices continue to rise faster than overall inflation; excluding energy, service prices increased 0.4% in January. Stripping out housing costs, so-called “supercore” services inflation accelerated to its fastest monthly pace since January of last year. Airline fares jumped 6.5%—the largest increase since 2022—while medical care costs rose 0.3%. Notably, January often brings larger price hikes as firms reset prices at the start of the year, making the relatively modest overall increase somewhat surprising.

Trade policy remains a wildcard. Research from the Federal Reserve Bank of New York suggests that firms have absorbed as much as 90% of recent tariff increases, limiting the immediate impact on consumers. Eventually, however, economists expect more of those costs to be passed through to consumers. Some sizable price increases in appliances, furniture, and new cars from December to January may be early evidence that companies are beginning to shift more of the burden to customers, potentially keeping inflation elevated in the months ahead, which is one reason that, despite encouraging progress, the Federal Reserve is likely to remain cautious. While the core CPI is moving closer to the Fed’s 2% goal, policymakers place greater emphasis on the PCE price index, which remains somewhat above target. Officials will benefit from another month of employment and inflation data before their meeting at the end of February. They will likely seek clearer evidence that disinflation is firmly entrenched. Meanwhile, real wages rose 1.2% over the past year, offering households modest gains in purchasing power even as prices continue to climb.

In summary, January’s report offers cautious optimism. Inflation is clearly cooling, energy prices have provided meaningful relief, and housing costs are no longer accelerating at the pace seen in recent years. Real wages are rising, giving households a bit more breathing room. Yet underlying service inflation remains firm, and the eventual pass-through of tariff costs could reintroduce upward pressure in the months ahead. For now, the trend is moving in the right direction—but both consumers and policymakers will be watching closely to see whether this progress proves durable.

The Bureau of Economic Analysis will release the Fed’s preferred inflation gauges—the PCE price indexes for December—on February 20th, and Higher Rock will summarize and review the data shortly after publication.